The world’s leading on-chain and financial metrics, charts, and data provider Glassnode’s latest research article, entitled “Dealing with the DeFi Downtrend”, analyzed the decentralized finance (DeFi) sector’s consistent token underperformance drivers. The research highlighted that while the Ethereum application layer’s flexibility paved the way for innovation, making the DeFi sector its prominent use case, DeFi investments remained complex, with poor token price performance in recent years.

Glassnode took to Twitter to inform its followers about its DeFi token performance drivers research by tweeting:

The flexibility of the #Ethereum application layer has become a remarkable bedrock for innovation and narrative generation, with the #DeFi sector remaining one of the most prominent use cases.

— glassnode (@glassnode) May 31, 2023

However, investments into DeFi have been complex, recording remarkably poor token… pic.twitter.com/ZICTzs9NmH

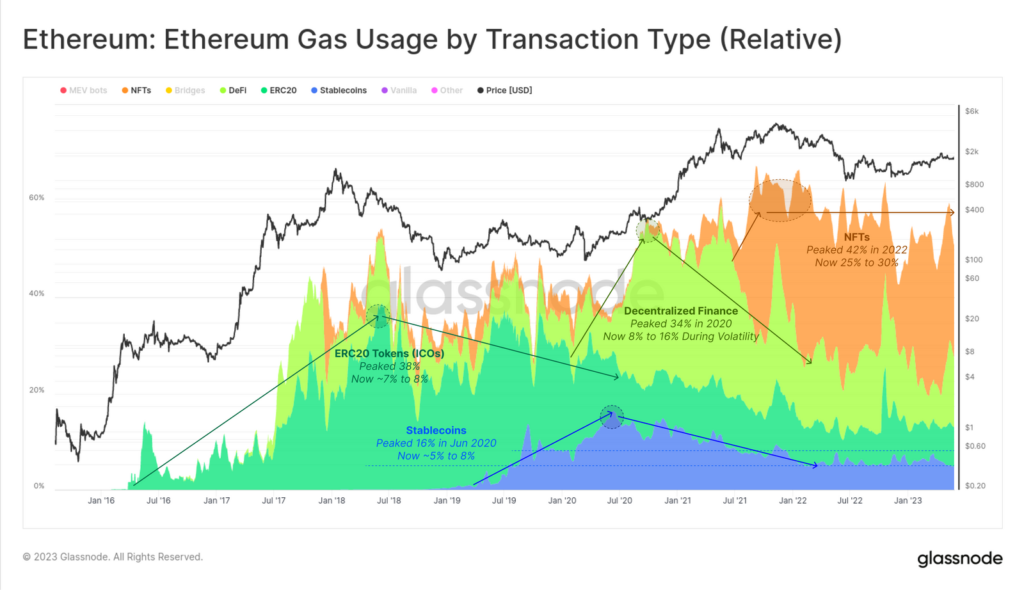

The financial data provider went on to analyze the four major narratives that shaped the Ethereum ecosystem, viz. Initial Coin Offerings (ICO), DeFi, Non-Fungible Tokens (NFTs), and Stablecoins. The analysis shown in the graph below revealed a pattern having a boom-bust cycle, taking the new application from 30% to 40% of all gas consumption. It is then followed by an 8% baseline structural consumption decline for the application types.

The research also revealed that in 2017 and 2018, Initial Coin Offerings (ICOs) peaked, claiming 40% of gas fees in ERC-20 token transfers. June 2020 to 2021 saw DeFi accounting for over 30% of gas usage. Glassnode noted that the supply-weighted price index for DeFi is now down over 90% since early 2021.

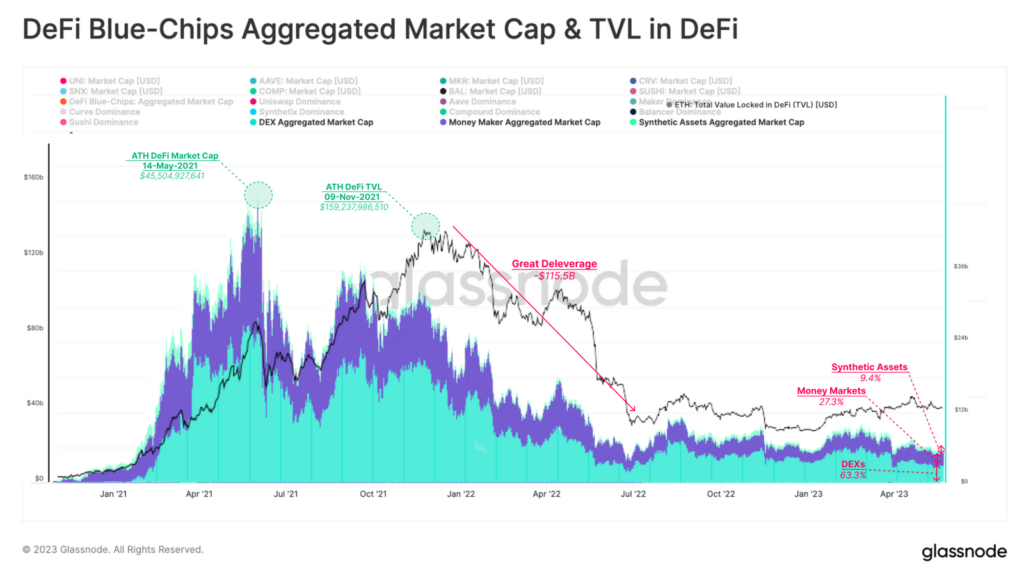

The DeFi Blue-Chips’ total value locked (TVL) touched $45 billion at its peak, while the DeFi market cap is currently at 12% of its all-time high. The Decentralized Exchanges (DEXs) have claimed the largest market share with 63.3% of the aggregated DeFi market cap.

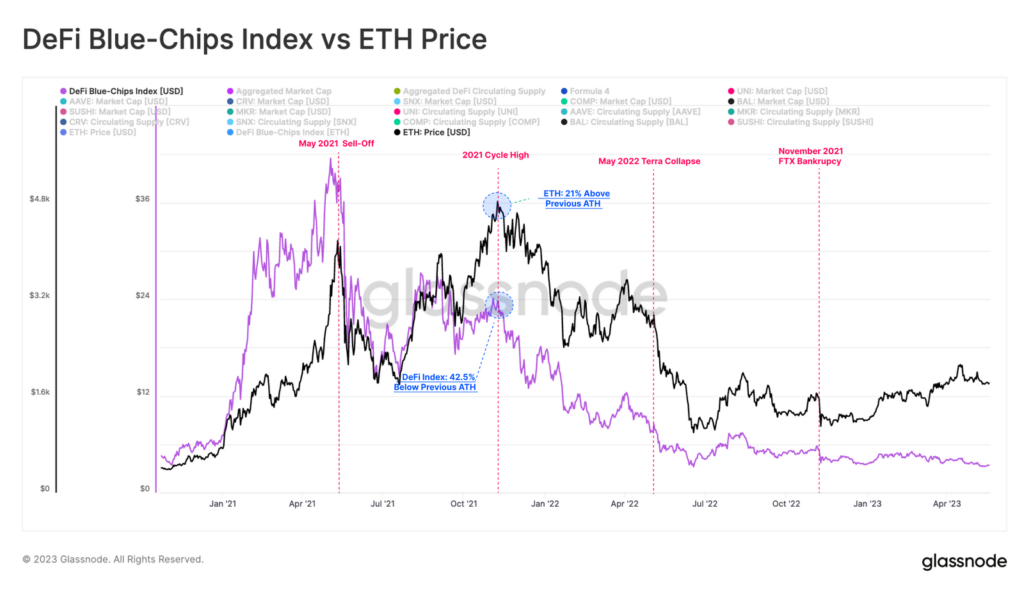

Glassnode asserted that indexing the DeFi Index ATH in May 2021 to that of ETH revealed in the 2022 bear market, DeFi tokens fell -92.1% from the May 2021 ATH. During the same period, ETH fell only 45%, outperforming the DeFi Index by 6.7x in a bear cycle.

Further, the world’s largest cryptocurrency exchange, Binance, holds the highest token liquidity in Glassnode’s DeFi index across all centralized exchanges, with $175 million or 2.70%, followed by the OKX exchange’s $39 million. Notably, the Staking sector has been reported to have reached an aggregated market cap of $3.20 billion in April 2023, from $505 million in January 2023.