- Bitcoin’s 4-month price range triggers an altcoin interest surge.

- BTC’s price flatline mirrors conditions from 15 years ago.

- Despite a minor drop, Bitcoin’s price remains within the established band.

For the past four months, Bitcoin (BTC), the progenitor and de facto leader of the cryptocurrency market, has kept to a surprisingly narrow trading range of $28,000 to $32,000, as reported by Santiment, the renowned blockchain data, and analytics platform, on X. This narrow banding is a departure from its prior behavior when the currency rarely maintained a price within a 5% range for longer than two months, a pattern evident from 2020 to 2022.

📊 #Bitcoin has spent about 4 months now in the same $28k to $32k range. There are occasional swings to shake up #altcoins, but flat $BTC action eventually leads to irrational behavior. Read how the crowd's restlessness will dictate the next #bullmarket. https://t.co/0aGQcMEMUv pic.twitter.com/CtFiwzRfbb

— Santiment (@santimentfeed) July 25, 2023

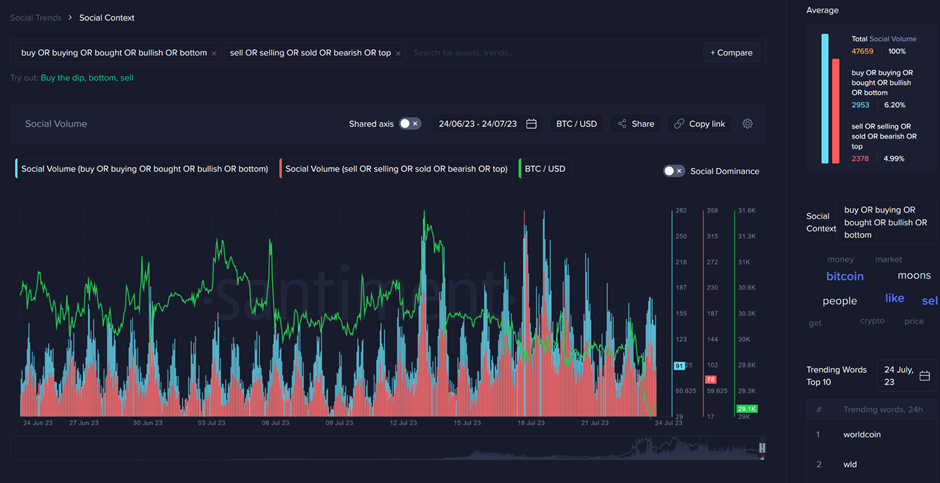

The latest report from Santiment, shed light on this peculiar market phase, exploring the resultant implications for the wider crypto trading environment and the potential shift in market sentiment. With Bitcoin’s market movements near a standstill, trader focus has shifted from the crypto titan towards the more volatile altcoin market, leading to a flurry of activity that could serve as a harbinger of the next bull market.

According to the report, as BTC’s price action becomes increasingly flat, it seems the market’s excitement is directed elsewhere, closely mirroring the conditions from around fifteen years ago when Bitcoin was first mined. While the situation appears identical in sentiment, the landscape has reportedly changed, with a multitude of altcoins now vying for the attention of traders in the absence of BTC price exhilaration. BTC’s price started this week at a slightly subpar $29.2k, but it remains well within its established price band.

As Santiment noted, these times of flat Bitcoin activity tend to provoke irrational behavior among traders, serving as a breeding ground for exaggerated price swings among altcoins, an environment where professional traders often generate the most profit. It’s in these circumstances that understanding market sentiment becomes paramount for predicting the market’s next big swing.

An earlier Santiment report noted an abundance of bullish calls exceeding bearish ones, despite Bitcoin’s failure to maintain the psychological support level of $30k. This dominance of optimism over caution might not be the ideal indicator for a market turnaround, but it does show a lack of worry among traders, which can potentially fuel volatility.

As of July 25, 2023, the price of Bitcoin stands at $29,129.16, with a 24-hour trading volume of $14,553,850,478, according to CoinMarketCap data. Despite a 2.25% drop over the last 24 hours, Bitcoin retains its number one ranking on CMC, with a live market cap of $566,227,339,309 and a circulating supply of 19,438,506 BTC coins.