Gold Suffers Biggest Drop Since 2013 as Bitcoin Briefly Tops $114K

- Gold plunged 6.3%, marking its steepest one-day drop since 2013, wiping out $1.75T in value.

- Bitcoin briefly topped $114,000 before dropping to $108K, triggering $150M in short liquidations.

- Analysts cite profit-taking and algorithmic flows as triggers for gold’s sudden correction.

Gold and Bitcoin have seen opposing movements this week, which has sparked speculation about capital rotation between the two significant assets. While Bitcoin briefly surged above $114,000 before reversing lower, gold saw its biggest one-day loss in over a decade. The contrasting moves highlight changing sentiment in global markets as traders reevaluate risk and liquidity.

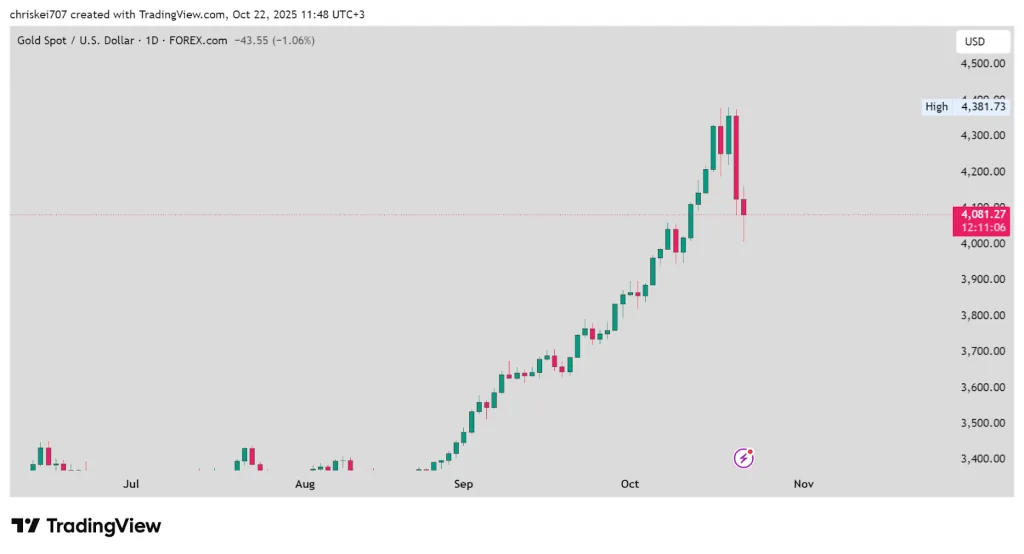

Gold declined 6.3% on Tuesday, the biggest daily decline since 2013. This wiped out about $1.75 trillion in market value. The drop came after Monday’s record high of $4,380 per ounce, where strong algorithmic flows and profit-taking caused a quick correction.

Gold Faces Sharp Correction After Record Rally

The sudden correction came after a strong rally driven by inflation concerns, geopolitical tensions, and strong central bank demand. Since early September, gold has increased steadily, exhibiting a distinct upward trend marked by higher highs and lower lows. The $4,380 level, however, was unsustainable, and the market quickly reversed course. After a brief decline below $4,000, the price recovered to about $4,150 as dip buyers appeared.

Source: TradingView

The $4,000 mark now acts as a psychological level. A break below it could lead to deeper losses toward $3,850 or even $3,800. For now, buyers appear to be defending that zone, keeping gold’s broader trend intact. The long-term outlook is still dependent on central bank accumulation and inflation trends, both of which continue to support demand.

Peter Schiff and other gold advocates described the decline as a “shakeout,” arguing that it reflects short-term volatility, not the end of the cycle. They said gold remains a hedge against currency debasement and fiscal risk. However, for traders, the event highlighted how fragile momentum can become when prices rise too quickly.

Silver faced similar pressure, dropping nearly 9% to $48.40 per troy ounce. The metal had tracked gold’s rise earlier this year, supported by demand from industrial sectors and investors seeking inflation hedges.

Bitcoin Surges Then Reverses Amid Market Volatility

While gold faced liquidation, Bitcoin staged a brief recovery. The cryptocurrency climbed over 2% on Tuesday, reaching $114,000 before falling back near $108,000. The move triggered more than $150 million in short liquidations as leveraged traders scrambled to cover positions. The surge followed bullish comments from Binance co-founder Changpeng Zhao, who said Bitcoin could one day surpass gold’s market capitalization.

Bitcoin’s rebound comes after a steep pullback earlier in October, when the asset dropped from its record $126,000 high to $104,000. The $112,000–$115,000 zone now acts as short-term resistance. A clear breakout above that level could open the path toward $120,000 and beyond. However, failure to hold above $100,000 could expose Bitcoin to deeper declines. Traders describe the market as neutral to bullish, awaiting stronger momentum.

Related: Bitcoin Outlook Weakens Amid Fear and Falling Momentum

The contrast between Bitcoin and gold is a reflection of diverging investor behavior. In the midst of unstable macro conditions, some funds may be switching from metals to cryptocurrencies in an attempt to increase returns.

Market data shows both assets are very sensitive to macroeconomic changes. Trading dynamics are still impacted by shifting liquidity, geopolitical stress, and rising interest rate uncertainty. Bitcoin’s volatility continues to reflect speculative activity, while gold’s long-term fundamentals are still correlated with real yields and central bank policy.

Despite the turbulence, Bitcoin has outperformed gold on a year-to-date basis. The digital asset remains up over 90% in 2025, while gold has gained roughly 40%. There is currently little indication of a persistent “gold-to-Bitcoin” rotation, according to analysts. However, the divergent moves demonstrate how investors are adjusting to shifting macroeconomic conditions.