Bitcoin (BTC) Holding Above $108K as Bearish Trends Persist

- Bitcoin’s price briefly reclaimed $111K but quickly fell below $108K, signaling bearish pressure.

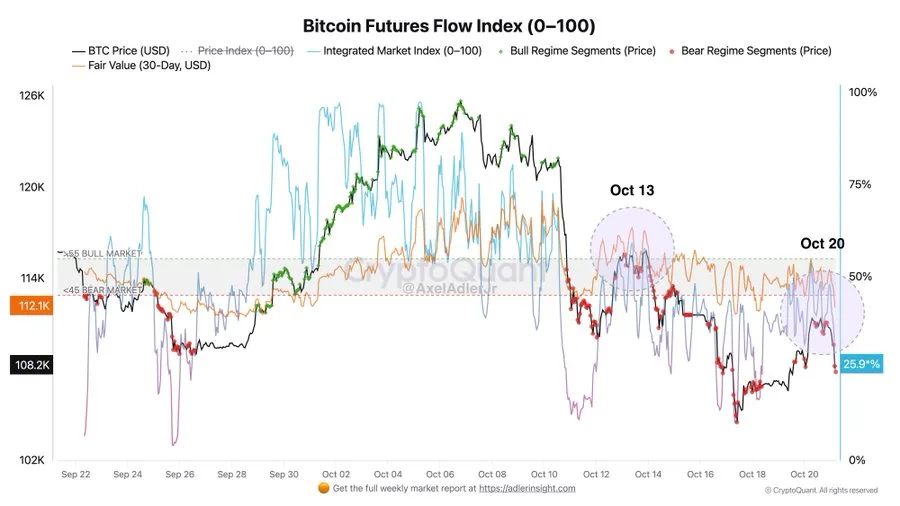

- BTC’s failed rallies on October 13 and 20 show weak momentum and a lack of sustained growth.

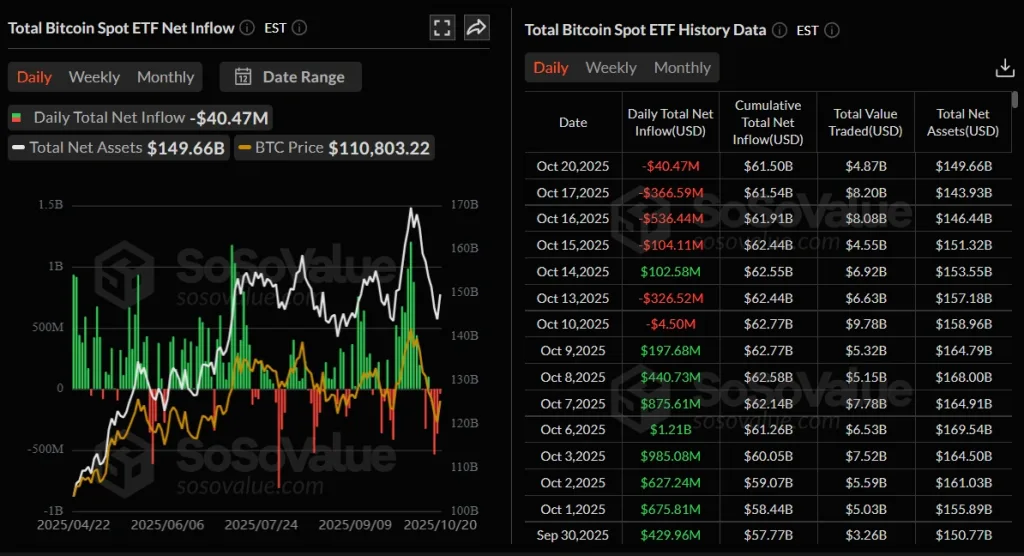

- Institutional demand weakens as BTC spot ETFs see continued outflows amid global uncertainty.

Bitcoin began the week with positive momentum, briefly reclaiming the $111,000 mark on Monday. However, the gains were short-lived, with the cryptocurrency falling below $108,000 on Tuesday. As of press time, BTC is trading at 108,297, down by 2.17% over the past day. This rapid decline signals ongoing bearish pressure, highlighting a challenging week ahead for Bitcoin traders and investors.

CryptoQuant analyst Axel Adler Jr. reminded that Bitcoin made those two attempts to break higher on October 13 and October 20, but failed. To be sure, both rallies had strong openings that ultimately petered out, lacking follow-through momentum. The market index is still under 45, which implies no interest by buyers and weakens Bitcoin’s short-term perspective.

Adler also noted that Bitcoin’s price is trading below its 30-day fair value. This implies weak futures flows and a more generalized loss of faith in the asset. The recent rallies of Bitcoin have fizzled out the bulls as they lack any notable response to the bears in control.

Global Economic Tensions Weigh on Bitcoin

Bitcoin is taking a steep influence from global economic forces. A three-week U.S. government shutdown has also muddied the waters for investors and added to a risk-averse mood. Some analysts predict the shutdown could be resolved soon, but uncertainty about government activity continues to make investors skittish.

Ongoing tensions between the U.S. and China are impacting market sentiment. Trump’s threat of a 155% tariff on Chinese goods has increased investor anxiety. This geopolitical uncertainty has particularly affected high-risk assets like BTC, which has struggled due to the trade war.

Institutional demand for Bitcoin is waning as well. Bitcoin spot Exchange-Traded Funds (ETFs) posted a $40.47 million outflow on Monday, following four straight days of withdrawals. This comes on the heels of some of the biggest weekly outflows since the ETFs were launched.

Bitcoin Faces Bearish Momentum Amid Weak Market Confidence

Technical indicators are currently bearish for Bitcoin, which is trading below key exponential moving averages (EMAs). The 200-day EMA ($108,062) still acts as a crucial support level, and beyond it are the three significant resistance levels (100-day EMA, 50-day EMA, and the 20-day EMA) at $112,448, $112,852, and $113,802, respectively.

The bearishness is further confirmed by the moving average convergence divergence (MACD) indicator, which indicates the MACD line below the signal line, resulting in downward pressure. A negative histogram reading of -942.85 again confirms that selling pressure is dominating buying activity, thus likely maintaining the current bear market.

Related: Bitcoin Outlook Weakens Amid Fear and Falling Momentum

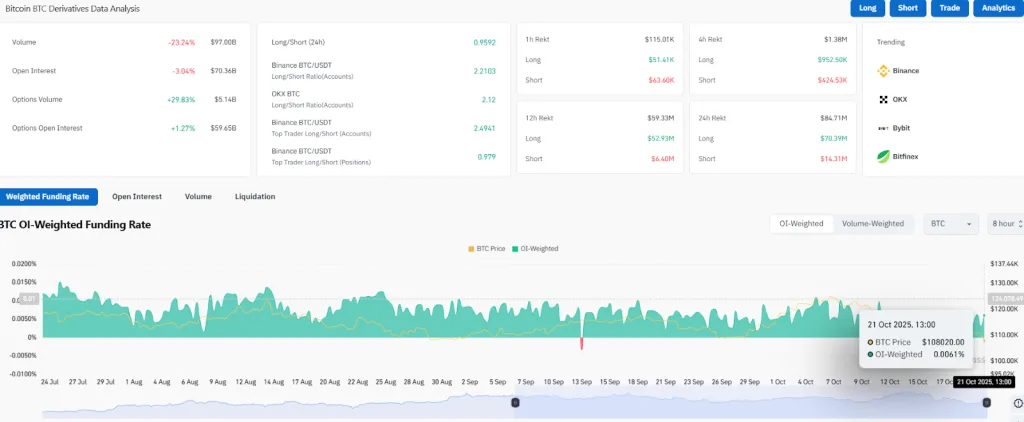

According to analytics platform Coinglass, volume has seen a 23.24% decrease to $97 billion, meaning decreased trading activity. Open interest dropped 3.04% to $70.36 billion, indicating a lack of investor confidence. The 24-hour liquidations, which totalled $84.71 million, further indicate market weakness.

Bitcoin’s price weakness is also overshadowed by macro concerns such as the prolonged U.S. government shutdown and uncertainty in U.S.-China trade talks. Institutional investors remain cautious, with several Bitcoin spot ETFs experiencing outflows, further fueling bearish sentiment. The confluence of the lackluster demand from buyers and poor technicals indicates that it would be a tough road ahead for Bitcoin.

Without clear evidence of recovery, the Bitcoin price stays in the bear camp. Uncertainty over political and economic tensions is weighing on traders and investors. Unless Bitcoin can overcome its technical resistance and gain strength.