PEPE Jumps 16% as Bulls Target Breakout Toward $0.000016

- PEPE rallies 16% in a day with weekly gains at 28% and market cap hitting $5.18B.

- Open interest jumps to $743.5M as traders pour in and bullish confidence builds.

- $1.46M in short liquidations sparks momentum as demand exceeds market supply.

PEPE has staged a remarkable rally over the past 24 hours, gaining more than 16% to trade at $0.00001233. The surge reflects not only features short-term momentum, but also strength across larger timeframes, with weekly gains achieving 28% and a monthly rise of 4% as well.

This consistent performance makes PEPE one of the standout movers on the market. Backing the rally is a notable increase in market capitalization, which surged to $5.18 billion. Liquidity has also poured in, as 24-hour trading volume surged 186% to $1.61 billion.

Source: CoinMarketCap

Such a sharp spike highlights the extent of investor activity, with speculators getting confident in the token’s short-term outlook. Notably, the Altcoin Season Index has risen rapidly, now standing at 80 from a low of 59 earlier in the week, signaling broader rotation towards alternative tokens.

PEPE Price Action Signals Bullish Breakout Ahead

The PEPE token is showing powerful bullish signals after forming an Adam and Eve pattern on its daily chart. The token is currently testing the neckline area of the formation in the price range of $0.0000123-$0.0000125, a zone that coincides with the 50% Fib retracement level and is considered a key zone of resistance.

Source: TradingView

An upside break above this level could clear the path to the next immediate target at the 61.8% Fib level of $0.0000132. From there, the rally may continue to 78.6% Fib at $0.0000145, last tested at the end of July.

Surpassing this threshold could allow for a further push to the $0.0000155-$0.0000163 area, representing potential gains of 24% to 32% from current levels, which is in line with the depth of the Adam and Eve setup.

Market analyst Ali echoes this bullish outlook with more insight: He notes that PEPE is also consolidating within a symmetrical triangle formation, progressing closer to the formation’s apex, which often precedes a sharp breakout.

Source: X

Ali notes that an upside move is probable but dependent on the token breaking through resistance at the 0.786 fib of $0.000012801, which matches the upper trendline of the triangle. Should PEPE manage this breakout, Ali maps a clear roadmap of targets.

The first is located at $0.000016311, followed by $0.000022194 at the 1.272 Fib level. His ultimate projection suggests 1.414 Fib based near $0.000026, which would represent a move of nearly 110% from current prices.

On-chain Market Sentiment Favors the Bulls

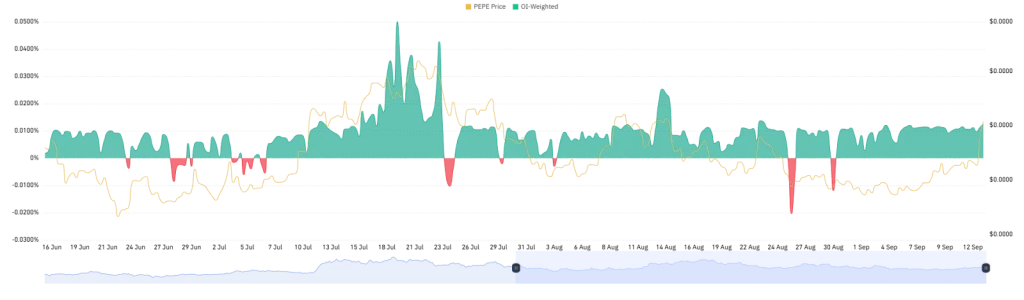

From an on-chain point of view, PEPE is flashing strong bullish signals. The OI-weighted funding rate, for instance, has remained in the green zone since early September, holding steady at +0.0124% rate.

Source: CoinGlass

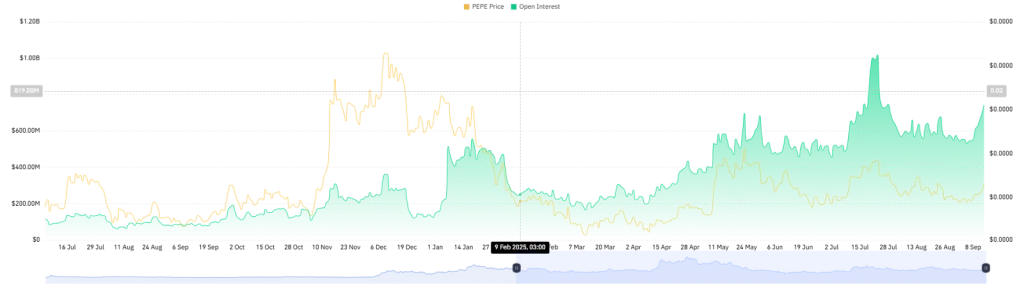

This reveals that long traders are paying short sellers to maintain their positions, a situation that usually implies increasing confidence in future price gains. At the same time, the meme coin’s open interest has surged.

After consolidating between $530 million and $680 million throughout August, the open interest now stands at $743.50 million. Such a sudden upward spike signifies fresh capital entering the market and an increase in the number of active participants.

Source: CoinGlass

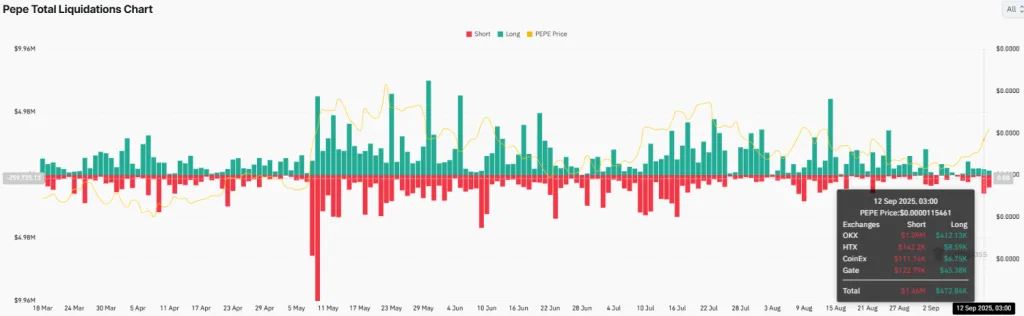

A growing open interest following an upward price action usually points to robust demand, thus strengthening the bullish story. Adding fuel to the bullish momentum, short position liquidations totaled $1.46M in the past 24 hours, compared with just $472.84k in long liquidations.

Source: CoinGlass

This imbalance shows the bearish traders are being squeezed out as the longs tighten control. As shorts rush to cover losses, demand continues to outweigh supply, creating conditions that could effectively send the value of PEPE far higher in the near term.

Conclusion

PEPE’s recent explosion signals strong technical setups, increased engagement in the market, and rising investor confidence. With bullish chart patterns coinciding with positive on-chain data, the momentum for the token appears to be steadily building.

Short squeezes and rising open interest give this outlook more weight. While volatility is still a factor in the market, the overall trend suggests that PEPE may continue to push forward, making it one of the standout performers among the altcoins in the near term.