- Solana’s recent staking spike of 4.51 million SOL, valued at $450 million, indicates a bullish market trend.

- Increased staking activity in Solana reduces market supply, potentially triggering a price surge.

- Solana’s price trajectory aligns with broader market trends, including the impact of Bitcoin Spot ETF approval.

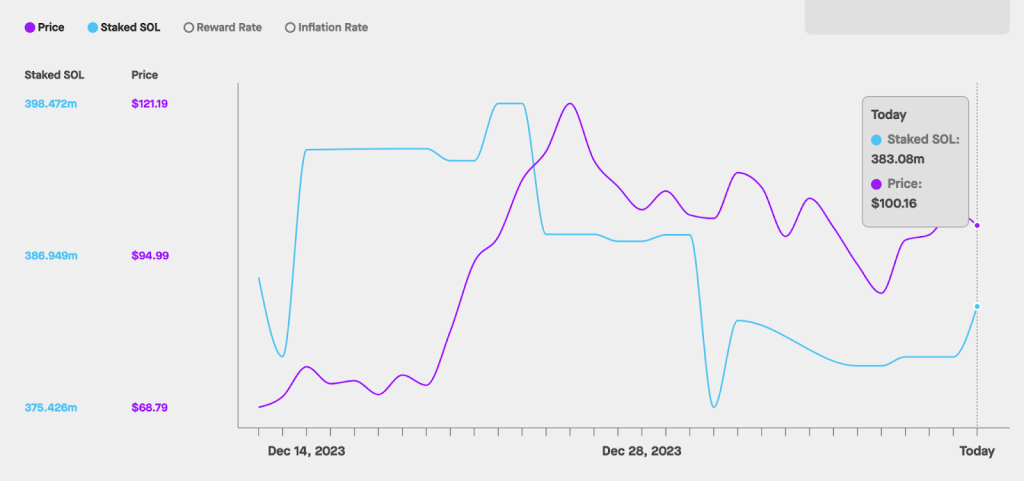

Solana has recently reclaimed its position above $100, sparking significant interest in the cryptocurrency community. A notable surge in SOL staking, amounting to an influx of 4.51 million SOL, signals a bullish sentiment among investors. This move, valued at approximately $450 million, reflects an optimistic outlook for the altcoin.

At the beginning of 2024, the crypto market experienced tepid price movements. Solana, however, has bucked this trend since January 8. It has seen a 20% increase, effectively regaining its $100 milestone. This positive shift aligns with the broader market sentiment, particularly with the recent approval of the Bitcoin spot ETF. Such developments boost Bitcoin and often have a ripple effect across the altcoin sector, including Solana.

Staking, a process where investors lock their coins in smart contracts to earn rewards, has implications for a cryptocurrency’s market dynamics. In Solana’s case, the substantial increase in staking activity reduces the number of tokens available for trading. This scarcity can lead to price appreciation. Historically, Solana’s significant rallies have coincided with spikes in staking activity. Hence, the current trend suggests a similar trajectory, pushing Solana’s price towards the ambitious $150 mark.

On January 8, Solana witnessed a significant boost in staking, with 378.6 million SOL committed to smart contracts, a figure that has since risen to 383.08 million. Over the past three days, an additional 4.51 million SOL, valued at around $450 million, has been staked, signaling growing investor confidence in the cryptocurrency.

Solana must overcome key resistance levels to achieve this price target, particularly around $117. A decisive move beyond this point could pave the way for further gains. However, a fallback below $85 could dampen the bullish outlook. Nonetheless, the market’s current dynamics and Solana’s staking activity present a strong case for the cryptocurrency’s upward trajectory.

As of this writing, SOL is exchanging hands at $103.85, recording an increase of over 6% since yesterday’s close of $95.80. The increase in price action followed by the overall market bullish outlook has led to an increase in the daily trading volume and the market capitalization. The market capitalization and daily trading volume have increased by 6.60% and 50%, respectively.

Technical indicators on the hourly chart hint at a bullish reversal as the price creates a bullish pennant pattern. SOL has risen from the middle band of the Bollinger Band at $98 and is close to touching the upper band at $105. A touch at $105 could lead to a new rally toward the previous highs of $115. The Relative Strength Index is steadily climbing and has touched the 59 index, suggesting increased buying pressure in the SOL market.

Solana’s recent market performance, highlighted by a surge in staking activity, presents a compelling growth narrative. This trend and favorable market conditions set the stage for Solana to reach or even surpass the $150 price point. With key resistance levels in sight, the weeks ahead will be crucial in determining Solana’s trajectory.