- Bitcoin showcases robust momentum and surges beyond the $41,400 mark amid ETF speculation and heightened institutional attention.

- Ethereum’s bullish trajectory sustains, achieving the $2,200 mark, and aims to overcome $2,275 resistance for the subsequent surge.

- Terra’s LUNC token, with a remarkable 86% surge, approaches the $0.000240 level despite a marginal 7.78% decline in 24 hours.

The cryptocurrency market witnessed an astounding leap in valuation, driven by major tokens that significantly bolstered their portfolios in recent times. Bitcoin soared past the $40,000 mark, signaling a robust bullish sentiment prevailing within the crypto sphere.

Renowned crypto analyst Crypto Busy unveiled the latest trending cryptocurrencies in the past 24 hours, providing insights into the dynamic landscape in a recent X post.

Bitcoin exhibited a remarkable surge, crossing the $41,400 mark on Binance, fueled by mounting anticipation for approving a Spot Bitcoin ETF. Factors such as increasing institutional demand and emerging tokens compliant with the BRC-20 token standard have been key catalysts propelling BTC’s upward trend.

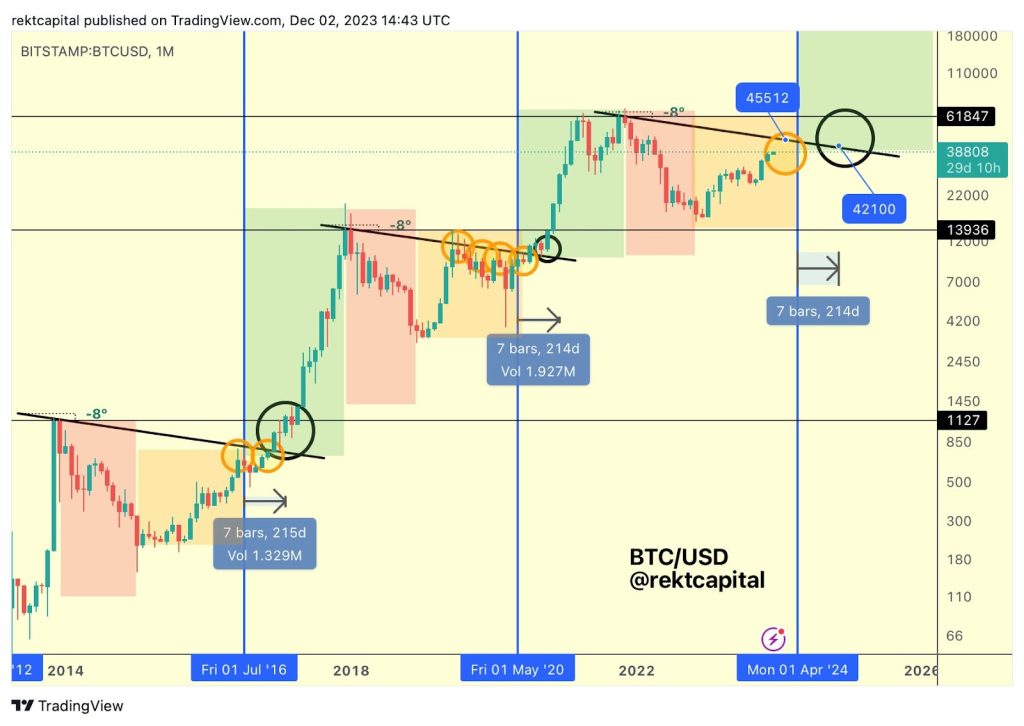

Upon analyzing Bitcoin’s trajectory, renowned crypto analyst Rekt Capital underscored the potential for BTC to retest the $45,000 level preceding the anticipated fourth halving event in April 2024. Highlighting a historical trend, the analyst projected a potential pullback to $42,000 after attaining the $45,000 milestone.

As of today, the price of Bitcoin stands at $41,654, reflecting a marginal 0.02% decline over the last 24 hours but maintaining an impressive 12.61% surge over the past 7 days. The crypto market remains an enthralling arena, poised for further excitement and fluctuations in the days ahead.

Ethereum has experienced a significant increase in value, similar to Bitcoin. It has surpassed the $2,000 mark and has overcome several obstacles around $2,120. This has put ETH on a positive path, exceeding $2,200 and setting the stage for a more significant rise.

Ethereum peaked at around $2,275 over several months and is now consolidating its recent gains. Although there was a slight retracement below the 23.6% Fibonacci level from the $2,148 low to the $2,275 high, ETH is still trading above $2,209, marking a 2.16 decline in the last 24 hours.

On the hourly chart of ETH, a pivotal bullish trend line emerges, indicating support near $2,225. Despite encountering resistance around the $2,250 mark, Ethereum eyes the crucial hurdle at $2,275, beyond which lies a trajectory toward $2,320 and a subsequent resistance at $2,350. A substantial breakthrough could initiate a surge toward the $2,500 mark.

The value of Terra’s LUNC has surged by more than 86% following its breakthrough beyond the critical resistance point at $0.00012855. Presently, the price lingers near its upper resistance threshold of $0.000240, with an imminent test on the horizon, the result of which remains uncertain. LUNC is trading at $0.00024018, reflecting a 7.78% decline in the last 24 hours and an impressive 154.89% surge over the past 7 days.

The Moving Average Convergence Divergence (MACD) exhibits a consistent green histogram, signaling sustained buying and selling pressures within the market. Additionally, the moving averages depict a steep ascent on the chart, implying a probable continued increase in value in the days ahead.

If the market’s upward momentum persists, the LUNC price seems positioned to challenge its resistance at $0.0002602. Maintaining stability at this price level might create an opportunity for Terra Classic to attempt to breach its upper resistance mark of $0.0002805 by the close of this month.