- PayPal’s PYUSD stablecoin has carved a niche in DeFi, becoming a significant player in Curve’s liquidity pool.

- The FRAXPYUSD pool, combining PYUSD and Frax’s FRAX, shows robust activity, indicating a growing market interest.

- Despite stiff competition from USDT and USDC, PayPal’s PYUSD shows promising growth and diverse use cases in DeFi.

PayPal’s foray into the decentralized finance (DeFi) sector has marked a new milestone with its US dollar-pegged stablecoin, PYUSD, gaining significant traction. This development is particularly notable in the domain of automated market maker (AMM) platforms, with Curve hosting a substantial liquidity pool featuring PYUSD.

As of recent data, this liquidity pool, known as the FRAXPYUSD pool, has amassed a total value locked (TVL) of approximately $135 million. This figure places it third in terms of size, trailing only the prominent 3pool on the Curve platform. The FRAXPYUSD pool, which went live on December 27, combines PYUSD and FRAX, a collateralized algorithmic stablecoin from Frax Finance.

In the world of DeFi, liquidity pools are essential. They consist of reserves of multiple cryptocurrencies locked in a smart contract to facilitate asset exchange on decentralized exchanges. Curve, being one of these exchanges, specializes in stablecoin transactions, and the volume of trades on Curve often reflects the preferences of larger, more influential investors in stablecoin conversions.

The unique pairing of FRAX and PYUSD in the FRAXPYUSD pool allows traders to swap FRAX for PYUSD. This allows seamless integration with the PayPal app, enabling users to make purchases and remittances with the acquired PYUSD. At the time of reporting, the pool showed an imbalance, with FRAX representing over 80% of the pool’s total liquidity.

Sam Kazemian, the founder of Frax Finance, explained the synergy between the two stablecoins. He described FRAX as the on-chain liquidity provider for PYUSD, which, in turn, acts as the off-chain fiat gateway. Since its inception, the pool has witnessed an average daily trading volume of around $5.5 million.

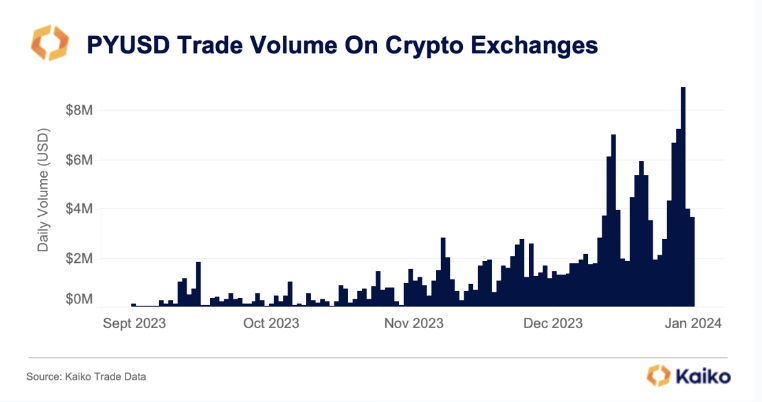

Since its launch in August, PayPal’s PYUSD has been gradually making its mark in the DeFi space. Although it still trails behind industry giants like Tether and Circle’s USDC in terms of market share and volume, PYUSD’s daily trading volume reached a peak of $9 million in December and currently averages around $4 million. In contrast, Tether’s USDT boasts a 24-hour trading volume exceeding $55 billion.

Clara Medalie, the research director at Kaiko, commented via email on PYUSD’s growing presence in DeFi. She noted that PayPal’s investment in expanding the stablecoin’s utility beyond mere payment functions within its app signifies a positive trend for liquidity in the DeFi space. However, she also pointed out the formidable competition PYUSD faces against USDT and USDC, especially in DeFi protocols where USDC is notably more liquid.

Looking ahead, Kazemian expressed optimism about the potential growth of the FRAXPYUSD pool. Frax Finance is exploring various DeFi integrations that could be supported by PayPal’s payment application, allowing users to save in PYUSD and FRAX within Curve and earn yields. This innovative approach demonstrates PayPal’s commitment to integrating traditional finance with the evolving landscape of decentralized finance, bridging the gap between conventional payment systems and the burgeoning world of cryptocurrency.