Will AERO Break Out or Break Down Ahead of Fed Rate Cuts?

- AERO rises more than 12% this week as bullish conviction grows with strong on-chain data.

- Fed rate cuts may soon decide whether AERO rallies to new highs or breaks lower again.

- Bearish flag hints at downside risk even as open interest climbs to record highs for AERO.

The AERO token has returned to the spotlight as market tensions build around its next decisive move, with bulls and bears locked in a struggle for control. This stress comes just before the highly awaited Federal Reserve rate cut decision, where analysts expect a cut of 0.25% to 0.50% points. The policy shift could serve as a catalyst, shaping whether AERO surges higher or slips into a downturn.

AERO Price Action: Bull-Bear Tug of War

The AERO token has been climbing steadily, gaining more than 12% over the past week as bullish sentiment spreads across the market. At press time, the token traded at $1.27, up 2.23% on the day, with a market capitalization of $1.14 billion.

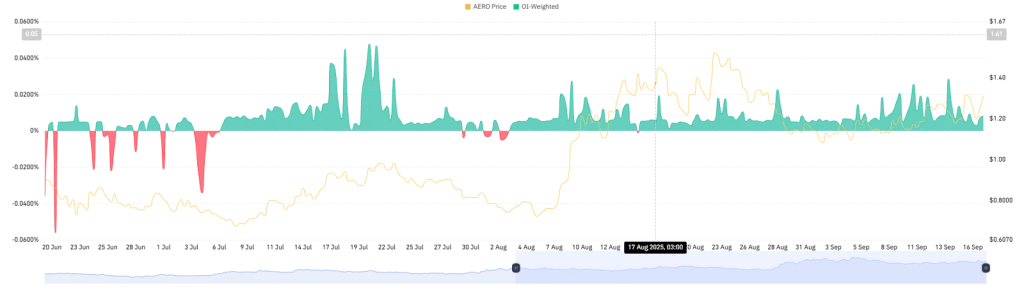

On-chain data has reinforced this momentum, particularly the OI-weighted funding rate, which has remained firmly in the green since early July, according to CoinGlass. This signals firm bullish conviction, as long traders continue paying shorts a premium to keep positions open.

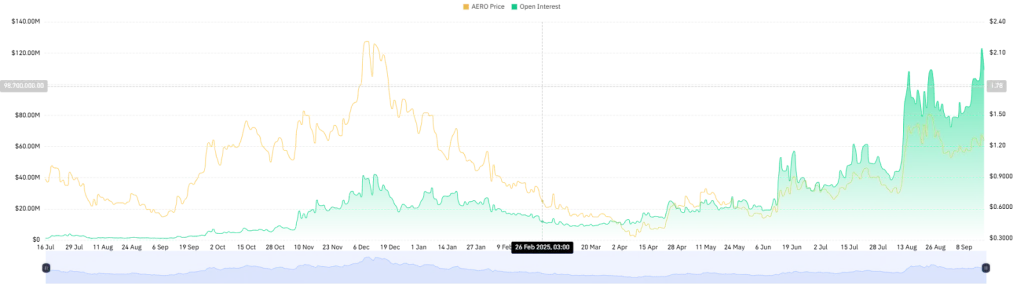

Market activity has also intensified. AERO’s open interest hit an all-time high of $122.77 million yesterday, highlighting that traders prefer to hold rather than close positions. This rise reflects heightened confidence but also suggests volatility ahead as liquidity builds in the market.

On the other hand, the technical picture presents a stark contrast. Charts from TradingView reveal the formation of a bearish flag pattern, often seen as a signal for continued downside. This comes after AERO’s steep slide from its August high near $1.60 to a September low of $1.05, a 34% correction in just ten days.

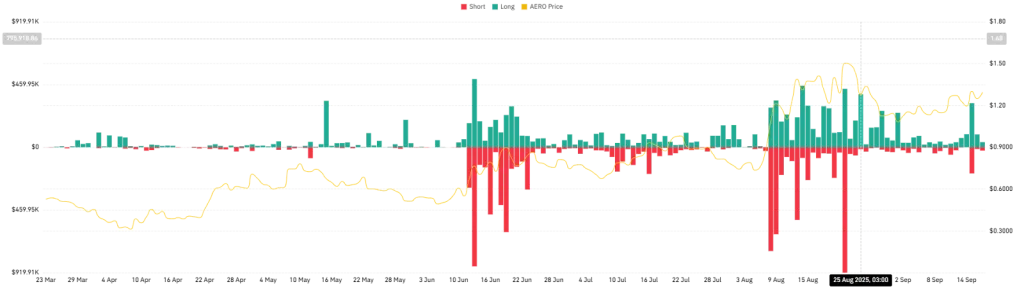

Since then, the token has moved within the flag formation, printing higher lows and highs, but keeping the risk of another downward break intact. Liquidation data adds weight to the bearish case. Over the past three days, $453,860 worth of long positions have been wiped out, double the $228,580 in short liquidations.

The imbalance suggests long traders may face further pressure if losses mount, fueling the risk of a squeeze. On a broader view, AERO remains 3.29% below its monthly opening price, a reminder that sustained bullish momentum has yet to take hold fully.

Related: HBAR Drops 7% as Institutions Sell, Bulls Face Key Test

What’s Next for AERO?

The next move for AERO hinges on how the Federal Reserve positions its long-awaited rate cut. A hawkish tilt would dampen sentiment, as investors rotate toward safer assets. In that case, AERO could first test the 38.20% Fibonacci level near $1.26, its closest short-term support.

A decisive break below this point may trigger a bearish flag breakdown, opening the door to $1.18 at the 23.60% Fib level, with further downside risk toward $1.05 or lower. A dovish outcome, however, could flip the narrative in favor of the bulls.

Should the Fed signal a rate cut, AERO’s price is expected to challenge resistance at the 50% Fib level around $1.32. A breakout above this barrier could accelerate momentum, driving the token toward $1.39 and potentially $1.48 levels that correspond with the 61.8% and 78.20% retracements.

Technical indicators provide added context. The Relative Strength Index (RSI) currently reads 56.47, reflecting neutral conditions while edging higher, a sign of building upward momentum. The MACD also reinforces the bullish case, with the MACD line at 0.02271 holding above its signal line near 0.01337.

Conclusion

AERO stands at a decisive point as traders weigh bullish on-chain signals against bearish chart patterns. The outcome of the Federal Reserve’s upcoming rate cuts will likely shape the token’s short-term path, determining whether momentum drives a breakout or pressure sparks a breakdown. With technical indicators leaning slightly positive, the market remains watchful, and AERO’s next move could set the tone for its near-term performance.