ASTER’s Price Dips After Stage 2 Airdrop Launch, Rebound or More Pain?

- Aster rebounds 60% after a record $20B liquidation, showing resilience in market recovery.

- Stage 2 airdrop launch rebuilds trader confidence and strengthens Aster’s market credibility.

- On-chain data reveals $26M in shorts at $1.50, signaling intense pressure near key zones.

Last week’s crypto selloff wiped out more than $20 billion in leveraged trades, marking the largest one-day liquidation the market has ever seen. Aster (ASTER) was among the most brutal hits, sliding fast and stirring anxiety that its price might slip under the $1 line.

However, the recovery came just as quickly. In three days, the token bounced 60 percent to reach $1.59, but that peak soon turned into a stubborn barrier. Since then, sellers have pressed the price down more than 10 percent in the past day, leaving ASTER near $1.35.

Over the week, the decline now totals 31 percent, indicating that traders remain cautious following the earlier shock. This move follows Aster’s release of its long-awaited Stage 2 airdrop, quelling rumors of another delay that had been linked to concerns over data review.

Aster Restores Market Trust with Stage 2 Airdrop Launch

After several weeks of uncertainty and shifting timelines, Aster (ASTER) has finally released its long-delayed Stage 2 airdrop. The claiming window went live on October 13 at 19:00 UTC, confirmed in a post by the project on X.

Earlier in the day, some users gained access earlier than planned. The team later explained that a timezone error had triggered the mistake and promised to fix it immediately. In its update, the team apologized for the mix-up and stressed its commitment to fairness.

All eligible users were given equal claim access, while trading fee refunds were scheduled to finish before October 14 at 12:00 UTC. The developers also confirmed that an internal review would follow to ensure smoother rollouts in the future.

Before the launch, the airdrop had been rescheduled for October 20 due to irregularities found in user allocations. Those figures have now been corrected, and affected users were given 48 hours to decide whether to receive a USDT refund instead.

Even with the delays, community sentiment has stayed upbeat. Trader MarcellxMarcell praised the project’s openness and said he has been buying ASTER since it traded near $0.14, adding more up to $1.90. He pointed to the backing from YZi Labs and Binance’s CZ as key reasons for confidence in Aster’s long-term potential.

In another post, Marcell addressed fears of a potential sell-off following the airdrop. He dismissed the idea of an “airdrop dump,” instead calling it an “airdrop pump,” suggesting growing confidence among holders. Ending his statement boldly, he hinted at a lofty target: “See you at $40.”

ASTER Price Action: Key Levels to Watch

From a technical perspective, ASTER has been moving within a descending channel, indicating that sellers still have the upper hand. Besides, the token trades within a supply zone, and many short sellers appear to be positioning themselves for a move from here.

Currently, the price is hovering near the 23.6% Fibonacci retracement level, around $1.33, which is acting as short-term support. If this level gives way, the next area to watch lies between $1.25 and $1.15.

Source: TradingView

That zone could serve as a possible entry point for buyers, but only if it manages to hold firm. A clean break below would drag the token closer to $1.00, or even slightly under it. On the upside, a rebound could aim for the $2.00 level, though the $1.55–$1.84 region may create strong resistance before any major move higher.

Momentum indicators add to the mixed picture. The RSI sits near 41, climbing from oversold territory. That shows a faint increase in buying pressure, but bears still dominate the short term. If RSI breaks above 50, it would signal a stronger shift toward bullish sentiment. For now, the chart leaves space for movement in either direction, a quiet pause before the market decides its next leg.

Related: Dogecoin Rebounds 40% After Crypto Market Turmoil: Is Momentum Back?

Liquidity Maps Expose the Battle Between Bulls and Bears

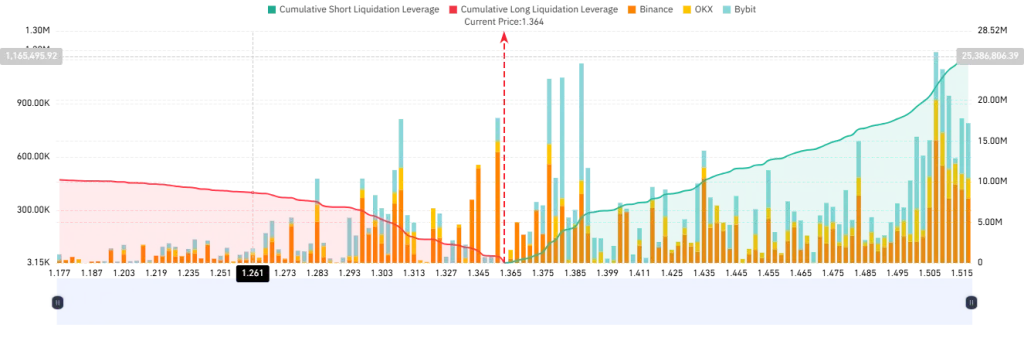

On-chain figures from CoinGlass indicate that ASTER has drawn a dense pocket of liquidity around the $1.50 level. Roughly $26 million worth of short positions are outstanding, suggesting that many traders expect further downside.

Source: CoinGlass

In crypto markets, these areas often become price targets, as liquidity tends to attract movement. The market usually drifts toward where the most significant number of stops or liquidations are waiting.

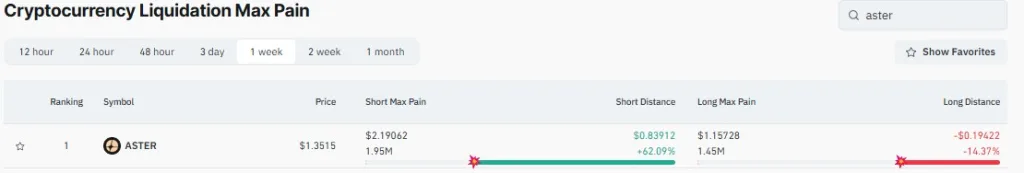

The Liquidation Max Pain Index adds more context. It places the short pain zone at $2.19, which is around 62% higher than the token’s current price. On the contrary, the long pain zone sits closer, near $1.15, about 14% lower.

Source: CoinGlass

That means traders holding long positions are more likely to be squeezed first if prices fall below that level, while short sellers won’t feel real pressure unless the market climbs back toward $2.19.

In summary, ASTER sits on uncertain ground. Buyers see a chance for recovery, while sellers remain firm. Liquidity levels suggest both sides are still active. The next move depends on momentum, whether confidence builds toward a rebound or fading demand drags the price lower again.