Bitcoin Crashes 17% As Crypto Market Loses $19 Billion

- Bitcoin plunged to around $102,000 after heavy liquidations swept $19B from the crypto market.

- CoinGlass data revealed 1.6M traders lost positions during the sharp weekend crash.

- Bitcoin now trades near $111,000 with an RSI of 39, indicating intense bearish pressure.

Bitcoin faced one of its sharpest sell-offs in months on Saturday, falling 17% within hours, according to data from TradingView. The coin dropped from $122,500 to around $102,000, erasing nearly $21,000 in value in one trading session and shaking investor confidence across the cryptocurrency market. The widespread selling off of assets led to huge liquidations on the major exchanges, resulting in one of the most tumultuous trading days of the year.

The sharp decline reflected sheer panic among traders who had taken on heavy leverage, betting that prices would continue climbing after recently hitting new highs. Analyst Crypto Patel identified $108,100 as Bitcoin’s immediate support level, describing it as a pivotal area that could determine the next market direction.

Market Data Shows Record Liquidations Across Major Assets

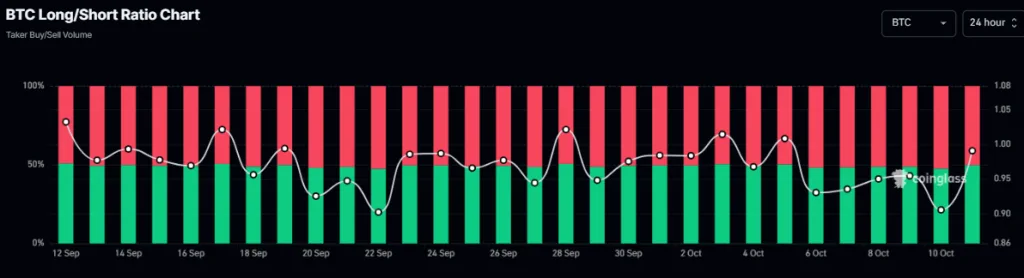

CoinGlass data reflects increasing indecision in the derivatives market. The BTC Long/Short Ratio chart, covering the period from September 12 to October 10, displays alternating bullish and bearish momentum within a narrow range.

Over the entire period, the ratio of Bitcoin fluctuated around 1.0, indicating a very close and equal participation of long and short traders. It dropped to 0.86, which was a clear indication that short traders were in control, before returning to about the same level. The continuous changes in buy and sell volume are an indication that leveraged traders are finding it hard to decide where the market is going amidst the ongoing volatility.

This situation of equilibrium in long and short positions is a sign of high tension. As Bitcoin swings between drastic rises and falls, traders are becoming increasingly cautious about taking aggressive positions.

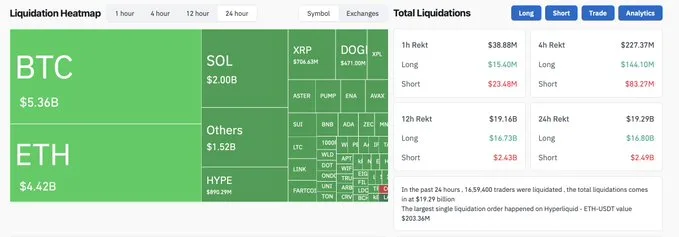

In just one day, the data reported that 1,659,400 traders were liquidated, resulting in an astonishing loss of $19.29 billion. The major impact was on Bitcoin, with $5.36 billion, followed by Ethereum, with $4.42 billion, Solana, with $2 billion, and XRP, with $706 million. Additionally, liquidations were also substantial on smaller altcoins, including DOGE, BNB, and ADA. The largest single liquidation occurred on Hyperliquid, involving an ETH-USDT position worth $203.36 million.

Related: Gold Pulls Back from $4K as Silver Hits ATH and Bitcoin Holds Above $121K

Bitcoin Slips Below $111K as Sellers Tighten Grip Near Key Fibonacci Levels

Bitcoin continues its bearish slide, trading at $110,925 at press time, according to TradingView. The daily chart paints a grim picture, showing BTC breaking below the 0.236 Fibonacci retracement level at $112,492, with bears maintaining their grip after a sharp drop.

The correction aligns perfectly with Fibonacci retracements, with resistance stacked at $117,096 (0.5 level) and $122,083 (0.786 level), while immediate support sits at $108,377, a zone previously tested in late September. A break below this could expose $100,050, the next psychological and structural support.

The RSI (14) has cooled to 39.12, slipping below the neutral 50 mark, which signals fading momentum and reinforces the short-term bearish bias. Unless bulls reclaim $112K, to shift the short-term trend, otherwise, the decline may persist