The SafeHaven Shift: Gold Eyes New Record Above $4,050 as BTC Rebounds

- Gold extends its gains above $4,070 as on-chain inflows exceed $4 million in two days.

- Bitcoin faces $98M in outflows, indicating that traders are retreating from risk exposure.

- Rising open interest shows firm confidence in gold’s short-term uptrend.

Gold has reclaimed the spotlight in global markets, widening its lead over Bitcoin and other risk-driven assets as traders move toward safety. Economist Peter Schiff, a long-time supporter of the metal, noted that both gold and digital assets are higher tonight, though for sharply different reasons.

According to Peter, Bitcoin is only partially recovering from Friday’s fall, while gold has climbed above $4,050, a step away from a record peak after holding steady through the weekend. Silver is moving in tandem, trading just under $51 as it closes in on its high.

The rally marks a clear “safe-haven shift” in market sentiment. Mixed economic data and the threat of fresh volatility have prompted investors to seek hard assets they can trust, rather than speculative holdings that fluctuate with sentiment.

Gold and silver’s advance underlines that search for security. Bitcoin’s mild rebound, by contrast, shows caution still shadows digital value. As Schiff’s remarks hint, the market’s glow tonight may be golden, but it’s driven more by fear than by speculation.

Gold vs. Bitcoin: Will BTC Join the Safe-Haven Trend?

After touching a weekly high of $4,059, gold dropped about 3% on Thursday, testing support around $3,951–$3,941. That range held steady, setting the stage for a rebound when Donald Trump announced a 100% tariff on all Chinese imports and fresh export restrictions on critical software, effective November 1, 2025.

Source: TradingView

The policy jolt rattled global markets and reignited fears of another trade confrontation between Washington and Beijing. As risk appetite faded, the metal drew the heaviest inflows, climbing back to about $4,023 by Friday’s close.

The momentum carried into the weekend, pushing prices beyond the $4,053–$4,059 resistance zone. At press time, gold trades above $4,070, with an RSI reading of 66.3 signaling intense buying pressure and room for further gains before reaching the overbought threshold.

Analysts predict that if momentum persists, the metal could surpass $4,100 and potentially set new records. On the other hand, Bitcoin faced a far rougher week. The token’s market value plunged on Friday, with more than $5.3 billion in leveraged positions wiped out, most of them from overextended long bets.

Source: TradingView

The mass liquidation triggered a sharp sell-off, which dragged prices down to approximately $102K before a rebound brought them back to the $110K-$111K range. At the time of writing, Bitcoin was trading near $115K, with the 50% Fibonacci retracement zone providing short-term support.

At the same time, its RSI has climbed from 38 to around 47, reflecting a cautious return of buyers. Analysts view the current RSI as a neutral signal, showing neither strong bullish nor bearish momentum. Yet, a move above 50 could mark a shift toward a fresh rally, potentially pushing the price toward $120K if confidence returns.

Related: BNB Rebounds to an ATH of $1,370 As Traders Push for Breakout

Confidence Gaps Widen Between Safe and Risk Assets

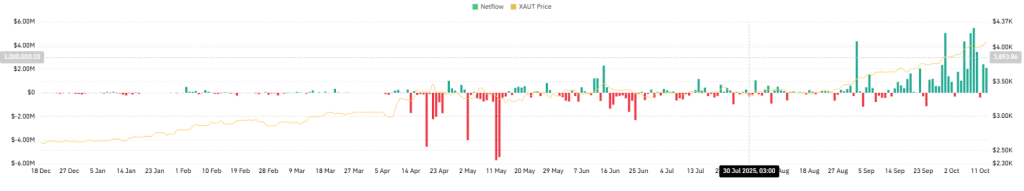

Gold is quietly attracting new capital. In the past two days, more than $4 million has flowed into spot markets, according to CoinGlass on-chain figures. The steady rise in inflows indicates that investors are once again treating the metal as a haven for their investments.

Source: CoinGlass

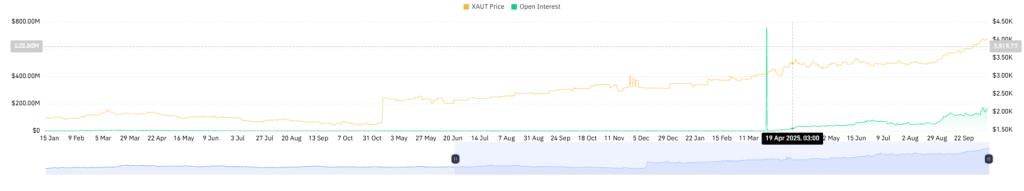

With that renewed demand, prices may have room to rise in the short term. Open-interest data paints a similar picture. Totals now hover around $166 million, suggesting most traders prefer to stay in their positions rather than take quick profits.

Source: CoinGlass

That kind of conviction often means confidence in the trend, but it can also spark a more optimistic trading approach. As open interest builds, intraday price swings tend to get sharper, a sign of heavier participation.

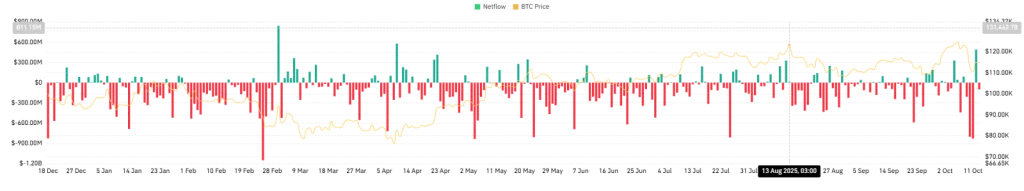

Nevertheless, Bitcoin isn’t sharing the same luck. Network data indicates that around $98 million is leaving the market as traders pull back and shift toward safety. The outflow hints at a weaker appetite for risk and adds extra pressure on prices that were already drifting lower.

Source: CoinGlass

Open interest in Bitcoin has also fallen, from about $94 billion to roughly $74 billion, as many holders close positions and take money off the table. With fewer active contracts in play, liquidity thins, making the market more susceptible to manipulation. That drop leaves Bitcoin more exposed to volatility if selling continues over the coming sessions.In summary, Gold’s consistent inflows and higher open interest indicate a clear shift toward safety as uncertainty increases. In contrast, Bitcoin’s declining activity suggests a waning confidence in speculative markets. The broader trend demonstrates that investors are returning to stability, with gold regaining its traditional appeal as a trusted store of value.