- Revolut halts cryptocurrency services for U.S. customers from September 2, 2023, citing regulatory uncertainties.

- Starting October 3, 2023, U.S. users will lose access to cryptocurrencies on Revolut, affecting trading and holding.

- The decision aligns with the SEC’s view on crypto as securities, prompting delisting.

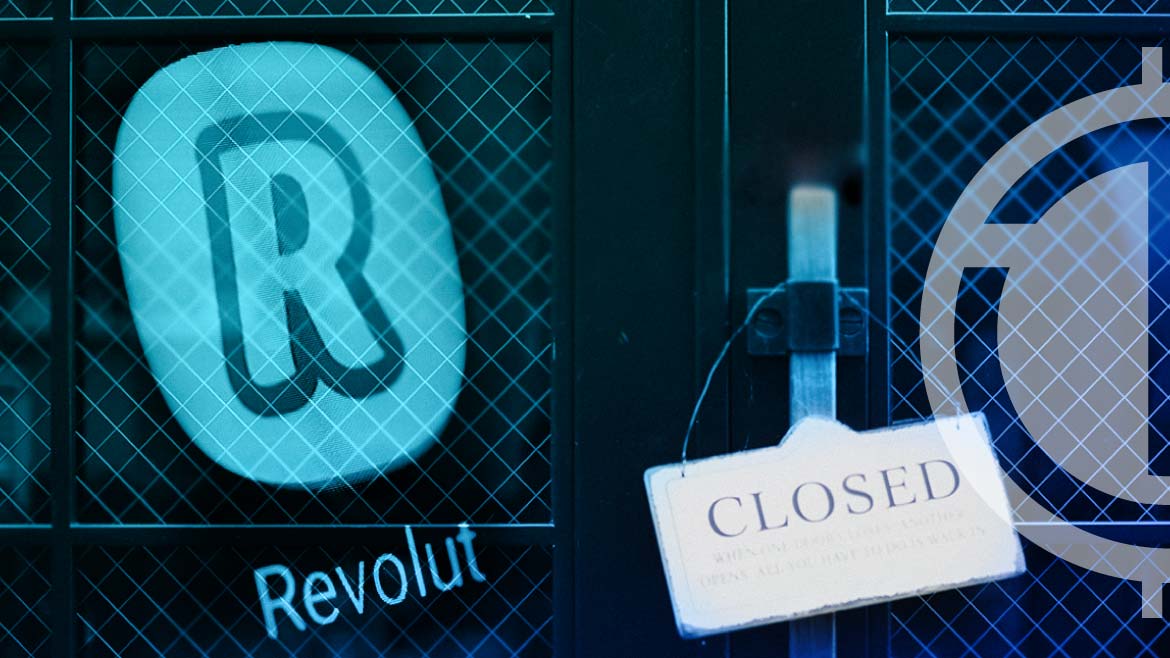

UK-based fintech giant Revolut has revealed its decision to suspend cryptocurrency services for its customers in the United States due to the ever-changing regulatory environment and uncertainties surrounding the American crypto market. This suspension is scheduled to come into effect on September 2, 2023.

Starting from the stipulated date, users in the U.S. would no longer have the option to initiate buy orders for cryptocurrencies through the Revolut platform. A more comprehensive restriction would follow from October 3, 2023, rendering access to cryptocurrencies via Revolut unavailable for U.S. customers. Consequently, these users would lose the ability to engage in cryptocurrency trading, purchasing, or holding. A spokesperson from Revolut conveyed the rationale behind this decision, stating,

As a result of the evolving regulatory environment and the uncertainties around the crypto market in the US, we’ve taken the difficult decision, together with our US banking partner, to suspend access to cryptocurrencies through Revolut in the U.S.

Revolut communicated this significant alteration in its service through emails sent to all cryptocurrency customers within the U.S. As per the report, the email’s content expressed regret over the forthcoming cessation of the crypto platform in the U.S.

The decision aligns with the regulatory backdrop concerning cryptocurrencies, particularly the U.S. Securities and Exchange Commission’s (SEC) position. The SEC contends that many cryptocurrencies should be classified as securities under investor protection regulations.

Recently, the SEC escalated its efforts by initiating legal action against leading crypto exchanges Coinbase and Binance, alleging their failure to register multiple cryptocurrencies as securities. Both exchanges have rejected these claims.

In response to the SEC’s stance, Revolut promptly began the process of delisting specific tokens, including Cardano (ADA), Solana (SOL), and Polygon (MATIC). The regulator designated these tokens as securities, a likely driving force behind Revolut’s decision to suspend crypto services. While most crypto industry participants challenge the SEC’s jurisdiction, lobbying for legislative clarity on classifying cryptocurrencies as commodities rather than securities, Revolut’s shift does not extend beyond the United States.

Revolut is expanding its crypto offerings in other regions, mainly Europe, where its services remain active. In February, the company introduced a staking program, enabling customers in Great Britain and approximately 30 European nations to earn cryptocurrency rewards. Underscoring the uninterrupted availability of crypto services for users outside the U.S., the Revolut spokesperson affirmed: “Revolut customers in all other markets can continue to sign up and enjoy using our crypto services.”