The overall market analysis shows that the crypto markets have been stabilizing, with relatively low volatility in recent weeks. The market cap has remained relatively steady and there are no major trends of significant declines or increases. This indicates that the market is becoming more neutralized as Bitcoin and Ethereum hold above the key support levels of $16.8k and $1.2k respectively.

The crypto market is also seeing a few bright spots with some of the altcoins gaining traction. The biggest gains over the past week have been in Helium, which has increased by almost 25%. In addition, Litecoin and Ripple have also seen significant gains, with their prices increasing by more than 1.5% each.

Bitcoin and Ethereum Price Analysis

Bitcoin price analysis reveals the BTC/USD pair is trading in a relatively tight range between $16.8k and $17.5k. The coin is yet to make any significant moves in either direction but is currently consolidating around the weekly resistance level of $17.2k. A breakout above this level could signal a strong bullish move for BTC in the near future, while a breakdown below this level could lead to further price drops.

Bitcoin has been making higher highs and higher lows, as a triple top and triple bottom pattern has formed. This is a sign that the bears are losing their grip, and a bull run could be expected if Bitcoin breaks above $17,500.

Bitcoin is trading at $16,832.92 and is trading at a sideways angle. Bitcoin seems to have reached a bottom since last week and is now looking to find a new support level. Bitcoin seems to be consolidating, prior to a potential breakout. The $16,500-$17,000 range seems to be the new support for Bitcoin.

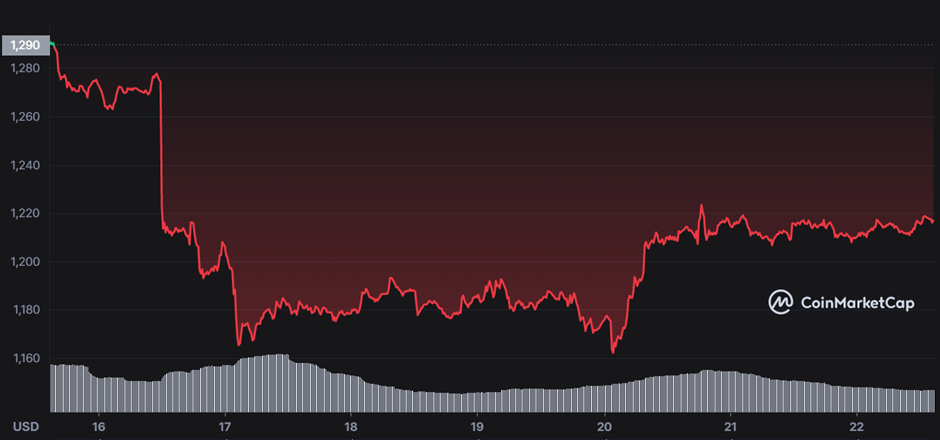

Ethereum price analysis reveals that Ethereum has also found a level of relative stability around the $1.2k mark and is trading at $1,206.65 at press time. The ETH/USD pair had attempted to break through this resistance level on multiple occasions in recent weeks but had failed each time. Ethereum is likely to remain within this range until it builds up enough momentum to break out of the resistance and retest a high of $1.9k.

Overall, the market sentiment appears to be relatively stable despite a few minor gains across the board. Bitcoin and Ethereum continue to dominate the market and remain the two most influential coins in setting the overall market direction. Until any major movements occur, it appears that the crypto markets will remain relatively neutralized at least until the beginning of 2023.