Amidst regulatory uncertainties, Bitcoin has demonstrated exceptional resilience and steadfast optimism, with investors reflecting these sentiments through unwavering engagement with the digital asset.

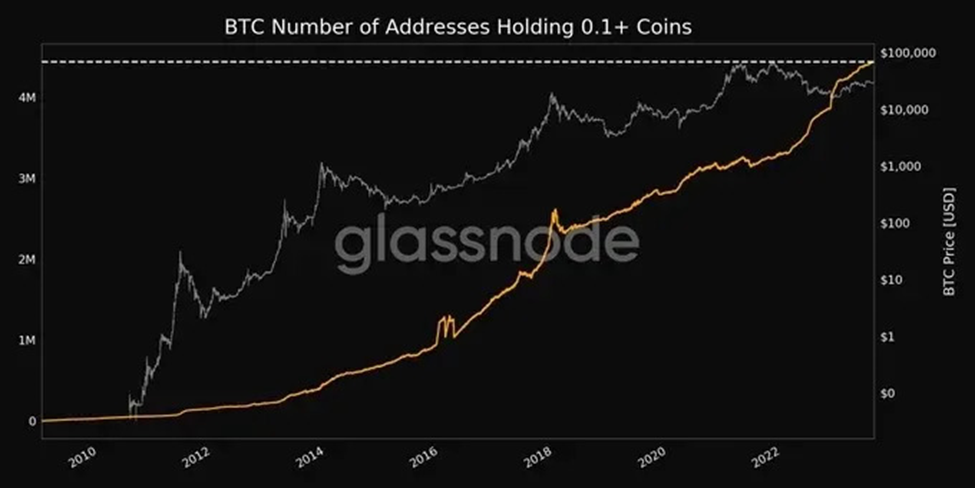

Recent data from Glassnode, a pioneering on-chain analytics firm, revealed a steadfast surge in the count of Bitcoin addresses containing 0.1 or more coins. This metric has now scaled unprecedented heights, highlighting the unshakeable confidence of the crypto community.

With a graphical representation that speaks volumes, the tally of addresses holding above 0.1 coins has surged to an awe-inspiring 4,436,539, a peak value that stands as a testament to the unwavering faith in Bitcoin. These numbers increase daily, a noticeable leap from Tuesday’s count of 4,436,305.

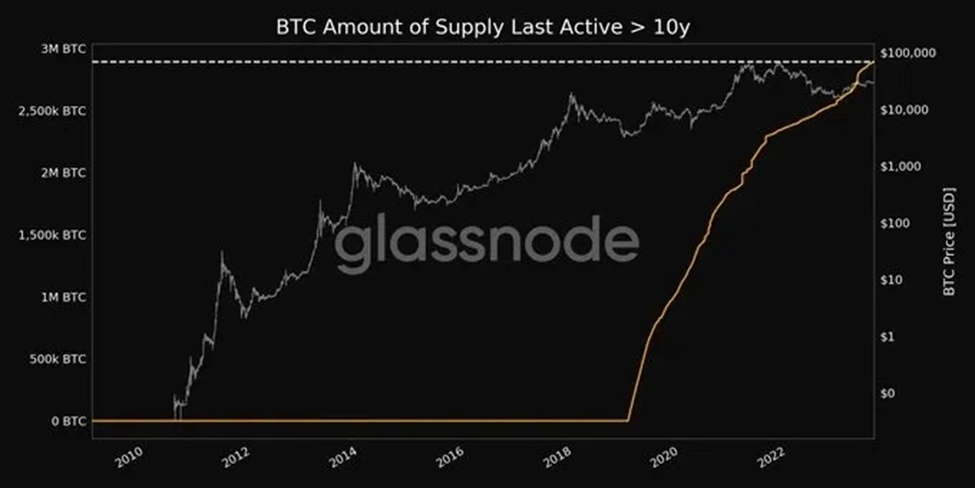

Parallelly, a noteworthy facet in the Bitcoin saga is the endurance displayed by the “10-year supply last active” cohort. Financial experts posit that this subset has consistently set new records, indicative of the enduring optimism and trust in Bitcoin’s potential.

According to the latest data, this specific category of coins, dormant for a decade, has attained a historical pinnacle at 2,891,206.251 Bitcoins. The holders of these coins, who weathered the storm during the early tumultuous phases and clung to their convictions, now bask in the dismissal of their steadfastness. Of paramount significance is the dominance exerted by long-term holders, steering the market towards a predominantly bullish trajectory.

Marking a consistent pattern, this subset continues to hit new performance highs, symbolic of the prevailing hope and trust within the Bitcoin community. Notably, this segment stood at an impressive 56% just two weeks ago, underlining an enduring optimism and an increased inclination towards holding assets.

A remarkable serenity envelops the market, as historical records indicate remarkably low volatility levels. Currently, Bitcoin is trading at $29,486.04, marking a substantial 1.45% upswing over the preceding seven days.

Bitcoin’s journey remains marked by steadfastness in the face of regulatory headwinds, underscored by a growing tide of positivity among investors. The records of address growth and the persistent behavior of long-term holders paint a vivid picture of enduring trust in the face of challenges.