Cardano Defends $0.60 Line, Can ADA Bulls Ignite the Next Rally?

- ADA holds above $0.60 as institutional ETF filings signal fresh investor confidence.

- RSI near 38.47 and a possible golden cross hint at early bullish momentum forming.

- Open interest drop and rising exchange outflows point to a quiet accumulation phase.

Cardano (ADA) has been under steady pressure for weeks, yet it continues to hold its ground near a critical zone. The token slipped roughly 23% over the past month, giving up another 5% in the last week. Even so, buyers have managed to keep prices above the $0.60 mark, with support building between $0.62 and $0.59.

Over the last 24 hours, ADA has climbed by almost 1%, hinting at an early recovery after retesting the same support area. The bounce may look small, but its timing is crucial, as it coincides with a hint of optimism from institutional circles, something that has been lacking in the market’s recent tone.

Institutional Interest Adds New Fuel

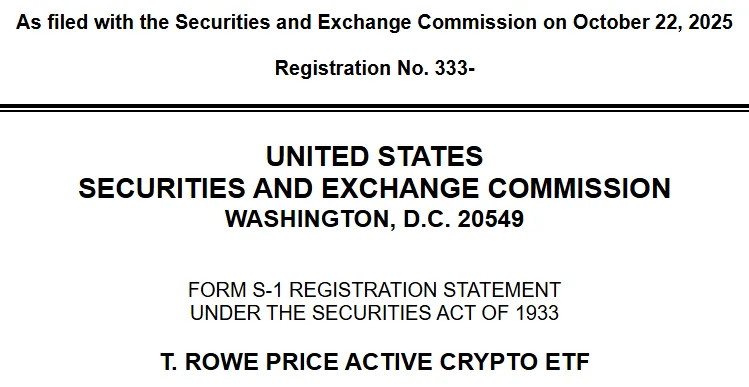

A filing by T. Rowe Price, the $1.68 trillion asset manager, has caught attention across the crypto market. On October 22–23, 2025, the firm lodged an application for an Active Crypto ETF, naming Cardano (ADA) among its proposed holdings.

Source: SEC Filing

This came just weeks after Grayscale submitted its ADA ETF in September, which is still awaiting an SEC decision. Often, ETF filings have a history of rapidly changing sentiment. For instance, when Bitcoin and Ethereum went through this stage earlier in the year, institutional inflows followed. That same logic might apply to ADA.

Approval could invite new liquidity and attention from long-term investors rather than short-term traders. It’s also a credibility shift. ADA being listed by firms like T. Rowe Price shows the project is beginning to be viewed less as a speculative coin and more as a digital asset with staying power. In traditional finance, recognition often arrives quietly before momentum builds.

Technical Setup Hints at a Possible Shift

From a technical perspective, the Relative Strength Index (RSI) is currently at 38.47, near oversold levels that often precede rebounds. The MACD remains bearish, though its lines are converging. A golden cross could form soon, a signal that has frequently marked early trend reversals.

Source: TradingView

If ADA continues to stabilize, traders would watch for a break toward the 23.6% Fibonacci level at $0.66. A move past that resistance could open the path to $0.74 (the 50% Fib), where selling pressure has repeatedly surfaced since mid-October.

Above that, a broader rally could extend toward $0.82 or even $0.90, levels not seen since the last recovery wave. But that’s only if the $0.62-$0.59 floor holds. A breakdown below $0.59 would likely expose $0.51, a key area of liquidity. Such a drop would not necessarily end ADA’s long-term structure, but it would delay any meaningful bullish reversal.

Related: XRP Surges to $2.50 as Market Sentiment Hits 9-Month Low, Is It Time to Buy?

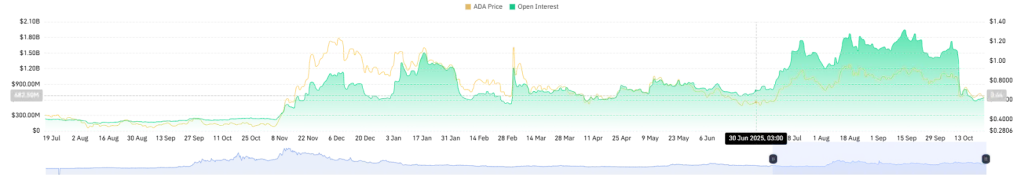

On-Chain Data Points to Accumulation

Beneath the charts, the data tells a calmer story. Open interest has fallen from $1.72 billion to about $636 million, suggesting traders have stepped back from speculative positions. This often leads to a quiet, sideways phase rather than a sudden collapse.

Source: CoinGlass

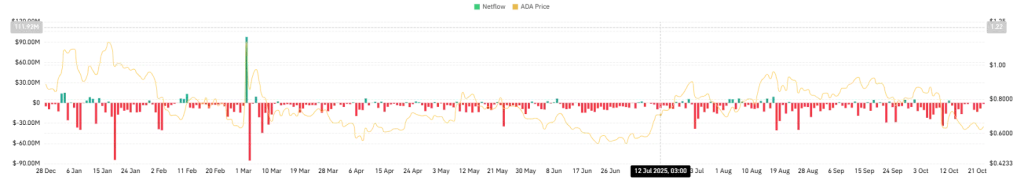

Exchange data also shows a steady outflow of ADA from trading platforms. That means holders are moving their coins to cold wallets, a sign they’re not planning to sell soon. Reduced supply on exchanges typically compresses volatility, and when demand returns, it can fuel sharper price reactions.

Source: CoinGlass

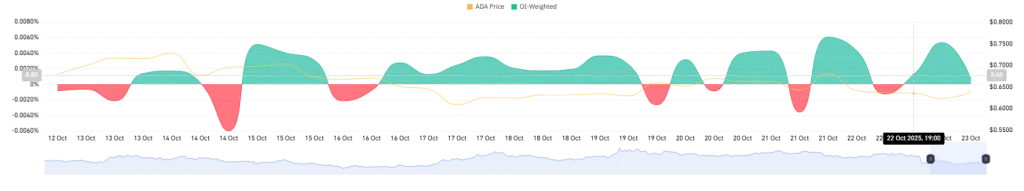

Besides, the weighted funding rate, now positive at +0.0007, backs that sentiment. This indicates that long traders are willing to pay shorts sellers a premium to maintain their positions, showing that confidence is creeping back.

Source: CoinGlass

It’s not euphoric, but it’s a visible shift from last month’s caution. Altogether, the data hints that ADA is entering a consolidation phase, the kind that often builds quietly before a major move.