- Ripple’s XRP faced challenges maintaining support at $0.5 as a broad sell-off affected various altcoins, including Bitcoin.

- Historical patterns suggest Ripple’s undervaluation, as correlations between MVRV ratios and investment maturity indicate possible upcoming price rallies.

- Ripple’s social engagement metrics have decreased, yet positive shifts in sentiment could signal upcoming improvements in its market performance.

Ripple’s XRP struggled to maintain its footing above the $0.5 support level recently, buckling under pressure as a broader sell-off impacted numerous altcoins, including Bitcoin. This downturn has fueled critical voices, some labelling XRP a “zombie token” due to perceived limited utility, casting a shadow over its long-term viability.

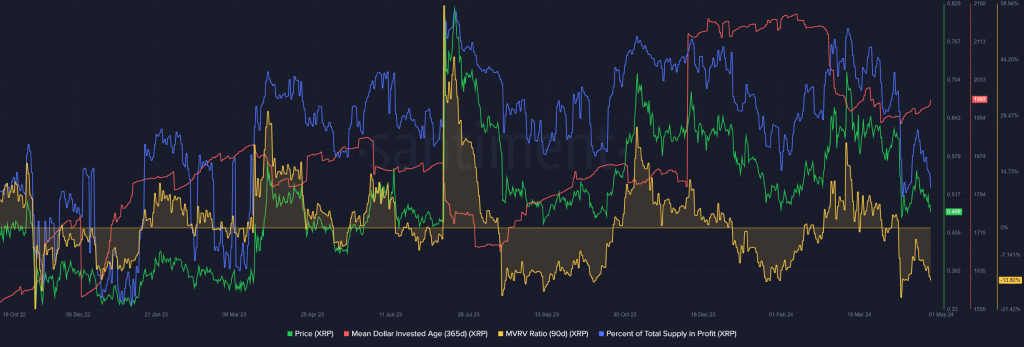

Despite the array of challenges confronting Ripple, the cryptocurrency’s underlying performance indicators still offer optimism amidst the prevailing market turbulence. Analysis by the renowned analytical platform Santiment highlights a significant drop in the percentage of total XRP supply in profit. Reflecting its 32.6% depreciation over the last six weeks, the coin has dropped from 92% in mid-March to 72.6% currently. However, the Mean Dollar Invested Age (MDIA), a metric indicating investment maturation, suggests that accumulation activities are reoccurring.

Source: Chart by Santiment

Further analysis reveals an interesting pattern between the Market Value to Realized Value (MVRV) ratio and MDIA. In the fall of 2023, despite the MVRV ratio dipping below 10%, indicating undervaluation, the MDIA was on a steady rise. This period of consolidation around the $0.48 support zone eventually led to a price rally, hinting at a possible repetition of this cycle.

Currently, Ripple’s price, along with MDIA and MVRV metrics, appears to be mimicking its September 2023 behavior. If the MDIA continues its upward trajectory, it could bolster investor confidence and ignite a bullish market response for XRP.

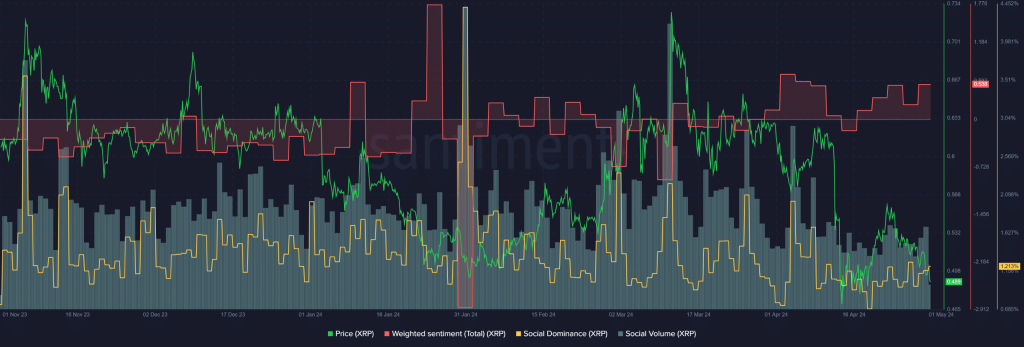

On the social engagement front, data from the Santiment indicates that Ripple has experienced a noticeable decline in interaction and activity levels. Social volume and dominance have decreased, with only a minor spike in early April. Despite this, the weighted sentiment over the last three days has been positive, reminiscent of early April’s sentiment shift, which preceded a price jump from $0.56 to $0.63. This demonstrates the volatile nature of market sentiment and its capacity to alter the trading landscape quickly.

Source: Chart by Santiment

While Ripple faces scrutiny and market fluctuations, key financial indicators and social metrics suggest that investor interest remains intact, with signs of a potential market correction on the horizon. This dynamic interplay of market forces and investor sentiment could pave the way for Ripple’s recovery, offering long-term holders and swing traders opportunities in the evolving cryptocurrency environment.