Crypto Boom in Latin America: A 63% Growth Driving the Future

- Latin America’s crypto adoption grew 63% in 2025, strengthening its global digital role.

- Brazil, El Salvador, and Panama lead Latin America with innovative crypto regulations.

- Stablecoins and digital payments in Latin America lower remittance costs and enable growth.

Cryptocurrency, a form of digital money built on decentralized networks, is gaining adoption. Unlike traditional currencies controlled by central banks and governments, cryptocurrencies like Bitcoin use blockchain technology to record transactions transparently and securely.

Trillions of dollars move through blockchain platforms each year, highlighting global momentum. Major businesses and companies accept crypto, which has led governments and banks to explore digital currencies.

Crypto momentum shifts toward the Global South

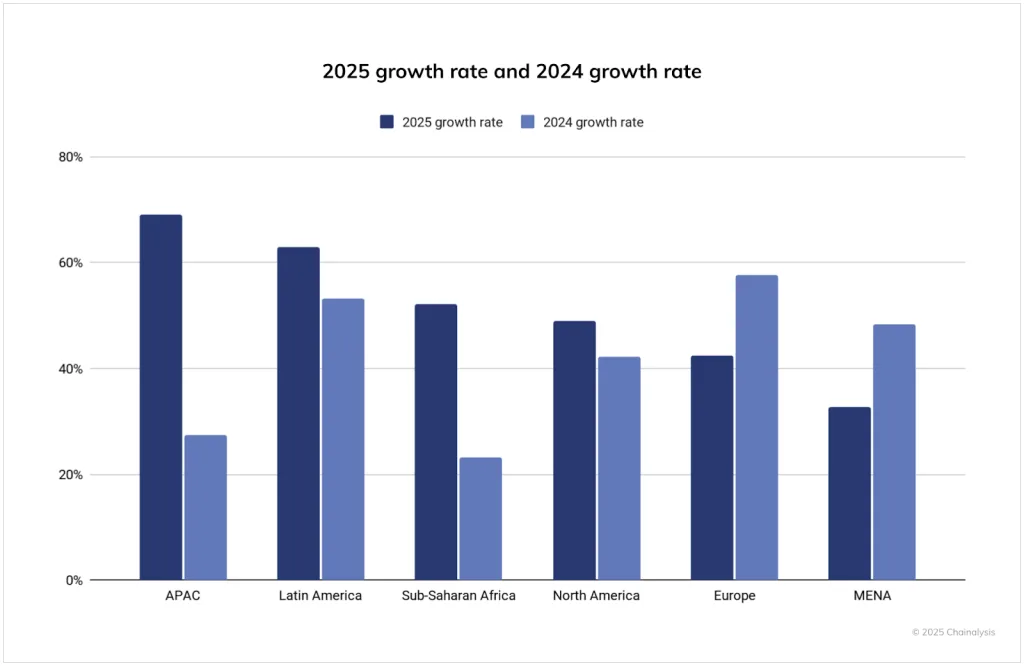

The geography of cryptocurrency adoption changed markedly between mid‑2024 and mid‑2025. Chainalysis’ latest Global Crypto Adoption Index shows that Asia‑Pacific (APAC) became the fastest-growing region for on‑chain digital asset activity, with on‑chain value received rising 69% year on year to about US$2.36 trillion. This surge was driven by millions of users in India, Vietnam, and Pakistan and reflected broad participation across exchanges and decentralised finance platforms.

Latin America followed closely with 63% growth over the same period, while Sub‑Saharan Africa increased 52%.

Europe and North America still account for more volume in absolute terms – about US$2.6 trillion and US$2.2 trillion, respectively – but their growth rates were lower at 42% and 49%, highlighting the pace at which the Global South is catching up. The Middle East and North Africa recorded 33% growth, showing relatively slower adoption.

Cryptocurrency adoption accelerates rapidly as citizens seek alternatives to volatile currencies and expensive remittance channels. Nations with volatile currencies or limited banking access see digital assets as a way to bypass inefficiencies and inflation. At the same time, regulators are working to balance innovation with consumer protection and financial stability. Latin America’s regulatory innovations and high usage place it among the world’s leaders in crypto adoption.

Latin America’s evolving Cryptocurrency regulatory landscape

Latin America includes countries in South and Central America, as well as parts of the Caribbean. The region’s 63% growth in digital‑asset transaction volume reflects both grassroots usage and institutional engagement.

Countries across Central and South America have introduced diverse regulations, ranging from legal tender experiments to licensing regimes and tax reforms. These policies illustrate a broader attempt to harness crypto for economic development while mitigating risks.

El Salvador’s evolving Bitcoin experiment

In 2021, El Salvador became the first country to adopt Bitcoin as legal tender. Merchants were required to accept the cryptocurrency alongside the U.S. dollar, and the government launched the Chivo digital wallet to promote adoption. Three years later, the administration revised this policy. In early 2025, lawmakers amended the Bitcoin law, eliminating the mandate that businesses must accept Bitcoin.

Merchants now have the option to choose or refuse crypto payments, though the government retains significant reserves and remains committed to its Bitcoin strategy. Officials cited the need to secure an IMF loan and public skepticism about the currency as reasons for this change.

Despite the shift, the government still reports large unrealized profits; by July 2025, the country’s Bitcoin holdings showed gains of about US$456. The amended law confirms that the U.S. dollar remains the national currency and clarifies that Bitcoin use is voluntary, alleviating concerns among multilateral lenders.

Brazil’s regulatory maturity and tax reforms

Brazil has established one of Latin America’s most sophisticated digital-asset frameworks. Law 14,478/22, effective June 2023, designates the Central Bank of Brazil as the regulator of virtual-asset service providers (VASPs). Under this law, exchanges, brokers, and custody providers must obtain licenses and adhere to anti‑money‑laundering (AML) standards.

The central bank also oversees Drex, a central bank digital currency (CBDC) project designed to modernize wholesale payments. Brazil’s Congress reformed crypto taxation in June 2025. Previously, small capital gains were tax-exempt; the new policy imposes a flat 17.5% tax on all crypto capital gains. This move simplifies compliance but removes benefits for small investors.

Brazil also recognizes crypto as a payment method; payment companies may settle transactions in digital assets provided they meet legal and tax requirements. The PIX instant‑payment platform has further boosted adoption. In February 2025, Mercado Pago enabled Brazilian tourists to pay via PIX in Argentina, demonstrating how domestic payment systems can facilitate cross-border commerce. Brazil’s blend of clear licensing rules, a central-bank-backed CBDC, and consumer-friendly payments infrastructure positions the country as a regional model.

Emerging frameworks in Panama, Guatemala, and Nicaragua

Panama aims to become a fintech hub through a March 2025 draft law that recognizes Bitcoin, Ethereum, and stablecoins as payment options when both parties agree. The bill requires VASPs to obtain licenses, observe KYC and AML protocols, and allows payment of municipal taxes in cryptocurrency. It also promotes blockchain in public services, endorses smart contracts, and introduces a digital identity system. Though not yet enacted, the proposal signals Panama’s intent to attract crypto businesses while upholding global standards.

Guatemala is transitioning from informal use toward regulation. Bill 6538, introduced in May 2025, would permit the voluntary use of cryptocurrencies while confirming the quetzal as the sole legal currency. The draft exempts small personal trades from capital-gains tax and mandates that VASPs register with the Superintendence of Banks. It also involves the central bank, tax administration, and financial intelligence unit in oversight. Guatemalans increasingly use crypto for remittances; Banco Industrial’s Zigi app integrated the SukuPay stablecoin rail in May 2025, offering instant, low-cost U.S. remittances. However, the bill remains pending, leaving a regulatory vacuum.

Nicaragua overhauled its fintech framework in April 2025. Resolution CDMF‑XIII‑2‑25 and an accompanying central-bank resolution set up licensing regimes for Payment Service Providers (PSPs) and Virtual-Asset Service Providers (PSAVs). The rules replace a 2022 regulation and impose minimum share‑capital requirements, a mandatory general manager, and stricter operational standards. Regulated activities include issuing electronic money, exchanging fiat and virtual assets, custody services, and peer‑to‑peer transfers. Existing fintechs must meet capital and technical requirements by May 2026 and December 2026.

Diverse approaches across the region

Mexico: The 2018 Fintech Law underpins Mexico’s crypto environment. Banks need a license from the National Banking and Securities Commission (CNBV) to offer crypto services. At the same time, non‑bank VASPs operate under reporting obligations to the Financial Intelligence Unit and the tax authority. Exchanges must maintain reserves, comply with AML rules, and disclose risks to clients. Mexico taxes crypto income at 30–35%, adds a 16% VAT on services, and applies a 10% tax on capital gains.

Peru: Peru treats cryptocurrencies as intangible assets. VASPs must register with the Financial Intelligence Unit and adhere to AML and KYC rules. Peru plans to enforce the Financial Action Task Force’s Travel Rule in August 2026, requiring exchanges to share sender and recipient information. Tax rates range from 8% to 30% for individuals and 29.5% for companies. Gains from trading are taxable, though VAT and the financial transaction tax do not apply.

Colombia: Between 2021 and 2023, Colombia operated a regulatory sandbox, allowing banks and exchanges to test crypto services. The sandbox has ended, but VASPs can continue under existing financial rules, and crypto earnings are taxed as income.

Related: A Comprehensive Guide on VASP License for Crypto Exchanges

Uruguay: Law 20,345 (October 2024) gives Uruguay’s central bank and Superintendency of Financial Services authority over PSAVs. It classifies tokens as securities when they confer economic rights. Exchanges must register and comply with AML and counter‑terrorism financing rules, and the central bank emphasises that crypto is not legal tender, although trading is allowed under supervision.

Paraguay: Paraguay legalized crypto mining and payments in 2022, but miners and service providers must register and follow AML requirements. The currency is not recognized as legal tender. In March 2025, Paraguay’s SEPRELAD signed a cooperation pact with El Salvador’s digital asset commission to enhance oversight. Officials warned that delays in passing a comprehensive law could push activity into unregulated markets.

Argentina: Argentina allows crypto trading but restricts payment processors. In May 2023, the central bank banned payment service providers from facilitating crypto transactions. Congress responded with Law 27,739 in March 2024, requiring VASPs to register with the National Securities Commission (CNV) and meet net‑worth, custody, and cybersecurity standards. CNV resolutions set registration deadlines: individuals by July 1, 2025, local entities by August 1, and foreign entities by September 1. Crypto gains are taxed as movable assets up to 15% plus income tax.

Bolivia: Bolivia banned cryptocurrencies until June 2024. The central bank lifted the ban and reported a 530% increase in virtual-asset transactions by June 2025. Authorities are developing a framework aligned with FATF standards to license exchanges and miners.

Honduras: Honduras took a conservative stance in February 2024, banning financial institutions from holding or transacting with digital assets. However, crypto continues in special economic zones like Próspera and “Bitcoin Valley.” National regulators remain cautious.

Costa Rica: Costa Rica lacks a specific crypto law, but issued a 2023 tax ruling declaring cryptocurrencies virtual or intangible assets. Business-related crypto activities face corporate income tax; personal holdings are subject to capital income and capital gains taxes. Fees for services such as exchanges or custody incur corporate income tax and VAT. Service providers, domestic or foreign, must comply with these rules when dealing with Costa Rica residents.

Chile: Chile embraces fintech yet takes a cautious approach to crypto. The Fintech Law 21,521 (2023, updated 2025) integrates digital assets into the financial system, letting non-bank entities issue payment instruments backed by fiat currency and recognizing stablecoins on distributed-ledger technology. The law defines virtual financial assets as transferable digital units, treating them as financial instruments unless exempted. Only the central bank may issue legal tender; fiat-backed stablecoins operate under supervision. Chile tightened its AML regime with Circular 62 in March 2025. The circular mandates compliance officers, recordkeeping, and reporting of cash transactions over US$10,000. It also introduces the Travel Rule, requiring identification of transfer participants from July 1, 2025. The tax authority treats crypto as intangible goods: profits from sales are taxed, purchases are deductible, and crypto is not subject to VAT.

Venezuela: Venezuela launched its oil-backed Petro token in 2018 and remains unique with a state-issued digital asset. Sunacrip, the national regulator, resumed operations in 2024. Crypto miners and exchanges need licences, and transactions are taxed between 2% and 20%. Despite inflation and sanctions, Venezuelans increasingly use stablecoins to protect purchasing power.

Innovation and payment‑infrastructure milestones

Latin America has also seen notable technical milestones. Brazil’s PIX network processed more than 26 billion transactions in 2024 and has inspired similar systems across the region. Argentina’s acceptance of PIX payments via Mercado Pago indicates growing interoperability. The Drex pilot in Brazil aims to tokenize deposits and enable programmable payments by late 2025. In Guatemala, the SukuPay integration allowed sub‑US$1 cross‑border transfers, illustrating how stablecoins can reduce remittance costs. Panama’s draft law promotes blockchain for public services and digital identities. Chile’s Fintech Law paves the way for regulated stablecoins that could operate alongside bank money.

Regional cooperation is another milestone. The March 2025 agreement between Paraguay’s SEPRELAD and El Salvador’s digital asset authority aims to harmonize oversight and share expertise. Such cooperation reflects recognition that cross‑border transactions require harmonized rules to detect illicit activities.