The American blockchain analysis firm, Chainalysis, released a set of guidelines for “On-Chain User Segmentation for Crypto Exchanges”, shedding light on crypto firms’ strategic use of on-chain data.

The blockchain analyst shared a Twitter thread on its official page inviting the crypto community’s attention to the report:

1/ Our newest report is here: The Chainalysis Guide to On-Chain User Segmentation for Crypto Exchanges. Inside, we break down how crypto businesses can use on-chain data to better understand their users & improve their growth strategy.https://t.co/SitQOBQQjJ

— Chainalysis (@chainalysis) June 22, 2023

Sneak preview here👇

In a series of tweets, Chainalysis provided deeper insights into the blockchain industry and crypto space. By providing a detailed sketch and illustrations, the platform elucidated the use of on-chain data in crypto businesses.

Chainalysis asserted that Blockchains are “inherently transparent”, adding:

That doesn’t just make cryptocurrency uniquely safe and secure. It also means crypto businesses have reams of data not available in other industries, which they can use to make better business decisions.

Exemplifying “overall holdings and wallet age”, the analyst explained how the businesses could reach better decisions through on-chain data. Chainalysis briefed, “Exchanges can granularly segment their users based on wallet behaviour and make better decisions about where to focus their acquisition and retention efforts”.

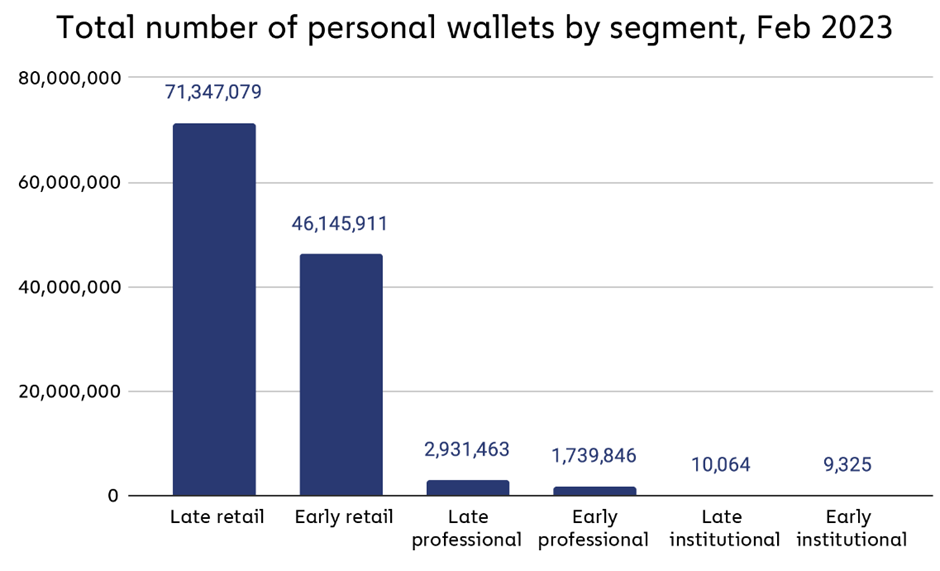

The analytics platform shared the on-chain data of the six segments including early retail, early professional, early institutional, late retail, late professional, and late institutional across Bitcoin and Ethereum. Chainalysis’ findings revealed that a majority of active wallets belong to the late retail, indicating “relatively new, low-balance wallets”, while the majority of the capital is held by the late institutional wallets, followed by the late professional.

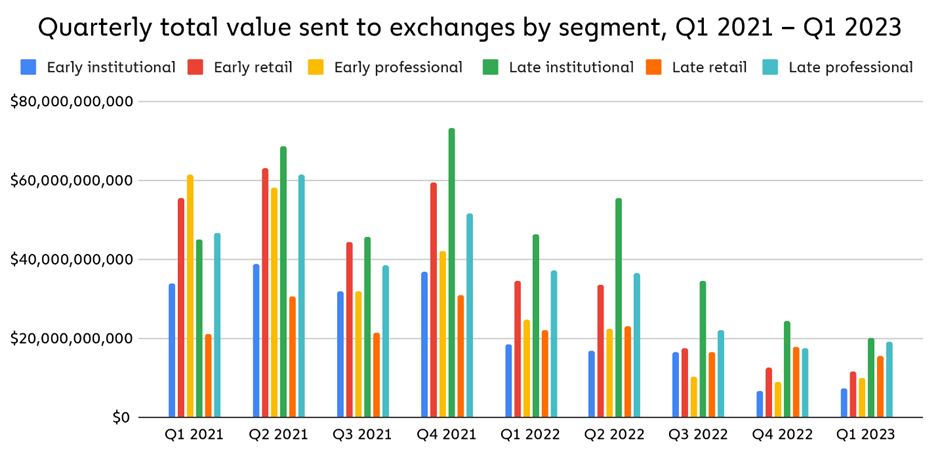

Further, the platform went on to narrate the interaction of these segments with the exchanges, citing that the biggest share of value sent to the centralized exchanges (CEXs) is connected to the late institutional wallets, at a percentage of 23.6, followed by early retail and late professional at 19% and 18.8% respectively.

Notably, the platform mentioned that except for late retail wallets and early institutional wallets accounting for 11.4% and 11.9%, the segments show a resemblance in the value sent to exchanges. The significant difference arises from the least capital command in retail wallets and the lowest share in institutional wallets.