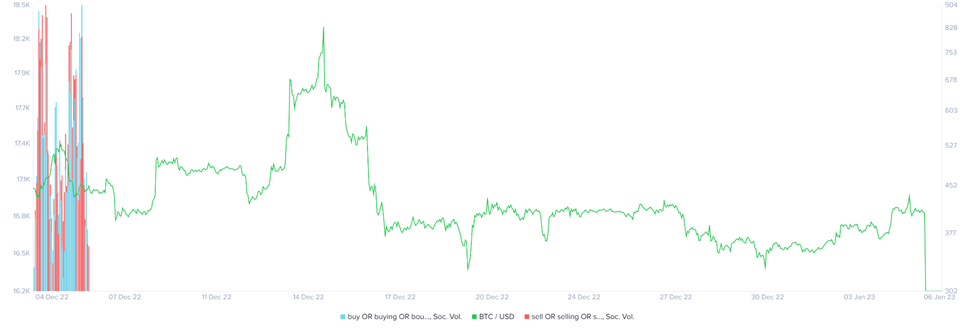

The current crypto market rally has picked up some steam and is showing signs of a modest upturn, especially on altcoins. This is illustrated by the spike in social media mentions of positive terms such as “buy”, “buying”, “bottom” & “bullish”. This kind of euphoria and fear of missing out (FOMO) can lead to an unsustainable rally, so investors should be cautious and tread carefully.

Before getting too excited about this recent mini-market rally in cryptocurrencies, it is essential to remember that these short-term rises do not necessarily indicate a larger shift or market stability. Looking at the fundamental facts and examining possible reasons for the current price spike can provide us with more clarity if we are looking for a long-term trend.

Furthermore, it is also critical to consider potential risks associated with investing during times of heightened sentiment. Crypto markets are known for their volatility and sudden price swings, so investors should be aware of the potential for losses and not get carried away by the euphoria around the current market rally.

Despite the recent, timid upsurge of crypto markets this week, it is essential to be mindful and vigilant when investigating fundamental elements before investing in any crypto projects. Thoroughly inspecting the project’s financials, team composition, experience, and product offering are key steps for evaluating a potential investment opportunity.

Looking ahead, investors should be cognizant of any potential signs of euphoria and FOMO as these could indicate an unsustainable rally. By understanding investor sentiment and acting with caution, investors can make smarter decisions in the crypto markets and maximize long-term returns.

The current market conditions present both opportunities and risks, so it is important to stay informed and take a strategic approach when making investment decisions. Ultimately, the success of any crypto investment relies on having a sound understanding of the markets and the potential risks associated with them. Stay vigilant and keep your eye on the trends, as they can change quickly in this volatile space.

Conclusion

The current crypto market rally is a sign of positive sentiment in the markets, yet investors should remain cautious and vigilant in order to maximize their return on investment. It is important to keep an eye out for signs of investor euphoria or FOMO that could indicate an unsustainable rally. By staying informed, analyzing underlying fundamentals, and developing strong risk management tactics, investors can make smarter decisions and maximize their returns in this volatile space.