- Digital asset investments surged $326M, the biggest weekly gain since July ’22, fueled by optimism and the US SEC’s anticipated Bitcoin ETF approval.

- A notable 90% of the inflow, a whopping $296 million, flooded into Bitcoin, while anticipation of a spot-based ETF approval led to cautious investor optimism.

- Ethereum experienced an anomaly, with outflows totaling $6 million, amidst the broader surge in digital asset investments.

In an unprecedented turn of events, digital asset investment products experienced a surge of $326 million, marking the most substantial weekly increase since July 2022. Colin Wu, a well-known crypto journalist known for his insights on Wu Blockchain, has recently highlighted this surge in a post on X. This surge in investment resulted from growing optimism among investors and is likely linked to anticipation of a spot-based Bitcoin ETF approval by the US SEC.

Digital asset investment products saw inflows of US$326m, the largest single week of inflows since July 2022. Bitcoin saw 90% of the inflows at US$296m. The improving optimism also prompted significant inflows of US$24m into Solana. https://t.co/K5xThwJC5x

— Wu Blockchain (@WuBlockchain) October 30, 2023

According to a recent report, the surge in Bitcoin is undoubtedly favorable. However, it’s worth noting that the weekly inflow ranks as the 21st largest on record. This indicates that investors are being cautious and anticipating the upcoming spot-based ETF. The ETF is expected to catalyze a significant shift in the industry’s regulatory landscape.

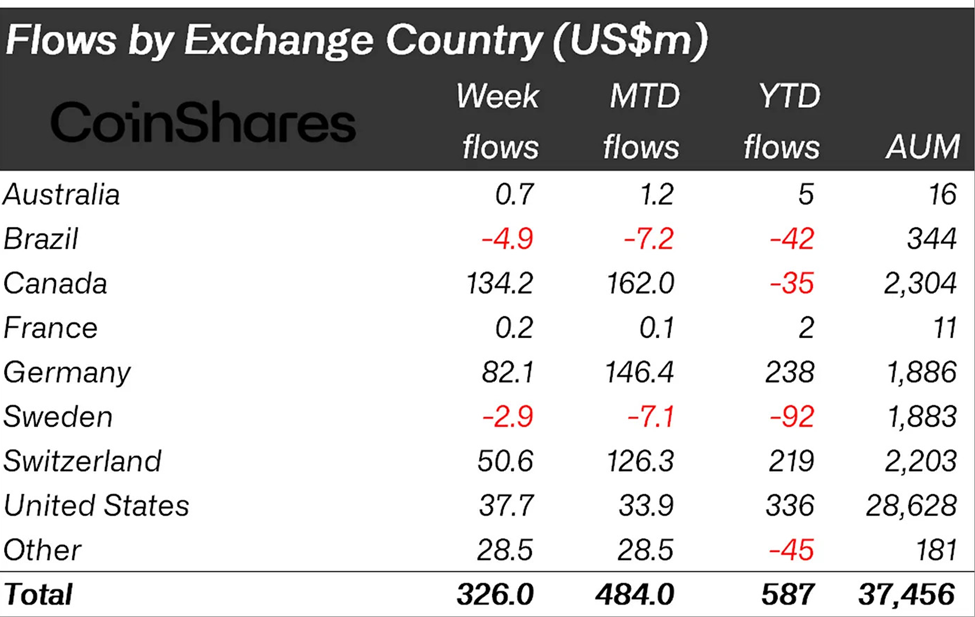

From a global perspective, the United States contributed a modest 12% of the total flows, amounting to $38 million, likely due to investors awaiting the arrival of the spot-based ETF. Notably, the lion’s share of the inflows originated from Canada, Germany, and Switzerland, with contributions of $134 million, $82 million, and $50 million, respectively. Additionally, Asia witnessed a surge in inflows, totaling $28 million, marking a historic high for the region.

The overwhelming majority of the inflows, a staggering 90%, flooded into Bitcoin, amounting to a colossal $296 million. Concurrently, the recent surge in Bitcoin prices also triggered a secondary influx of $15 million into short-Bitcoin investment products.

In a notable turn of events, Solana emerged as a significant player in this surge of investor confidence, attracting an impressive $24 million in inflows. While some alternative cryptocurrencies experienced similar surges, Ethereum stood as an exception, with outflows totaling an additional $6 million.

As a result of this extraordinary week, total assets under management in the digital asset investment sector have reached an impressive $37.8 billion, marking the highest point since May 2022. With the looming prospect of a spot-based ETF, the industry is poised for a seismic shift in the coming months.