Bitcoin Dips Below $105K as Miners Fuel Fresh Market Selloff

- Bitcoin trades near $105K, showing severe selling waves and weakening bullish volume.

- Miners deposited 51K BTC, exacerbating market stress and fueling fears of a decline.

- Institutional inflows may balance heavy supply, yet the $100K base stays fragile.

Bitcoin has experienced extreme bearishness in the market, dropping sharply to $104,943 on October 17 after a 3% decline within 24 hours. The cryptocurrency now trades inside a double descending channel, suggesting intense bearish pressure as sellers dominate market control. The 1-day Binance chart shows BTC fluctuating between $104,000 and $109,000 since mid-September. Analysts warn that unless bulls defend crucial levels, the asset could slide toward $98,000.

Source: TradingView

The $108,756 level, which corresponds to the 0.618 Fibonacci retracement, has been breached, hence confirming the existence of intense selling pressure. The next support level is at $104,058, which is at the 0.786 level. $100,050 has also been identified as a major psychological barrier. Resistance beyond this range is heavy for BTC in the area of $112,056 and $119,439. The resistance band, which extends from $122,000 to $126,000, has been in place since August, continually interfering with bullish momentum.

The 33.34 reading on the daily RSI indicator is a result of a recent drop from 52.16 and signifies a considerable oversold state. The sharp decline is indicative of an unbroken selling trend, wherein buyers are unable to show any strength in terms of recovery. The RSI value, which is close to a three-month low, indicates that market sentiment remains weak, and traders are cautious about initiating new long positions.

Technical Pressure Builds as Sellers Dominate

The market structure suggests that Bitcoin remains trapped in a pronounced bearish channel. Every recovery effort is met with rejection at the top of the channel, where the sellers are still active, unloading their positions. The red arrow on the chart highlights a recent bearish engulfing candle, indicating that buyers are becoming exhausted.

Market data confirms this downtrend has persisted since the September peak near $126,000. The 0.5 retracement at $112,056 and the 0.236 level near $119,439 create substantial barriers that limit upward movement. Traders anticipate a retest of $104,000, which could decide whether the asset finds support or breaks lower toward $100,050.

“The rebound on Sunday and Monday did not develop, and the 50-day moving average acted as local resistance,” said Alex Kuptsikevich, chief market analyst at FxPro. “The market is again testing the strength of 3-month support near current levels. Such persistence from the bears suggests the next stage will be a test of the 200-day average, which passes through $3.5 trillion.”

If bears maintain momentum, Bitcoin may experience extend losses.If bulls reclaim the $108,000–$110,000 region, short-term recovery toward $112,000 remains possible.

Related: Bitcoin and Ethereum Rebound as Global Crypto Market Recovers to $3.91 Trillion

Miner Activity Fuels Additional Selling Pressure

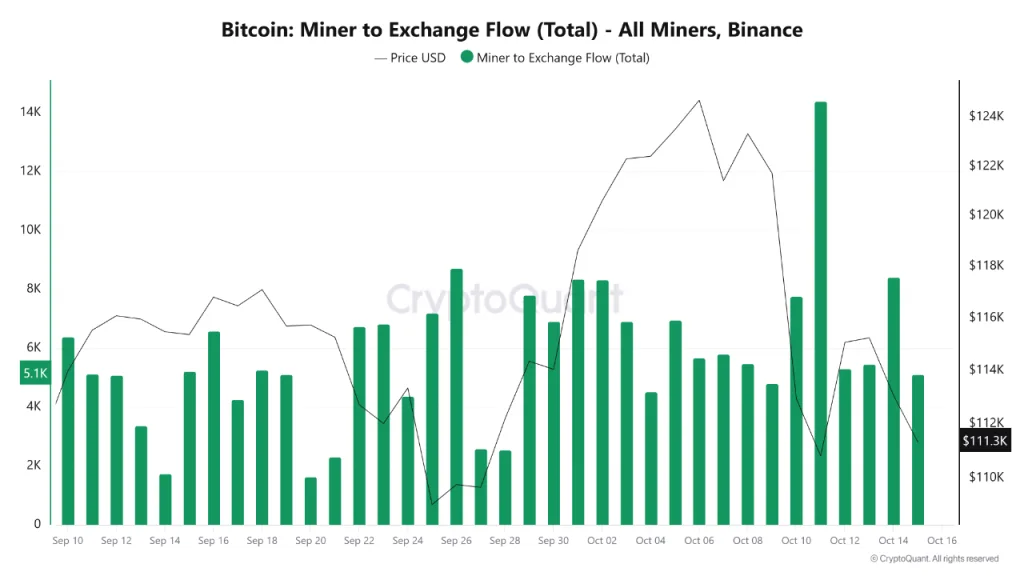

According to data from CryptoQuant analyst Arab Chain, miners have deposited over 51,000 BTC, worth approximately $5.7 billion, into Binance since October 9. The highest transfers happened on October 11, when more than 14,000 BTC were moved—the highest since July. This event coincided with Bitcoin’s drop to $110,000, thus confirming the bearish market sentiment.

Source: CryptoQuant

Usually, miners sending Bitcoin to exchanges mean they are ready to sell or hedge. The transactions, however, may also be for collateralization of derivatives or operational transfers between mining wallets and exchanges. It is a pattern that large miner inflows usually precede a downward trend in the market, as they are interpreted as the major holders becoming more active in selling.

Deposits of 51,000 BTC in the course of seven days have shown a total change in behavior from buying to selling. This selling pressure matches Bitcoin’s decline, and if demand cannot clear the excess supply, it may lead to a further price reduction.

Although there has been a significant increase in miner deposits, the demand from institutions and ETF inflows may be absorbing the supply of Bitcoin created by the miners. The market’s equilibrium between miners’ selling pressure and fresh institutional demand will determine whether Bitcoin stays above $100,000 or sinks further.