- The SEC vs Ripple case is approaching a pivotal deadline, intensifying scrutiny on potential penalties against the embattled cryptocurrency firm.

- The extension permits deeper scrutiny of Ripple’s financial statements, potentially impacting the forthcoming opening brief and the severity of penalties.

- Speculation abounds regarding the extent of penalties Ripple may face, with estimates ranging from $200 million to as high as $3 billion.

In a recent development, the legal battle between the U.S. Securities and Exchange Commission (SEC) and Ripple reached a pivotal juncture. All eyes are on the looming deadline that could shape the future penalties faced by the embattled cryptocurrency firm. In a recent X post, renowned XRP attorney James K. Filan drew attention to the impending development.

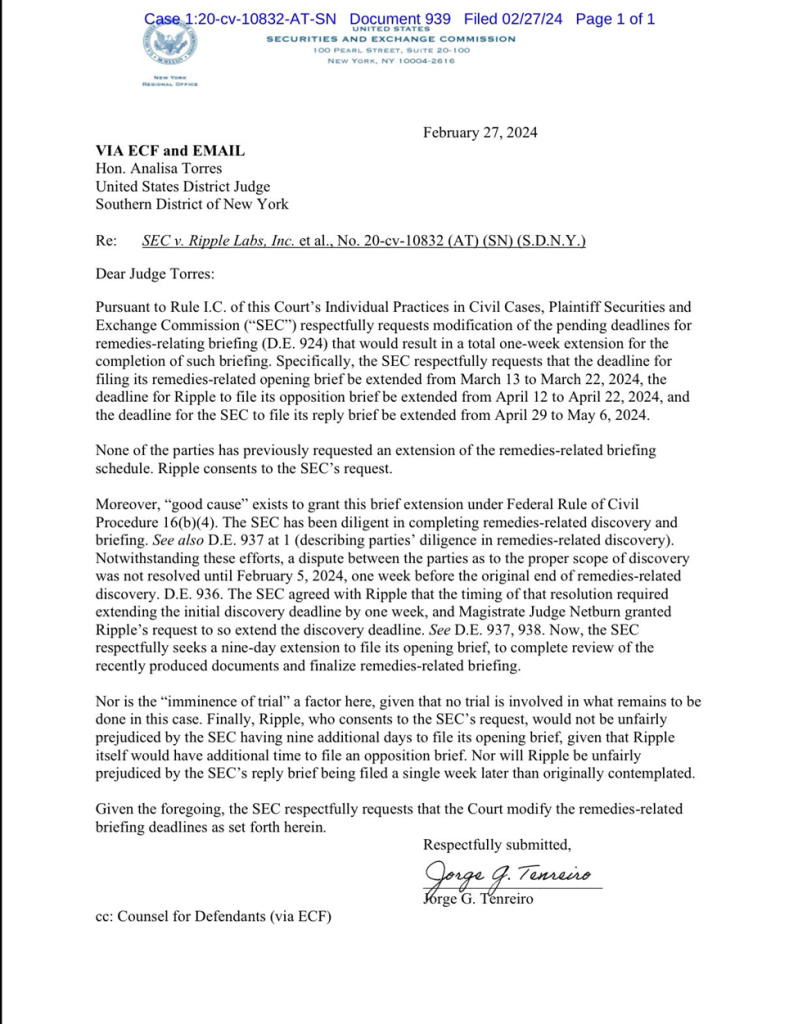

The SEC is on track to submit its opening brief regarding remedies by March 22 after an extension was granted earlier this month at the SEC’s behest. Originally slated for March 13, this extended deadline provides the commission additional time to scrutinize Ripple’s audited financial statements, potentially wielding them as a basis for its arguments in the forthcoming brief.

The impending submission deadline in a New York federal court, merely eight days from now, underscores the urgency of the legal proceedings at hand. Legal experts predict that the SEC counsel will present convincing evidence that may persuade the judge to impose significant penalties on Ripple for its alleged violations of securities laws.

Following the SEC’s submission, Ripple will have until April 22 to file its opposition, pushing back from the initial deadline of April 12. In this counterargument, the cryptocurrency payment giant is expected to contest the SEC’s assertions to mitigate the severity of the impending penalties.

Subsequently, the SEC is slated to file its reply by May 6, addressing Ripple’s arguments and reinforcing its stance on why significant penalties should be levied against the company. Once the remedies briefing concludes, the court will schedule a verdict date and determine the appropriate penalty for Ripple’s transgressions involving institutional XRP sales, valued at $770 million.

In light of these developments, there is considerable speculation regarding the magnitude of the penalties Ripple may face. Crypto analyst Zach Rector speculates that Ripple could face up to $3 billion in penalties, particularly if certain XRP sales related to On-Demand Liquidity (ODL) are deemed securities by the court.

As stakeholders anticipate the verdict, the crypto industry prepares for potential shifts in regulatory oversight and enforcement stemming from the outcome of the SEC vs. Ripple case. Recognizing its significance in shaping the trajectory of the digital asset landscape, stakeholders await the implications.