- Ripple CEO Brad Garlinghouse labels SEC Chairman Gary Gensler a “political liability,” questioning his alignment with American interests and economic growth.

- SEC faces setbacks in legal actions against cryptocurrency firms, including dropping charges against Ripple, pointing to flaws in its regulatory approach.

- Garlinghouse raises concerns over Gensler’s alleged connections with former FTX CEO and the SEC’s failed legal challenge against Grayscale Investments’ Bitcoin trust.

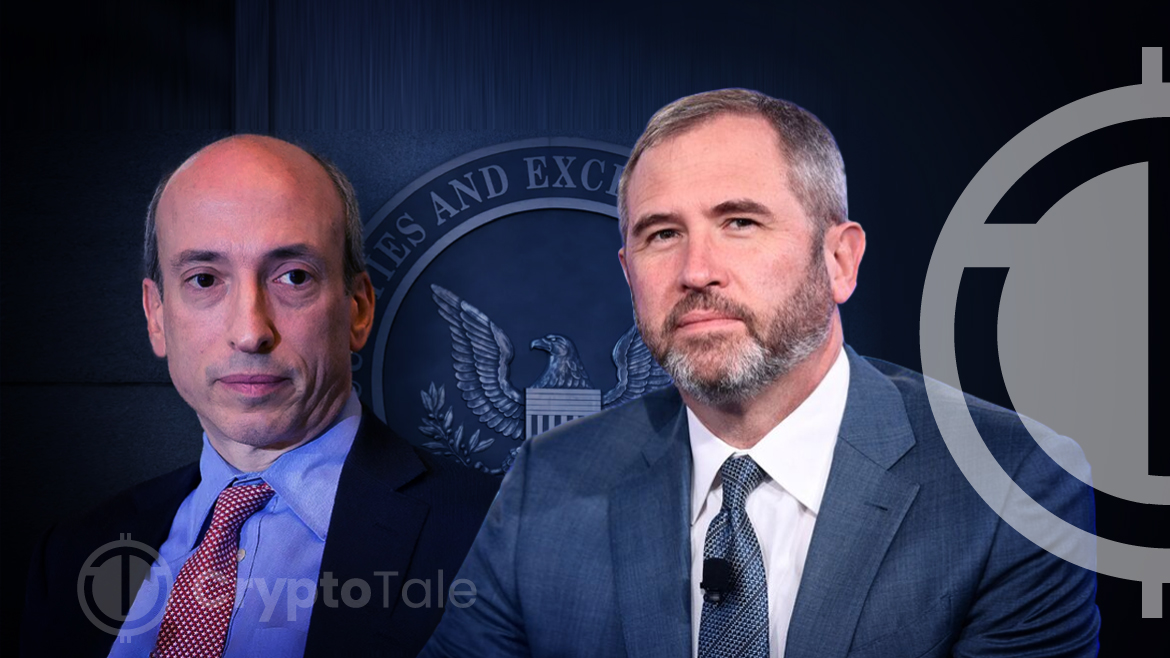

The Chairman of the U.S. Securities and Exchange Commission (SEC) is under fire once again from Ripple CEO Brad Garlinghouse. During his interview at the World Economic Forum in Davos, Garlinghouse called SEC’s Gensler a “political liability.” He also questioned whether Gensler was truly focused on his duties toward the American public and the long-term growth of the economy. Garlinhouse believes the U.S. would benefit if there were a change in leadership at the SEC.

The criticism comes at a time when the SEC has been very careful about its stance regarding the cryptocurrency industry. The regulator has been slow in approving Bitcoin ETFs and has initiated several big lawsuits against several cryptocurrency firms. There’s a lot of discussion about how the SEC handles these legal matters, especially in its case against Ripple. The SEC had also accused Garlinghouse and co-founder Chris Larsen of breaking securities laws. But later, the SEC dropped these charges. This was seen as a major setback for the SEC.

In his interview, which was being hosted by CNBC’s Arjun Kharpal, Garlinghouse stated:

I do think the chair of the SEC, Gary Gensler, is a political liability in the United States. And I think he’s not acting in the interests of the citizenry, he’s not acting in the interests of the long-term growth of the economy, and I don’t understand it.

Even though the SEC recently approved several Spot Bitcoin ETFs, Gensler keeps warning about the dangers of investing in cryptocurrencies. Garlinghouse accused Gensler of repeating the same act in the court and called it “insanity”. Gensler’s strategy has often failed in the courtroom against Ripple. He also predicted a potential change in SEC leadership, adding that it would be a benefit for the American people.

Garlinghouse’s remarks also touched upon Gensler’s alleged connections with former FTX CEO Sam Bankman-Fried. He referred to a video that raised questions about their meetings during the time FTX was having problems. This comment adds more to the ongoing disagreements and hints that Gensler’s decisions might be influenced by politics.

Furthermore, the SEC also faced a major loss in a court case against Grayscale Investments. Grayscale wanted to change its Bitcoin trust, known as GBTC, into a Spot Bitcoin ETF. The SEC tried to stop this from happening but failed. This loss in court is one of the major setbacks the SEC has faced, and it supports Garlinghouse’s criticism.