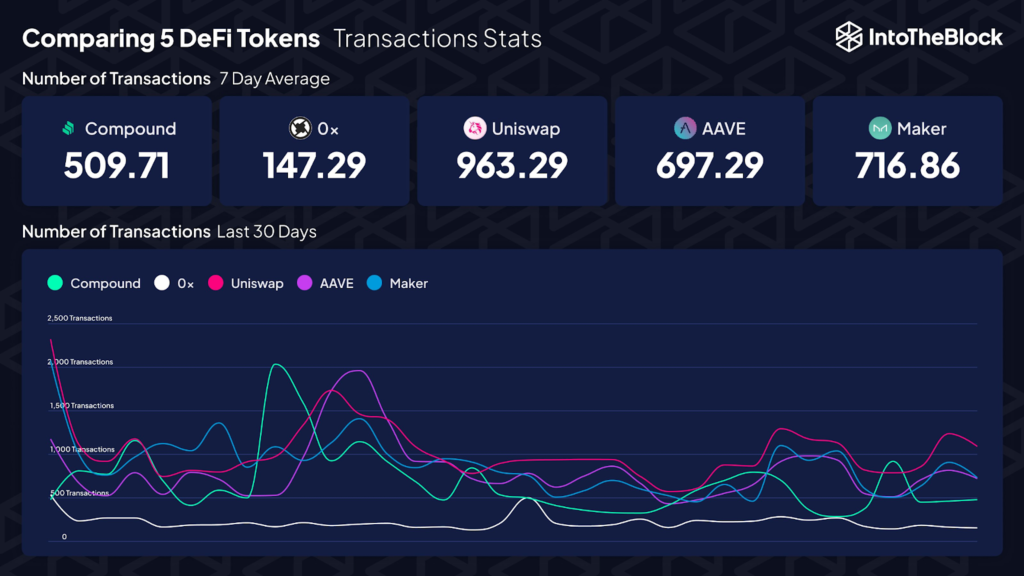

A recent analysis by market intelligence platform IntoTheBlock has shed light on the current landscape of some of the leading DeFi tokens. The study found Uniswap leading the pack in 7-day average transactions, with Maker and Aave not far behind. Amidst this trend, the DeFi ecosystem is grappling with a total value locked (TVL) that’s hit its lowest in 2.5 years.

The DeFi sector has witnessed fluctuating fortunes recently. Uniswap, priced at $4.60 and a 24-hour trading volume of $87,851,591, ranks 25th on CoinMarketCap. Despite the substantial trading volume, it’s seen a decline of 3.50% over the last day. With a circulating supply of 577,501,031 UNI coins out of a possible 1 billion, its current market cap stands at approximately $2.65 billion.

Maker, priced at $1,011.39, has experienced a 7.05% dip in the last 24 hours. Holding the 42nd spot on CoinMarketCap, its market cap hovers close to a billion dollars. On the other hand, Avalanche, with a price of $10.03 and trading volume surpassing $105 million, is ranked 20th. Though it has observed a modest 2.63% decline, it boasts a live market cap of $3.45 billion.

One of the intriguing facets of IntoTheBlock’s report was the 30-day transaction history chart. A significant surge at the beginning of the month wasn’t just an anomaly. Instead, the data underscores that this wasn’t a one-off occurrence. These assets had already been maintaining elevated transaction levels, a continuation of a trend that was initiated with a rise in June.

However, it’s not all rosy in the DeFi world. A separate post from IntoTheBlock highlighted the sector’s challenges. After plummeting by 80% in 2022, falling token prices have pushed many DeFi protocols downward. This has eroded yields, causing a decline in the protocol’s perceived value, consequently lowering the TVL.

A reduced inclination towards speculation in the current market has exacerbated this trend. Considering these dynamics, it’s evident why the value locked in DeFi is reminiscent of 2021 levels.