Trump Jr. and Witkoff Confirm USD1’s First Move-Based Launch on Aptos

- USD1 launches on Aptos on October 6 with ecosystem-wide DeFi support and exchange integration.

- Aptos challenges Ethereum and Tron with ultra-low fees and sub-second transaction speeds.

- WLFI plans to expand with a debit card and retail app expected to roll out by early 2026.

Layer-1 blockchain Aptos has struck a milestone deal with World Liberty Financial (WLFI), a project linked to the Trump family, to bring its flagship stablecoin USD1 onto the network. The teamwork marks the first Move-based deployment of USD1, underscoring Aptos’ growing presence in the stablecoin arena.

A Strategic Alliance for U.S.-Led Finance

Donald Trump Jr. and Zach Witkoff confirmed the launch through public announcements, highlighting USD1’s arrival on Aptos as a turning point for blockchain infrastructure. As per the sources, Aptos co-founder Avery Ching revealed that discussions with WLFI had been underway for some time.

He noted the project viewed Aptos as one of the strongest technology partners it could join efforts with. According to reports, the stablecoin, designed to return yield directly to users, is set to go live on October 6. From day one, USD1 will have broad ecosystem support.

Major DeFi protocols, including Echelon, Hyperion, Thala, Panora, and Tapp, are set to launch liquidity pools and incentives. Meanwhile, wallets and exchanges such as Petra, Backpack, OKX, Gate, OneKey, Nightly, and Bitget Wallet will provide instant accessibility for both retail and institutional users.

Aptos’ Edge in the Stablecoin Race

WLFI’s choice of Aptos was driven by cost and speed. As Ching explained, transactions are “less than a hundredth of a cent” and settle in under half a second, making the chain both affordable and efficient for stablecoin use.

This move places Aptos in direct competition with Ethereum and Tron, the current giants of stablecoin issuance. Ethereum dominates with nearly $95 billion in Tether circulation, while Tron handles $78.6 billion.

In contrast, Aptos currently supports about $1.12 billion in USDT and holds only 0.35% of the stablecoin market share. However, with over $60 billion in monthly transaction volume and support for multiple stablecoins, including USDC, USDe, and PayPal’s PYUSD, Aptos is poised for expansion.

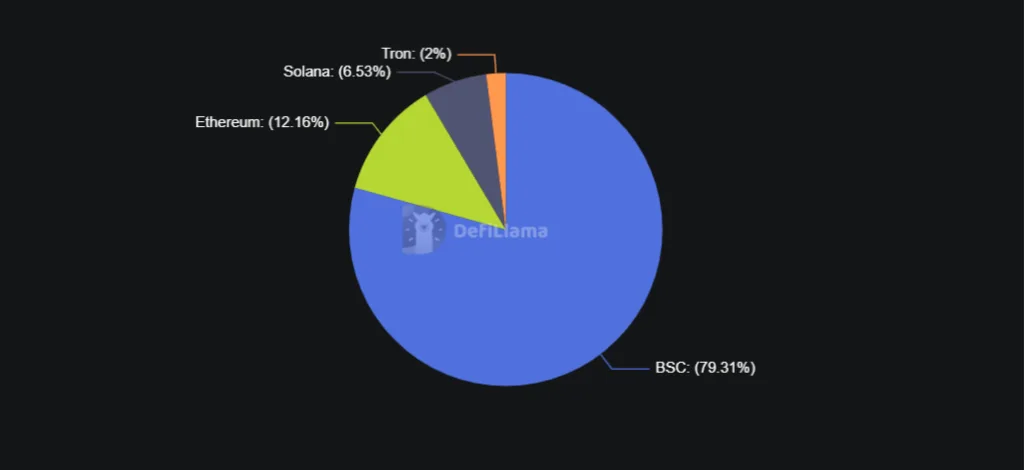

Source: DeFiLlama

Currently, USD1 has a market capitalization of $2.68 billion, primarily concentrated on the BNB Chain. The move to Aptos could diversify its footprint and fuel new adoption, particularly among retail and institutional participants looking for faster rails.

Related: WLFI and BONKFUN Announce USD1 Trading Pairs on Solana

New Projects on the Horizon

Beyond USD1, Aptos is preparing to roll out additional products. These include Decibel, a decentralized exchange designed for stablecoins and perpetuals, which is expected to launch later this year, and Shelby, a decentralized storage platform in partnership with Jump Crypto, slated for 2026.

Outside the two cryptocurrencies, World Liberty Financial is also building out consumer products. At last month’s Korea Blockchain Week, the team unveiled plans for a debit card, with a launch targeted for late 2025 or early 2026.

Zach Witkoff confirmed the timeline, adding that the card will work in conjunction with a new mobile app and wallet system. According to WLFI’s Brian Folkman, the integration will eventually allow users to link USD1 and the WLFI app directly with Apple Pay, offering seamless everyday transactions.

The debit card will sit at the center of a broader retail strategy. Folkman described the upcoming retail app as “Venmo meets Robinhood,” blending Web2-style peer-to-peer payments with trading features designed to bring digital assets into mainstream use.

Market Impact

The announcements come as both Aptos and WLFI tokens show signs of momentum. Aptos (APT) traded at $4.54, up 7.98% in 24 hours, with a market capitalization of $3.2 billion and a 110.63% surge in daily trading volume to $479.77 million.

Meanwhile, World Liberty Financial (WLFI) held steady at $0.2018, marking a 0.5% daily gain. Its market capitalization stood at $4.96 billion, while trading volume fell by 28.35% to $344.56 million.

The launch of USD1 on Aptos marks a defining step for World Liberty Financial as it expands its reach in digital finance. With strong ecosystem support, upcoming consumer products, and new infrastructure projects in development, Aptos is positioning itself as a serious contender in the stablecoin market. This collaboration highlights growing momentum in blockchain innovation and signals a broader shift toward faster, user-focused financial solutions.