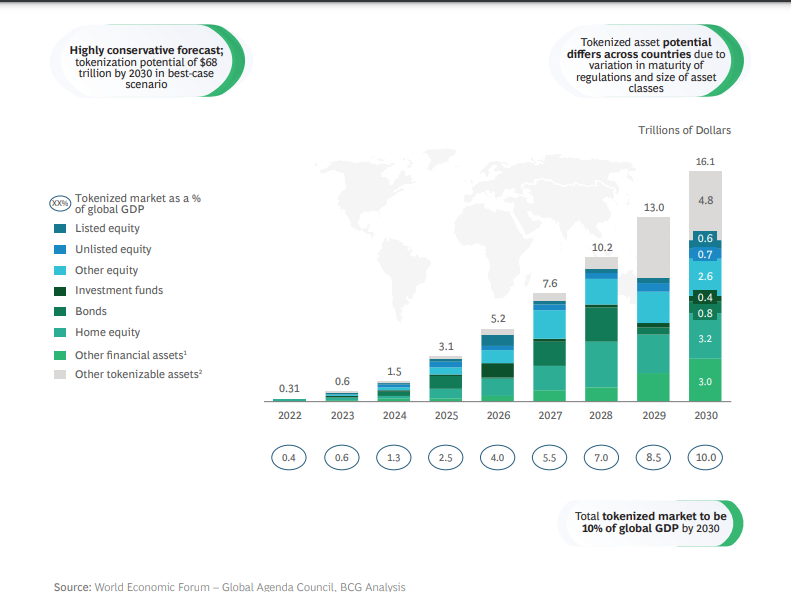

According to a recently published analysis by the Boston Consulting Group (BCG) and the digital exchange for private markets ADDX, a significant portion of the world’s wealth is now held in illiquid assets. The authors of the paper, who include BCG managing director Sumit Kumar and ADDX co-founder Darius Liu, also indicated that the entire quantity of tokenized illiquid assets, including real estate and natural resources, may reach $16.1 trillion by the year 2030.

Asset tokenization refers to the process by which an issuer produces digital tokens on a distributed ledger or blockchain. These digital tokens may either represent digital assets or physical assets, depending on the kind of asset being tokenized.

The tokenization of financial assets, including insurance policies, pensions, and alternative investments, as well as home equity and other tokenizable assets, such as infrastructure projects, auto fleets, and patents, is anticipated to see the greatest amount of growth in the near future.

The illiquidity problem that has been going on for a long time is caused by the fact that the asset class in question is out of reach for the majority of investors, there is a shortage of wealth management competence, and there is restricted access. On-chain asset tokenization, on the other hand, could be able to overcome this issue. According to the analysis, the potentially lucrative industry was worth more than $2.3 billion in 2021 and is projected to be worth $5.6 billion by 2026.

In addition, the value is estimated to be $16.1 trillion, which is a very cautious projection according to the report. Tokenization of global illiquid assets might potentially reach $68 trillion by the year 2030, according to the most optimistic projections.