- The recent negative trend in Polygon’s 30-day MVRV ratio may suggest a good entry point for investors.

- Stability in the 365-day MVRV ratio reflects a consistent sentiment among long-term MATIC holders.

- The current low MVRV Z-Score might indicate that Polygon is undervalued, presenting a potential investment opportunity.

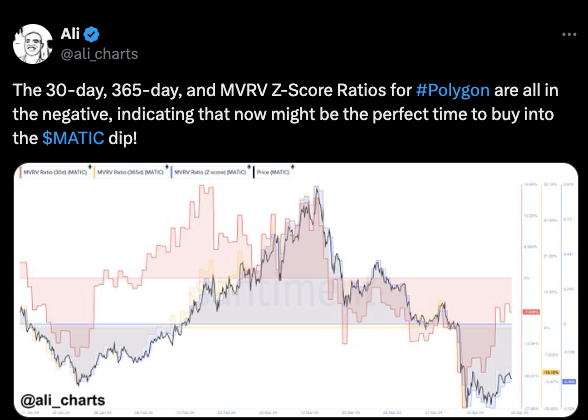

Polygon (MATIC) recently saw notable changes in its Market Value to Realized Value (MVRV) ratios across multiple timeframes, providing key insights into both short-term and long-term investor sentiment. Crypto analyst Ali shared this information on an X post, drawing attention to potential investment opportunities within the current market conditions.

The 30-day MVRV ratio for Polygon displays a variable pattern, highlighting fluctuating short-term investment interest. After reaching a high point, this ratio has fallen below the breakeven level, suggesting that short-term holders might be offloading their tokens at a loss.

Source: X

The MVRV Z-Score, which is utilized to determine when the market value of an asset significantly deviates from its realized value, has shown extremes on both the higher and lower ends during the period analyzed. This indicator is crucial for assessing whether the asset is currently underpriced or overpriced relative to its historical norms.

Overlaying these metrics is the trading price of MATIC, which has mirrored the intense swings in market sentiment. The price trajectory of MATIC correlates closely with the MVRV ratios, particularly noticeable when price declines coincide with downturns in the 30-day MVRV ratio.

Presently, with the 30-day MVRV ratio in negative territory and the Z-Score nearing a lower bound, the market sentiment might be leaning toward caution or pessimism in the short term. This setting is a prime buying opportunity for those looking to enter the market at a potentially lower valuation.

Despite a decrease in MVRV Z-Score Ratios, Polygon’s valuation has experienced an upward trajectory. Recently, the price of Polygon increased by 3.36%, reaching $0.7522. This jump is notable against the broader market context and reflects investor confidence.

In the cryptocurrency arena, the market capitalization is a key indicator of the network’s value. For Polygon, this metric has risen by 3.41%, bringing the total to approximately $7.45 billion. This places Polygon as the 17th most valuable crypto asset in the market.

Trading activity for Polygon has surged, as evidenced by a 9.92% increase in the daily transaction volume, which now stands at over $257 million. This rise in volume is a sign of heightened interest and liquidity in the market.