Bearish outlook?

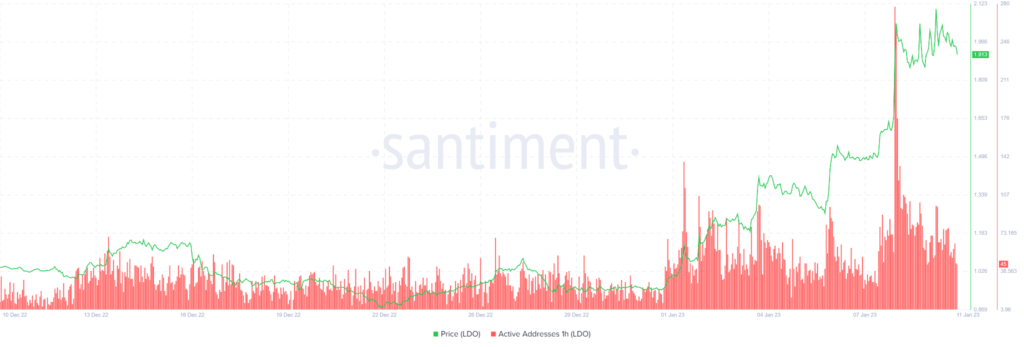

For bears, there are a few patterns that have been emerging in the market recently. On Lido, for example, the price remains on top but active addresses and network growth are down. This is a well-known bearish sign and indicates that the process of building a top may be taking longer than expected. Unfortunately, no one knows when the top will be built as the timing of this is uncertain.

It’s important to remain cautious when analyzing the market and look at all factors before making an investment decision. Analyzing network activity and growth patterns can help investors identify a bearish trend’s strength and make informed decisions accordingly. Keeping these considerations in mind will help navigate the market and make sound investment decisions.

With this knowledge, investors can have a better understanding of the market sentiment at any given time and use that information to their advantage.

Bullish outlook?

For bulls, MVRV is still below the dangerous ‘overbought’ level for many assets. This suggests that there may be more upside potential in the market and could be a sign that some tokens are just getting started on their journey to the top.

Additionally, there have been some bullish developments in terms of fundamentals across the market. For example, many DeFi protocols are continuing to grow and expand their user base, as well as offer new products and services to the crypto space. This is a positive sign that suggests there could be further growth in the market.

By staying informed and aware of both bearish and bullish developments, investors can stay ahead of the curve and be better prepared for shifts in market sentiment. With this knowledge, investors will be able to capitalize on opportunities and make more informed decisions when investing in the crypto space.

To help you make an informed decision on your investments, we’ve put together a comprehensive report that covers the performance of four major cryptocurrencies – Ethereum (ETH), Lido (LDO), Maker (MKR), and SushiSwap (SUSHI) – over the past week.

According to Santiment data Ethereum is up 10% in the last 7 days, Lido is up 61%, Maker is up 24%, and SushiSwap has seen a 15% increase. With these positive gains, it appears that the crypto market may be on an upward trend.

In conclusion, investors should remain informed on both bullish and bearish developments in the cryptocurrency space and use that information to make their own decisions. By weighing both sides of the market, investors will be able to identify which assets are currently overvalued and which have more potential for growth. This will help them make better investment decisions and navigate the crypto market with greater confidence.