- Buterin’s timely ETH sale underscores the importance of strategic decision-making in volatile markets.

- Ethereum’s journey reflects both exuberance and volatility, shaping investor sentiment and market dynamics.

- Contrasting approaches between Buterin and Nakamoto highlight divergent strategies in managing cryptocurrency holdings.

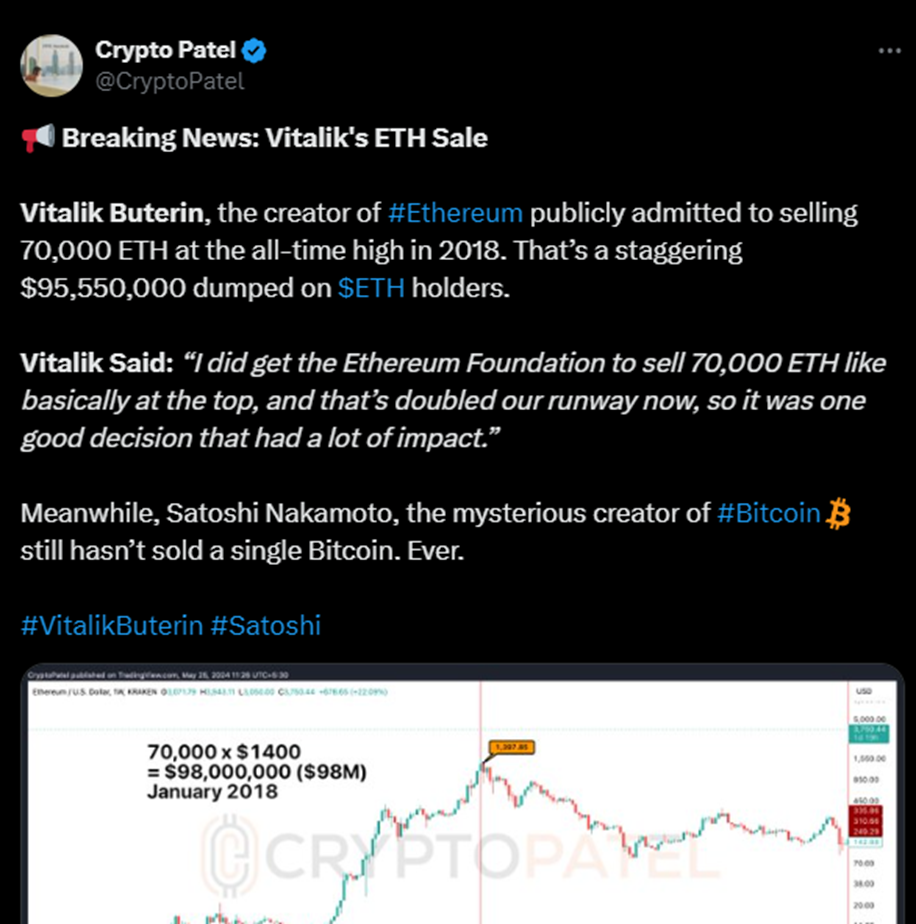

Vitalik Buterin, the renowned creator of Ethereum, disclosed a strategic move involving the sale of a significant portion of his ETH holdings at the peak of the cryptocurrency’s value back in 2018. With the sale of 70,000 ETH, Buterin reportedly amassed $95,550,000, a decision he credited with effectively doubling the Ethereum Foundation’s financial runway.

The confession by Buterin has ignited a fervent discussion within the cryptocurrency community, prompting reflection on the contrasting approaches of key figures within the industry. As highlighted by Crypto Patel, a top analyst, Vitalik Buterin opted to capitalize on Ethereum’s peak value. Meanwhile, Satoshi Nakamoto, the enigmatic creator of Bitcoin, has steadfastly refrained from selling any of his Bitcoin holdings, maintaining an unwavering commitment to the pioneering cryptocurrency.

The timing of Buterin’s sale, coinciding with Ethereum’s record high in January 2018, underscores the volatile nature of cryptocurrency markets. During this period, Ethereum surged to unprecedented heights, driven by speculative fervor and heightened investor interest in digital assets.

However, this meteoric rise was followed by a sharp downturn, plunging Ethereum into a protracted bear market characterized by significant price fluctuations and investor uncertainty.

Analysis of Ethereum’s price trend reveals key inflection points that have shaped its trajectory over the years. From its early stages of growth between 2015 and 2017, marked by steady price appreciation and adoption, to the euphoric peak of January 2018.

Ethereum’s journey has been defined by both exuberance and volatility. Subsequent periods of consolidation and retracement have underscored the resilience of the Ethereum network amidst market turbulence.

Throughout Ethereum’s evolution, various support and resistance levels have emerged as crucial indicators of investor sentiment and market dynamics. From the $335.86 support level witnessed in early 2018 to the $1,397.85 all-time high, these price milestones serve as reference points for assessing Ethereum’s performance and charting its future trajectory.

At press time, Ethereum stands at a crossroads, with its price hovering at $3,750.54 and exhibiting signs of moderate strength and stability. The cryptocurrency’s 24-hour trading volume of $18,086,718,294 reflects ongoing market activity, while indicators such as the 1-day RSI and MACD suggest a neutral stance with positive momentum.