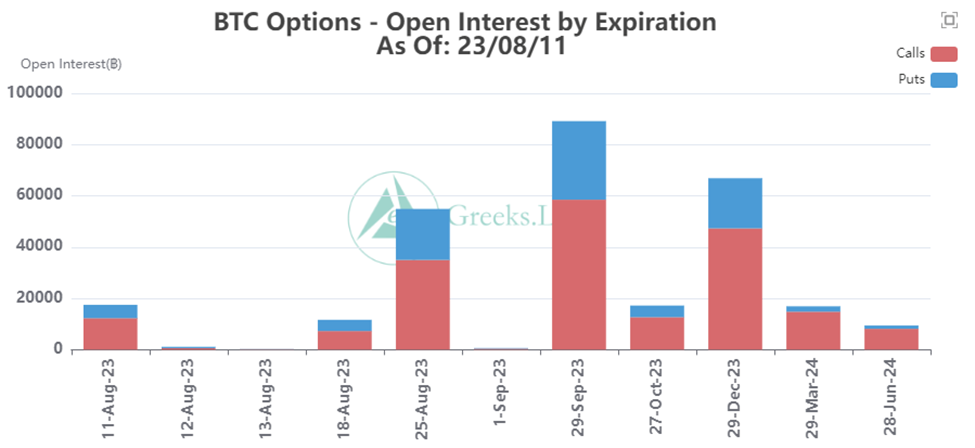

Today, the cryptocurrency world is buzzing with anticipation as Bitcoin braces itself for an impactful event: the expiration of options contracts valued at a staggering $510 million. These options, which have reached their end date, signify a momentous occasion that could potentially affect Bitcoin’s future price movement.

Bitcoin is nearing the max pain threshold at $29,500 in the current financial landscape. For those unfamiliar with the term, the max pain point is a price benchmark where the most significant number of open contracts would incur losses upon expiration. The proximity of Bitcoin’s current spot price to this max pain level might have considerable implications for its price dynamics in the coming days.

Source: X/@GreeksLive

Diving deeper into the specifics, Bitcoin’s options contracts exhibit a put/call ratio of 0.42. This metric provides an insight into market sentiment, revealing that more call options are in circulation than puts. A call option is a financial contract that offers the holder the right, but not the obligation, to buy a stock or asset at a predetermined price before the option expires.

Another factor stirring discussions within crypto circles is the potential for an ETF, or Exchange Traded Fund, related to Bitcoin. The chatter around a possible ETF approval has intensified, especially given the consistent focus on mainstream cryptocurrency throughout the week.

On the Ethereum front, there’s also a significant event on the horizon. A total of 121,000 Ethereum contracts, with a combined notional value of $220 million, are set to expire soon. Ethereum’s max pain point is pegged at $1,850, with a put/call ratio of 0.60 – indicating that, similar to Bitcoin, there are more calls than puts for this cryptocurrency. At the time of writing, ETH is at $1,845.70, with a decrease of 0.75% in the past 24 hours.

Currently, Bitcoin is priced at $29,372, showcasing a marginal 0.39% dip over the past day. The bears are now in control, and the bulls are fighting hard to regain the market. The $30k resistance level is strong enough to hold back the bulls. However, if bulls make a strong comeback, the price of BTC might surge above $30k.The 24-hour trading volume of BTC is $11,591,799,958, and the current total market capitalization is $571,408,284,098.

In summary, the world of cryptocurrencies is on the cusp of potential volatility. With massive options contracts for Bitcoin and Ethereum nearing expiry dates, the market’s direction remains uncertain. Add to this the speculations around a Bitcoin ETF, and it’s clear that the crypto community is in for an eventful period.