Ran Neuner, the co-founder, and CEO of the crypto asset and blockchain investment fund, Onchain Capital, recently shared his insights on the US debt ceiling’s impact on the leading cryptocurrency Bitcoin (BTC), asserting that BTC would meltdown. The popular crypto YouTuber shared his BTC analysis in a video posted on his social podcast Crypto Banter, noting that theoretically, BTC has invalidated the head and shoulders (H&S) pattern.

The Chartered Market Technician Crypto Birb, the CEO of CryptoNest, a top quality international trade group, also noted that the H&S pattern couldn’t break down, so BTC might perform better on the other side:

The H&S has failed to break down.

— Adrian Zduńczyk, CMT (@crypto_birb) May 29, 2023

Failed patterns tend to perform better in the opposite direction.#BTC https://t.co/nsIlggI1nr pic.twitter.com/4mIGvuwy6e

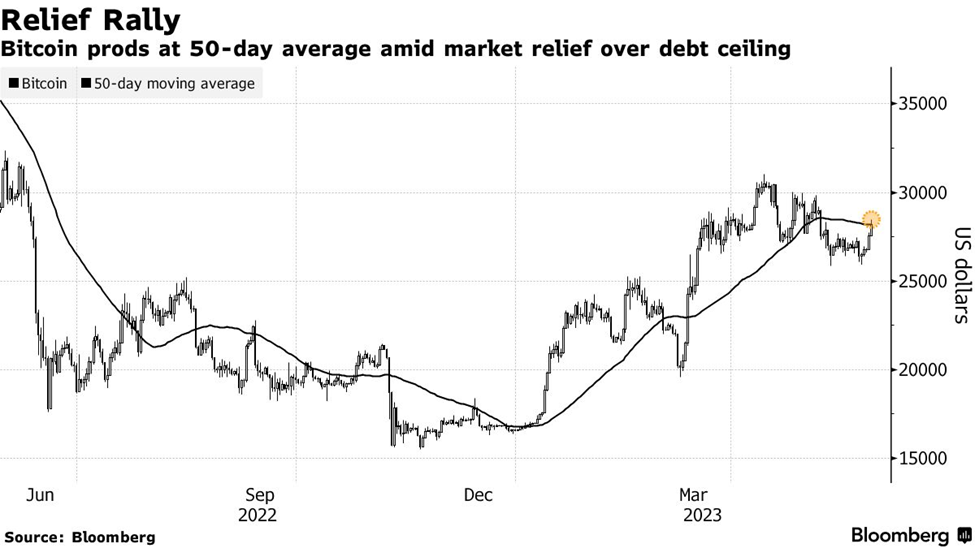

The CNBC crypto trader added that the debt ceiling is an absolute disaster for the crypto market, and if Birb is right, BTC would touch $31,000 to $32,000. The analyst showed the BTC/USDT chart on the ByBit exchange and reasoned that the BTC price pump might be a result of multiple shorts squeezes, as proclaimed by crypto analyst Daan Crypto. Notably, the price of BTC reportedly rose 3.2% on Monday, which is a massive hike when compared to its two-week high after the investor sentiment got relief from the US debt ceiling deal.

Caroline Mauron, the co-founder of digital-asset derivatives liquidity firm OrBit Markets,stated that

Bitcoin for now remains in a familiar range between $25,000 and $30,000, and we don’t think a future rally can be extrapolated from this latest move.

Further, Ran Neuner referred to the US PCE (Personal Consumption Expenditure) Price Index YoY (year-over-year) graph, used by the US Federal Reserve for inflation analysis, measuring the price changes of goods and services bought by consumers. The analyst noted that while the forecasted inflation rate was 3.9%, the actual inflation stands at 4.4%, compared to the previous 4.2%.

The analyst noted that no rate drops are expected this year, potentially limiting the performance of Bitcoin; but asserted that while the rates are anticipated to be higher for longer, the market continues its bullish momentum. Ran asserted that the potential US debt ceiling deal, awaiting a vote on Wednesday, is also believed to be a reason why the market bulls are winning.

The analyst referred to a tweet by The Kobeissi Letter, an industry-leading global capital markets commentary. Neuner summarized the US debt ceiling deal having $50 billion in spending cuts, with no budget caps after 2025, and $10 billion of new IRS funding clawed back—concluding that it would not support the crypto market positively.

Ran Neuner noted in a tweet that the market read the debt ceiling deal wrong, and the US economy would not default. He also asserted that the treasury would have to be sold once the debt ceiling is lifted. Ron continued his analysis as he pointed out that the treasury’s future actions would take the liquidity out of the market.

The analyst noted that as BTC and the American multinational financial services corporation NASDAQ are functions of liquidity, it would be tough for BTC to keep rising when liquidity is out of the market. Ran Neuner asserted that the debt ceiling is negative for liquidity. A debt ceiling increase would permit the government to refill the Treasury General Account (TGA), draining the liquidity in the next six months.