DOGE Price Holds Key Support at $0.18; Rebound in Sight?

- DOGE holds $0.18–$0.17 support as market sentiment cools and traders await direction.

- Analysts expect DOGE rebound potential once the price confirms a breakout above $0.20 mark.

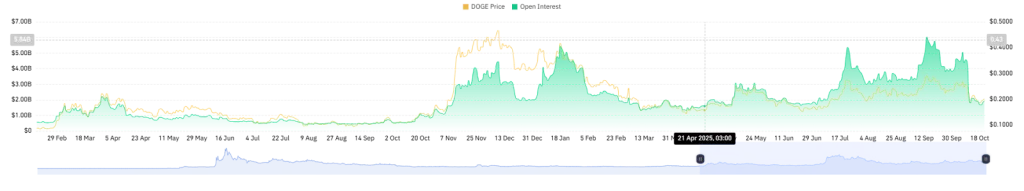

- Dogecoin derivatives open interest fell sharply to $1.92B from a monthly peak of around $5B.

Dogecoin is hovering near a critical level, testing the $0.18–$0.17 support range that has repeatedly anchored its price in recent weeks. Earlier this month, the token bounced from this same zone, gaining about 15% before running into selling pressure around $0.20.

That ceiling remains an obstacle. The $0.20 mark, which aligns with the 50% Fibonacci retracement, has so far limited every bullish attempt. Traders now watch closely to see if the support area can once again hold firm as market sentiment turns cautious. A sustained move above $0.20 could confirm that buyers are defending the range, opening the way for another rebound.

If the floor gives way, however, Dogecoin could face a deeper pullback before stability returns. For now, activity near the lower band suggests steady accumulation, with traders positioning for a possible short-term recovery.

Experts Weigh In on DOGE’s Price Action: Path Above $0.20

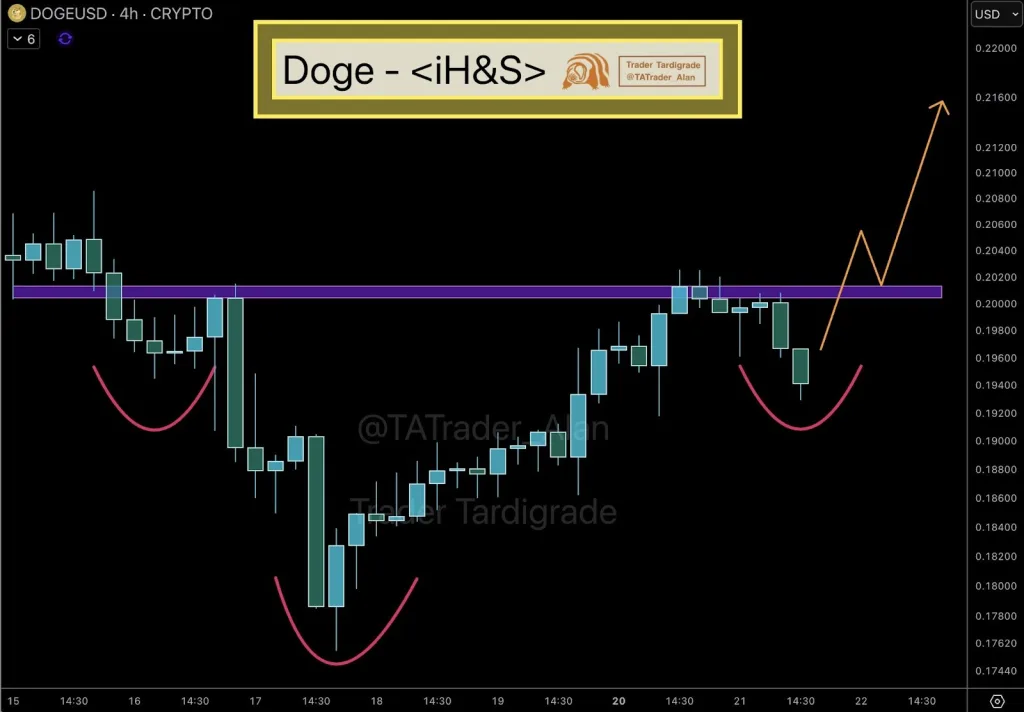

Market analyst Trader Tardigrade articulates that Dogecoin appears to be forming an inverse head-and-shoulders pattern on the four-hour chart, a setup traders often associate with a possible shift in momentum. The formation shows three clear troughs, with the middle dip standing out as the deepest.

Tardigrade places the neckline near $0.20, calling it the level to watch for confirmation of a breakout. If the price closes firmly above that mark, he expects the next leg of the move to reach around $0.21, signaling renewed buyer control.

Offering a wider view, analyst Ali_charts points to a rebound from channel support on Dogecoin’s daily chart. He notes that the token continues to follow an upward channel that has guided its progress since mid-2023.

Within this structure, Ali projects steady gains toward $0.29, with further upside targets near $0.45 and potentially $0.86, provided broader market conditions, particularly Bitcoin’s performance, remain supportive.

Related: BTC Tests $109K Support Amid Mixed Market Signals

Market Pressure Mounts as DOGE Struggles to Recover

Despite earlier bullish forecasts, Dogecoin’s momentum continues to fade as sellers tighten their grip, tempering the optimism that had recently lifted sentiment. At press time, the token has fallen about 4% in the past day and nearly 28% over the past month, signaling sustained downward pressure.

At the same time, trading volume has slid 21% to $1.95 billion, pointing to reduced market activity and waning speculative interest. On-chain metrics reinforce the cooling trend. Open interest in Dogecoin derivatives has dropped to $1.92 billion from a monthly high near $5 billion.

This shows that traders are scaling back risk and locking in profits rather than expanding positions. Such a decline often leads to lower volatility and can precede a stretch of sideways movement as the market seeks balance. Liquidation data paints a similar picture. In the past 24 hours, roughly $3.75 million in long positions were closed out, compared with only $19K in shorts.

In summary, Dogecoin remains at a decisive point as traders weigh key support levels against continued selling pressure. While technical signals hint at a potential rebound, weak momentum and declining market activity suggest a cautious phase ahead, leaving the token’s next direction dependent on broader market sentiment.