- Whale Alert reports two significant XRP transfers totaling over 83 million XRP, comprising transactions of 23.8 million XRP and 60 million

- The 60 million XRP transfer, involving $37,039,282 in fiat, leads to a wallet with an undisclosed owner, eventually traced to one linked to Ripple.

- The second transaction of 23.8 million XRP to Bitstamp from an unregistered address is connected to a Ripple-linked wallet, raising questions.

In a surprising turn of events in the cryptocurrency space, popular tracking bot Whale Alert has identified two substantial XRP transfers, totaling over 83 million XRP. The two transactions are: 23.8 million XRP ($14,657,017) and 60 million XRP ($37,039,282). Simultaneously, the XRP market has experienced a noteworthy surge over the past 24 hours, with the current trajectory indicating a potential further increase.

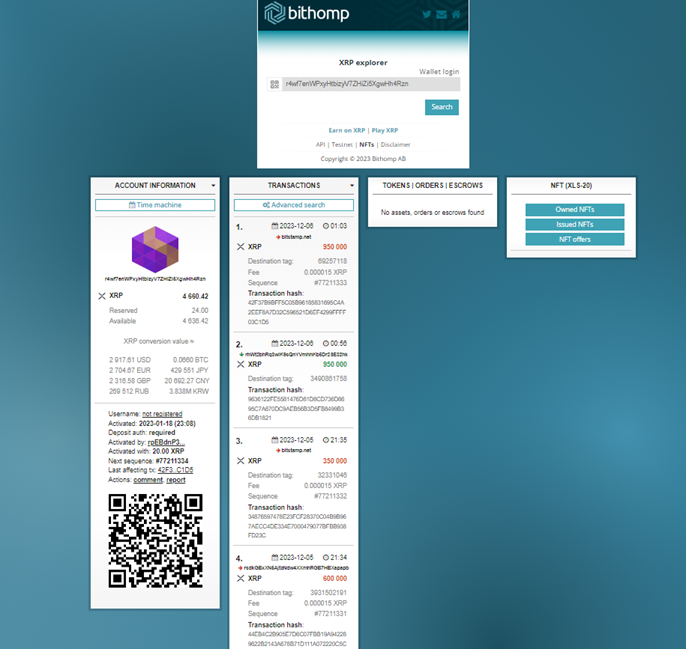

The primary transaction involved a remarkable transfer of 60 million XRP, valued at $37,039,282 in fiat, to a wallet with an undisclosed owner. Notably, analysis by the XRP-centric explorer Bithomp revealed that these millions of XRP eventually found their way into a wallet linked to Ripple.

The second transaction, involving 23.8 million XRP sent from an unregistered address to the Bitstamp crypto trading venue, raised eyebrows. Although initiated by an anonymous blockchain address, investigation through the XRP explorer unveiled its connection to a Ripple-linked wallet.

While the second transaction initially appeared as a straightforward sale following a recent XRP price surge, a closer look suggests a more nuanced scenario. Bitstamp has a longstanding partnership with Ripple, supporting its “Ripple Payments” platform for efficient and low-fee cross-border transactions.

Contrary to this recent positive news, a day prior, crypto data tracker Whale Alert reported a significant movement of XRP to the Bitstamp crypto exchange by an unidentified whale. A total of 24 million XRP, valued at $14,799,010, were transferred within the last 24 hours. Given the prevailing market conditions, the assumption of a potential sale at a loss was evident, as XRP reported losses in line with the broader crypto market, down 1.09% to $0.611.

In another twist, recent XRP price action has raised eyebrows among market observers. A candlestick chart displaying massive wicks extending in both directions signifies extreme volatility within a brief timeframe. Such anomalies often suggest market manipulation, where significant players may attempt to influence the market for potential gains.

This unusual activity has disrupted the otherwise lackluster market performance of XRP, triggering speculation about a possible liquidity hunt. Large orders targeting stop-loss levels of traders could result in a cascade of buy and sell orders, intensifying the currency’s volatility.