Powell’s “Termination Cannot Come Fast Enough”: Trump

- President Trump has slammed Fed Chair Jerome Powell for not cutting interest rates.

- Trump cites reducing prices and tariff revenue as the “perfect time” to lower interest rates.

- Powell insists on the Fed’s independence and not being influenced by external factors.

In recent weeks, the global economy has been navigating a complex landscape marked by Trump’s tariffs. Amid these tensions, President Donald Trump has escalated his public criticism of Federal Reserve Chair Jerome Powell, demanding immediate interest rate cuts and calling for Powell’s removal. His comments come one day after Powell delivered a stark warning in Chicago that Trump’s tariffs could cause higer inflation and slow economic growth.

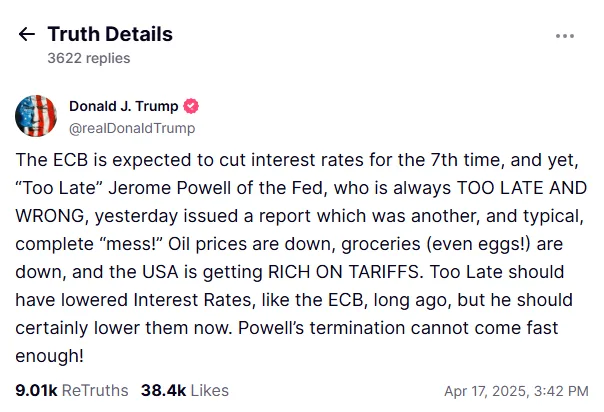

In a post on his social media platform, Truth Social, Trump lashed out at the Fed Chair, saying the US central bank is lagging behind its global counterparts, such as the ECB, which is expected to cut interest rates for the seventh time in the past year.

Trump argued that oil prices and groceries are down, and the USA is getting rich on tariffs, and the interest rates should have been lowered. He added, “Powell’s termination cannot come fast enough!” calling for Powell’s removal if rates aren’t cut quickly enough.

This isn’t the only time Trump criticized Powell. On Thursday afternoon at the Oval Office, he said, “If I want him out, he’ll be out of there real fast.” He also added that Powell will be under a great deal of political pressure to lower the interest rates.

In contrast, during his remarks in Chicago, Powell signaled no immediate policy change ahead of the May 6-7 FOMC meeting. He also expressed the Fed’s independence by stating that the central bank will continue to do its job without being influenced by political pressure. Further, he stated there are no plans to resign before his term ends in May 2026, despite Trump’s calls for his removal. The benchmark interest rates remain steady at 4.25% to 4.5%.

Related: Trump’s Tariffs Fuel Market Drop: Prices Rise, Exports Fall

While the new tariffs have boosted customs duties, the Budget Lab at Yale estimates that these tariffs could reduce US GDP and lead to 770,000 fewer jobs by the end of 2025. The ongoing tensions between Trump and Powell underscore the broader debate about monetary policy, economic indicators, and the Federal Reserve’s independence. As the clash between the White House and the Fed continues, the coming weeks will determine if Powell will bend to pressure and cut rates or stand firm on the Fed’s current course.