- Tether’s substantial capital injection into the market demonstrates robust confidence and liquidity, bolstering Bitcoin’s standing.

- The SEC’s green light for Bitcoin spot ETFs indicates a significant shift towards recognizing crypto’s potential in mainstream finance.

- This combination of Tether’s actions and SEC’s approval could usher in a new era of investment in the Bitcoin ecosystem.

Tether, a major player in the cryptocurrency market, is currently injecting billions into the ecosystem. This move coincides with the Securities and Exchange Commission’s (SEC) recent approval of a Bitcoin spot Exchange-Traded Fund (ETF). Ki Young Ju, the Founder and CEO of CryptoQuant.com, remarked that the SEC’s approval of a Bitcoin spot ETF signals a resolution to the concerns surrounding Tether, previously linked to market manipulation allegations.

Previously, the SEC had reservations about approving spot ETFs, citing concerns over potential market manipulation. However, this latest approval indicates a change in perspective, suggesting a growing recognition of the market’s maturity and robustness. Consequently, these developments are incredibly bullish for Bitcoin.

The combination of Tether’s aggressive market strategy and the SEC’s newfound openness is reshaping the landscape of cryptocurrency investment. This development reflects a greater institutional acceptance of digital currencies and opens the door for more mainstream investment in the crypto space.

Recently, Tether announced a historic profit of $2.85 billion for the last quarter. This success has propelled its flagship token, USDT, close to reaching a market capitalization of $100 billion. Significantly, $1 billion of these profits emerged from interest earned on investments in U.S. Treasuries, reverse repos, and money markets, essential in backing the USDT stablecoin.

Moreover, the remaining profit primarily resulted from appreciating other key investments, including Bitcoin and gold. This financial success highlights Tether’s strong market position and reflects digital currencies’ growing potential and acceptance in the global financial landscape.

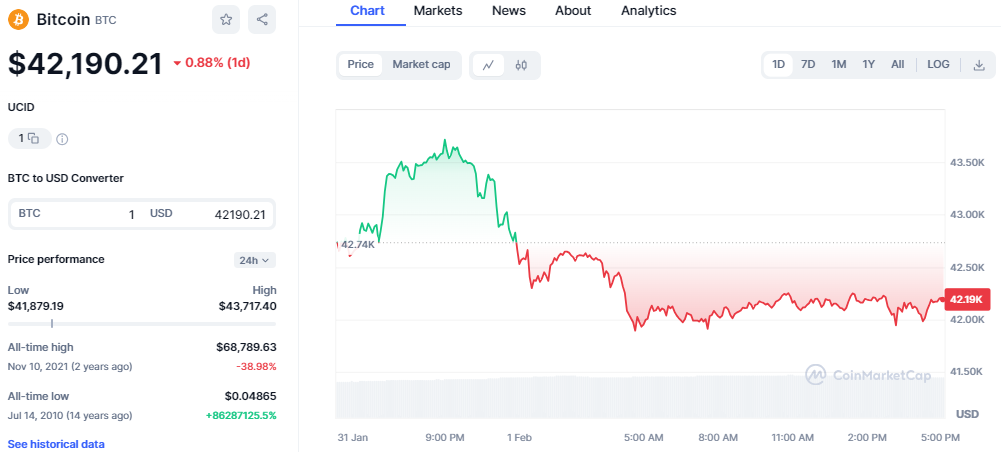

Looking at today’s Bitcoin performance, BTC is trading on a downward trajectory as the bearish activity takes hold. Currently, BTC is exchanging hands at $42,190, down by 1% on the daily timeframe. BTC has been trading in the negative territory since it failed, surpassing the $44k mark. However, the support level at $42k has been holding strong for the past few days, suggesting a price rebound on either side.

In summary, Tether’s significant financial input and the SEC’s approval of a Bitcoin spot ETF create a more stable and promising environment for cryptocurrency investment. This bodes well for the future of Bitcoin and the broader digital currency market.