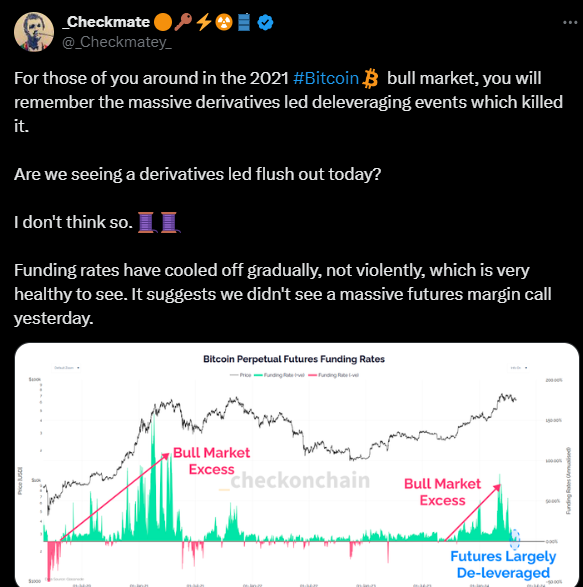

- Funding rates cooling gradually suggests a healthy market adjustment, not a violent upheaval.

- Long-side traders dominating liquidations highlight the unpredictable nature of the market.

- Weakening demand and consistent selling pressure contribute to near-term weakness in the Bitcoin market.

Amidst the recent turbulence in the cryptocurrency market, speculation has arisen regarding whether the current downturn is reminiscent of the derivatives-led deleveraging events of the 2021 Bitcoin bull market. However, a closer examination of the data suggests otherwise.

As highlighted by Checkmate, an onchain analyst, funding rates, a key indicator of market sentiment and leverage, have cooled off gradually, indicating a healthy adjustment rather than a violent upheaval. This gradual cooling suggests that the market has not witnessed a massive futures margin call, a stark contrast to the events of the past.

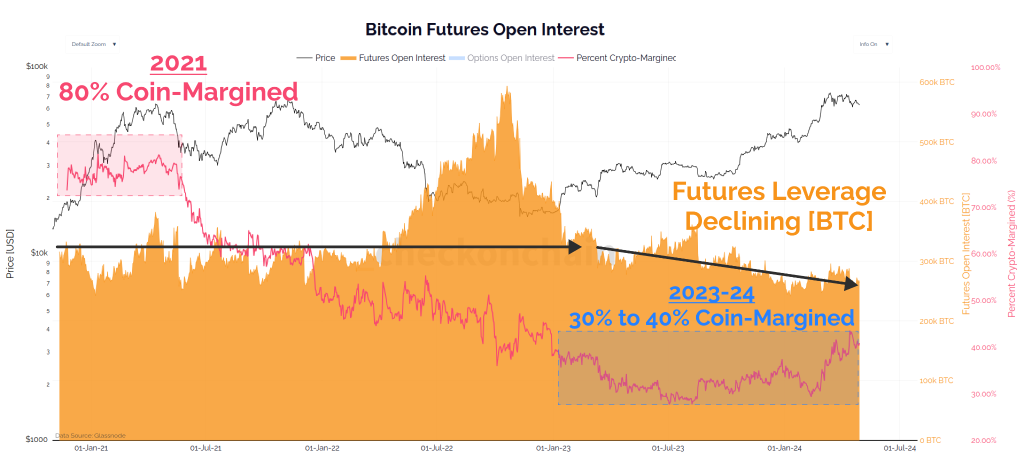

Furthermore, analysis of Bitcoin futures open interest reveals a decline over the past year when measured in Bitcoin terms, indicating a reduction in relative leverage. Coin-margin, too, has halved compared to 2021 levels, mitigating downside convexity risk and contributing to a more stable market environment.

Source: Checkmate

While there were two statistically significant deleveraging events during the rally to the $73,000 all-time high, they were quickly followed by a cooling-off period, suggesting that derivatives were not the primary driver of the recent sell-off.

It is worth noting that long-side traders have been dominating liquidations, a trend that underscores the market’s unpredictable nature and the risks associated with trading on sentiment alone.

Interestingly, despite the success of the Bitcoin exchange-traded fund (ETF) rally, market sentiment took a turn, resulting in short squeezes from $38,000 up until recent weeks. Only after this period of volatility did sentiment shift towards long positions, contributing to the current market dynamics.

Spot market data paints a picture of weakening demand, with daily excess Bitcoin market buys dwindling from $100 million to $50 million, indicating a shift towards sell-side dominance. The lackluster demand for Bitcoin ETFs, coupled with consistent selling pressure from the Grayscale Bitcoin Trust (GBTC), further contributes to the near-term weakness in the market.