Starknet (STRK) Soars with Strong Network Activity and TVL

- Starknet (STRK) shows strong growth, driven by the integration of Bitcoin staking.

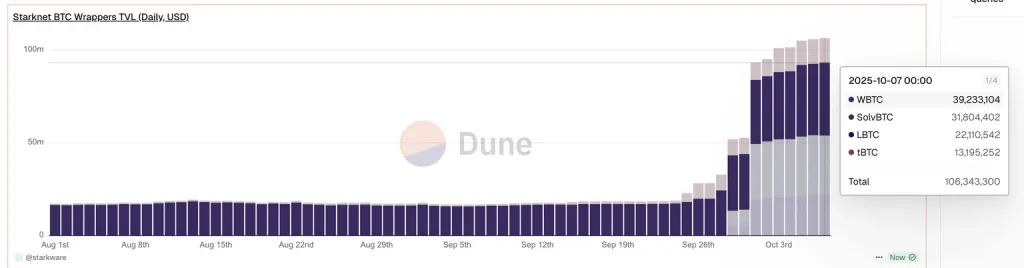

- Wrapped BTC tokens on Starknet hit $106.34M, reflecting rising investor interest.

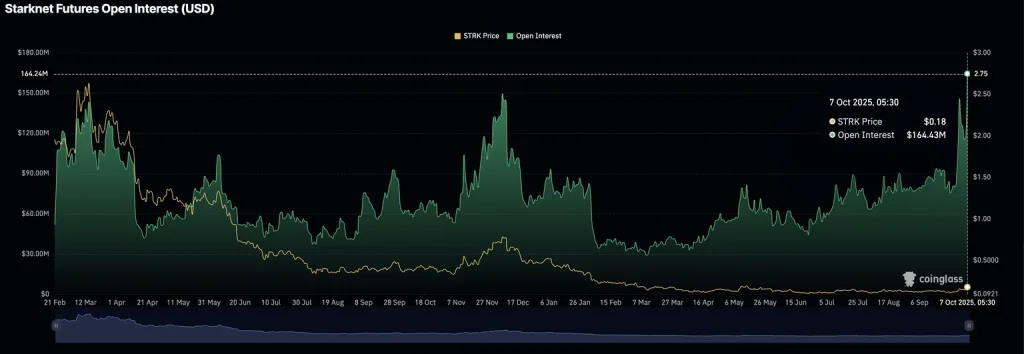

- STRK’s Futures Open Interest reaches a record $164.43M, signaling bullish retail sentiment.

Starknet (STRK) is experiencing significant upward momentum, trading above $0.1754 at press time, reflecting a 12.20% increase in the past 24 hours. This price surge follows a boost in network activity, largely driven by the launch of Bitcoin (BTC) staking. The BTCFi Season, introduced on September 30, has helped fuel positive growth and investor sentiment.

The Bitcoin staking on the Starknet mainnet was launched last week, bringing BTC onto the network’s consensus. The dominant consensus token is still STRK 75% (BTC is now 25%). Staking Rewards are now being split evenly with 25% of STRK emissions.

Starknet Sees Surge in Wrapped BTC Staking and Network Activity

BTC itself can’t be staked directly on the network, but wrapped BTC tokens such as WBTC, LBTC, tBTC, and SolvBTC are supported. Each wrapped token’s reward pool is unique. According to Dune data, the amount of staked wrapped BTC tokens was around $106.34 million.

The Total Value Locked (TVL) in Starknet has increased by 3.93% within the previous 24 hours to $221.09 million. This growth shows the sum of deposits in digital assets across this network. More TVL could usually be a sign of greater network adoption and increased confidence of the user in the platform.

Starknet DEX trading volume is also healthy, with more than two days of over $30 million trading. The market value of stablecoin has risen to an all-time high of $120.45 million. These developments demonstrate an enhanced level of trading and liquidity, thus strengthening the role that Starknet is playing in the blockchain.

STRK Shows Bullish Momentum Amid Resistance and Rising Retail Interest

The price of STRK fluctuated between $0.1885 and $0.1713 during the trading session. Exponential Moving Averages (EMA) show a mixed trend for STRK. The 20-day EMA is at $0.1439, while the 50-day EMA is at $0.1369. The 200-day EMA, acting as resistance, is holding back upward price movement at $0.1787.

In spite of the resistance area, the MACD is bullish with the MACD line at 0.0098 above the signal line at 0.0047. In addition, the histogram has a value of 0.0051. These signals indicate that buying pressure is likely growing within the market. A break above the 200-day EMA would confirm the uptrend to be in place.

Also Read: Starknet Price Prediction 2025-35: Will It Hit $30 by 2035?

According to CoinGlass, STRK Futures OI hit a new record high of $164.43m, compared to $117.63m on Monday. An increase in Futures OI suggests risk-on among traders as more and more people are entering fresh/amplified long positions, expecting a gain.

The Market Value to Realized Value (MVRV) for STRK is currently at -16.96%, according to Santiment. This negative value indicates that the token is undervalued relative to its holders’ cost basis. At these levels, many investors are holding positions at a loss, which may be preventing them from taking profits and contributing to reduced selling pressure in the market.

STRK could potentially grow in the future due to the low level of selling pressure. With many investors holding positions at a loss, profit-taking is limited, which may support upward price movement. As the market stabilizes, STRK could continue to rise, but it will need to break major resistance levels to maintain steady growth.

The inclusion of Bitcoin staking has given Starknet a push in network usage and investor confidence. STRK has a strong chance of growth following the rising technical indicators and store retail interest.