The SUSHI token and protocol usage are facing challenges as long-term holders exit their positions, potentially due to macroeconomic conditions and a recent SEC subpoena. This has led to a decline in TVL and a struggle to maintain protocol usage, while Uniswap continues to show healthy growth.

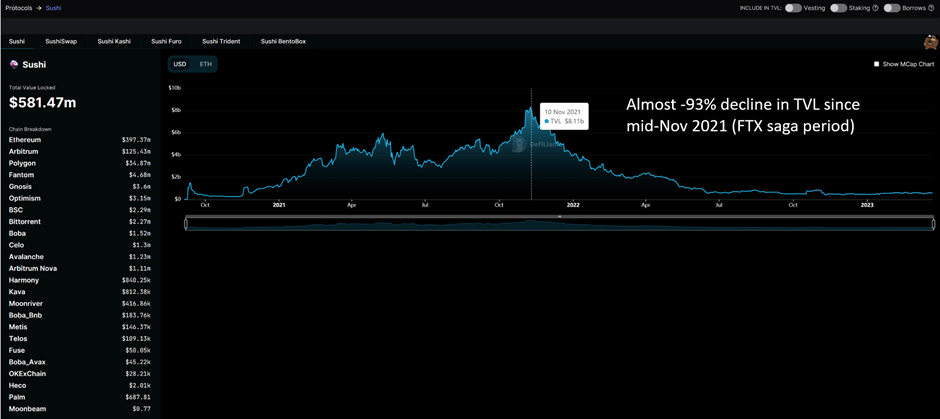

SUSHI’s TVL has dropped by -93% since mid-Nov 2021 and is now at a meager $581.47M USD. This is in stark contrast to Uniswap’s TVL, which has grown from $2.7B to over $20B in the same time frame.

Further evidence of users exiting SUSHI positions can be seen when looking at the protocol’s usage metrics. According to data from Glassnode, the number of active addresses on SUSHI has dropped by over -30% since mid-Nov 2021. This is indicative of long-term holders reducing their exposure and possibly moving away from SUSHI completely.

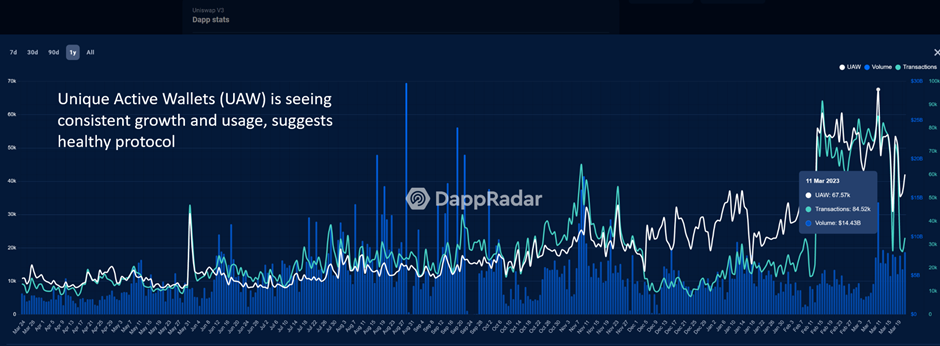

The picture is even more concerning when looking at the UAW – The number of unique active wallets interacting or performing a transaction with SUSHI’s smart contracts. There are occasional spikes in usage but overall, there’s little real growth as protocol usage on average remains pretty low.

On the other hand, Uniswap’s UAW has been increasing for the last year and at a pretty organic rate. This is likely due to its competitive fees, positive yield farming incentives, and overall better user experience compared to SUSHI.

The SEC subpoena regarding Uniswap earlier this year may have had an impact on users choosing to leave SUSHI in favor of Uniswap. Combined with the current macroeconomic climate, SUSHI has been unable to gain further traction and usage in the DeFi market.

The challenges SUSHI is facing may continue until investors can be assured of the platform’s long-term sustainability or until successful DeFi projects begin to emerge on top of it. Ultimately, SUSHI’s future is uncertain and will depend heavily on the success of its projects and developments.

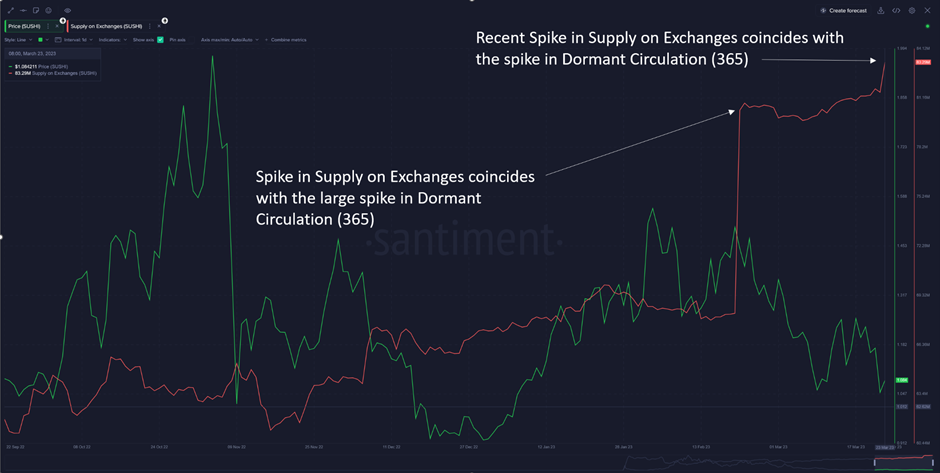

The SUSHI token itself has also seen notable movements since the start of the year. Looking at Dormant Circulation (365), which shows the number of tokens that haven’t moved for at least 365 days making a move on a day, there have been several spikes throughout 2021.

Previous spikes were followed by sharp price declines, and we are now observing yet another spike that happened yesterday. Investors will be watching closely to see if further declines in SUSHI’s TVL, usage, and price follow this latest spike.

The supply of SUSHI on exchanges coincides well with what we have observed in Dormant Circulation (365), suggesting that long-term holders decided to exit their positions. This has further weakened SUSHI’s position as a leader in the DeFi space and investors will need to keep an eye on its developments moving forward.

It is clear that SUSHI is struggling to remain competitive in the DeFi space and will have to innovate its platforms and products if it is to ever regain market dominance. SUSHI coin is trading at $1.02, down by 2.14% in the last 24 hours. The trading volume is at $60,228,150 and the market capitalization is $227,139,243 with a 24hr low/high of 0.99/$1.07 on Coinmarketcap at the time of writing.

In conclusion, SUSHI’s TVL, usage metrics, and price have all been affected by long-term holders exiting their positions possibly due to macroeconomic conditions and the SEC subpoena. Moving forward, SUSHI will need to innovate its platform and products in order to regain market dominance and stay competitive in the DeFi space.

Share:

X