- Mike Novogratz, CEO of Galaxy Digital, expects U.S. approval of the first Bitcoin ETF within a six-month window.

- Contacts at BlackRock and Invesco support the belief that the approval is a question of “when, not if.”

- Some analysts believe ETF approval will come following the outcome of the SEC vs Grayscale lawsuit.

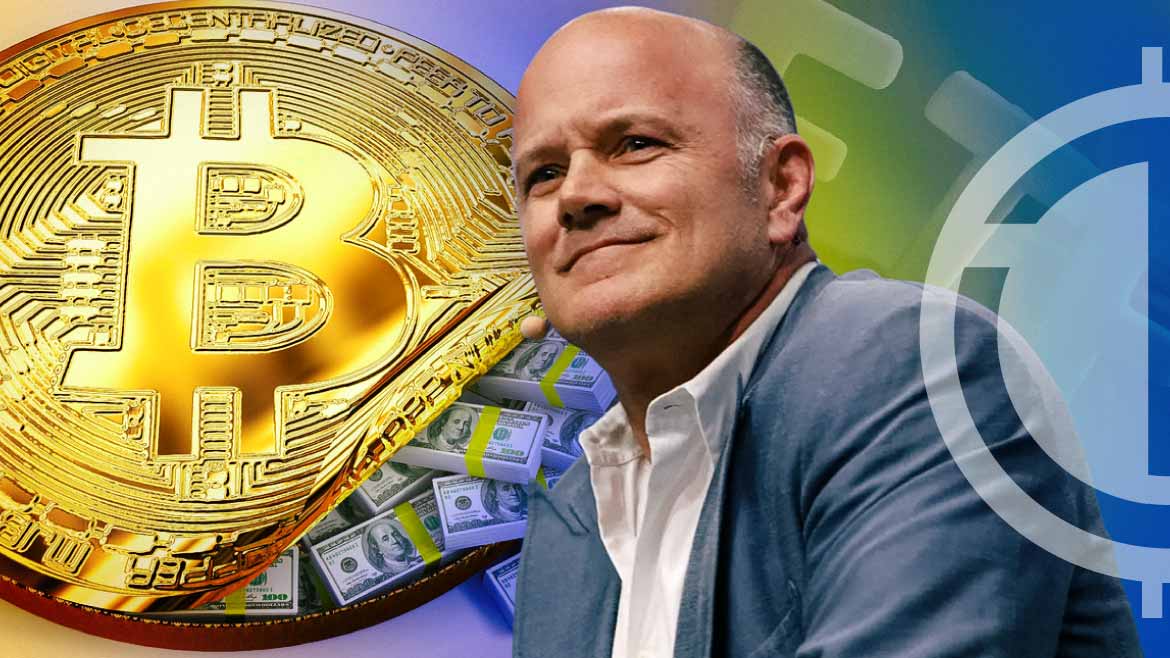

Galaxy Digital’s CEO, Mike Novogratz, has expressed optimism that the U.S. could soon approve its first Bitcoin exchange-traded fund (ETF). During the company’s Q2 earnings call, where a $46 million loss was reported, Novogratz shared this belief, backed by insider information from BlackRock and Invesco, two major investment firms.

Novogratz portrayed his excitement about the progress of the ETF, emphasizing the significance of the development, calling it a “big deal”. He referred to conversations with contacts at both Invesco and BlackRock, suggesting that the approval of the ETF is a question of “when, not if,” rather than a matter of uncertainty. According to his insights, the general expectation is that the decision would likely come within a six-month window.

Galaxy Digital, in partnership with Invesco, has reapplied to launch a Bitcoin ETF, and they are among several contenders. The expectation is that the Securities and Exchange Commission (SEC) would approve the ETFs within the next four to six months.

This potential approval has led to a shift in sentiment among big investment companies like BlackRock, which have begun to view Bitcoin more positively. BlackRock’s CEO, Larry Fink, has even advocated for Bitcoin as a global currency. The approval of a Bitcoin ETF would simplify large investments into Bitcoin, and Novogratz has emphasized Galaxy Digital’s intention to be a significant player in this market.

Meanwhile, some analysts believe that the wave of Bitcoin ETFs could come even sooner. This expectation depends on the outcome of a lawsuit between Grayscale, another investment company, and the SEC. If the SEC loses, several Bitcoin ETFs might be approved simultaneously.

Being the first to launch a Bitcoin ETF could be highly profitable. The first Bitcoin Futures ETF, the ProShares Bitcoin ETF, made $1.2 billion just two days after its launch. This first-mover advantage has led some firms to appeal to the SEC to treat all Bitcoin ETF applications equally. The SEC’s decision is eagerly awaited, and it is expected this week, in line with the 45-day deadline from the date of the first filing.