- Ripple whales’ $55 million XRP accumulation signals strong investor interest and potential price growth.

- XRP’s bullish close and stable consolidation near $0.5172 suggests a possible upward move toward $0.5650.

- Price stability near support levels suggests a possible consolidation zone for XRP.

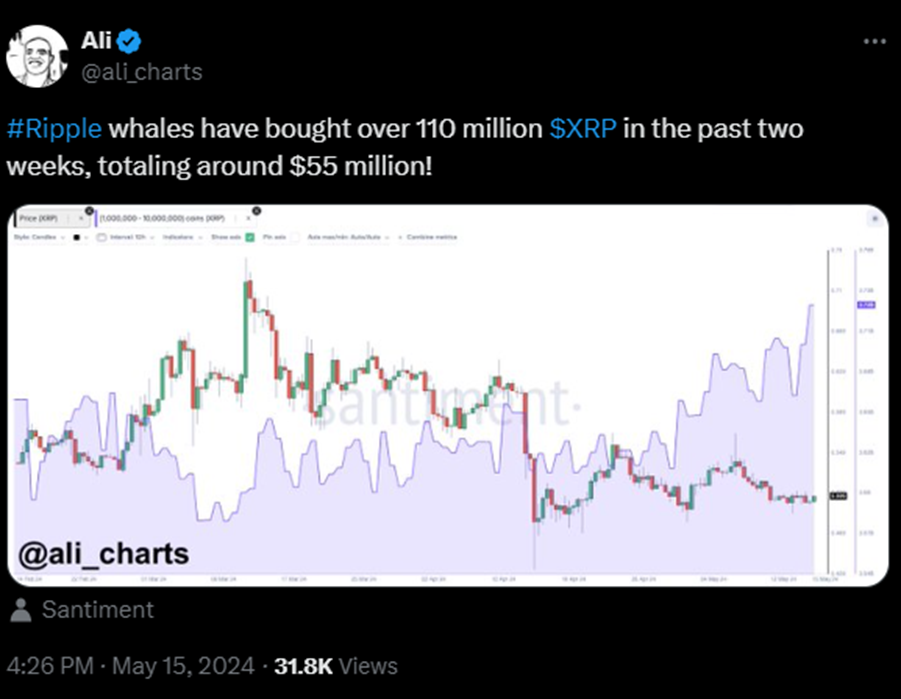

Ripple’s XRP has been on the move lately, with significant activity observed in both whale transactions and technical indicators. As highlighted by Ali Martinez, a top analyst, over the past two weeks Ripple whales have made hefty purchases. An accumulating of over 110 million XRP, amounting to around $55 million, was made.

As per CRYPTOWZRD, an analyst, XRP closed on a bullish note, hinting at a further upside move towards the $0.5650 mark and beyond. Expectations point towards increased volatility in the coming days as the recent trend indicates consolidation within a defined range. Price movements have stabilized around the current level, with minor fluctuations suggesting a potential for further growth.

Analyzing the price action, XRP/USDT is hovering around 0.5172, displaying a period of consolidation following a significant downtrend and subsequent recovery. The chart reflects stability near a minor support level at 0.5150, indicating a possible stabilization zone.

The 0.4800 level shows resilience as a support, absorbing selling pressure and preventing further declines. Additionally, the 0.3200 level serves as crucial support for long-term traders, marking the lower boundary of the observed trading range.

On the flip side, key resistance levels present challenges for bullish continuation. Breaking through the immediate resistance at 0.5650 is essential, followed by hurdles at 0.6500, 0.7300, and 0.8500. Each of these levels has historically posed difficulties for price advancement, requiring strong bullish momentum to overcome.

Currently trading at $0.517875 the 1-Day RSI reading of 48.36 suggests a neutral position, neither overbought nor oversold. Traders may eye buying opportunities if the RSI approaches the 30 mark. Moreover, the 1-Day MACD trading above the signal line indicates building upward momentum in the short term, while the 1-Day KST above the zero line hints at positive longer-term momentum.