- U.S. launches Bitcoin Spot ETFs with expected $4B initial inflow, far surpassing Europe’s crypto investment scale.

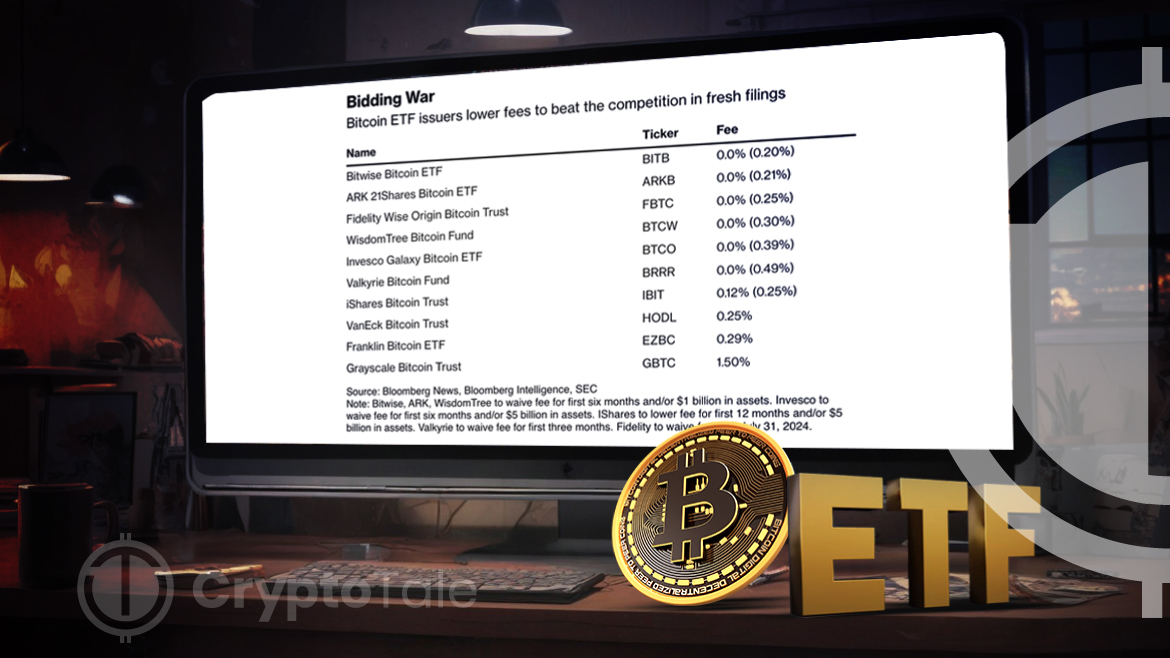

- Bitcoin ETFs offer lower fees, contrasting sharply with Europe’s market, signaling a shift in global crypto investing.

- Layergg anticipates a ‘Sell the News’ trend following Bitcoin ETF approval but remains optimistic about future growth.

The United States Securities and Exchange Commission (SEC) has approved the trading of Bitcoin Spot Exchange-Traded Funds (ETFs), marking a significant milestone in the integration of cryptocurrencies into mainstream financial markets. This approval is expected to unleash a new wave of investments, with Bloomberg predicting an inflow of $4 billion on the first trading day. According to Patrick Hansen, EU Strategy & Policy at circle, the magnitude of this development is underscored by comparing it to Europe’s 10 largest Bitcoin ETPs/ETNs, which collectively hold around €2.5 billion after years in the market.

The U.S. capital markets exhibit distinct characteristics, notably the lower fees and more extensive market size, compared to their European counterparts. Hansen emphasizes these differences, highlighting the potential benefits for U.S. investors and the broader Bitcoin market. The approval of Bitcoin ETFs in the U.S. is not just a regulatory milestone; it reflects the unique dynamics of the American financial landscape.

Despite the optimism surrounding this development, caution is advised. Historical trends, as noted by market research firm Layergg, suggest a pattern of ‘Sell the News’ events following such significant announcements. This cautious approach is evident in their de-risking strategy which shows a conservative investment shift following the ETF news.

However, Layergg remains optimistic about the long-term prospects, pointing towards the upcoming Bitcoin Halving event as a trigger for what they term a ‘Super Cycle’ in Bitcoin’s value. This dual outlook of caution in the short term and optimism in the long term mirrors the complex dynamics at play in the cryptocurrency market.

As the U.S. embarks on this new phase of cryptocurrency integration, a balanced perspective is crucial. The approval of Bitcoin Spot ETFs is a significant step forward, but it is accompanied by intricate market reactions and historical precedents. Investors and market watchers alike must navigate this new terrain with both enthusiasm and prudence.