CPI Slows to 3%, Fueling Bitcoin Optimism and Fed Cut Bets

- U.S. CPI rose 3.0% (y/y) in September, below forecasts, boosting Fed rate cut expectations.

- Bitcoin surged as traders bet on easing monetary policy and renewed market liquidity.

- Institutional demand for Bitcoin continues to rise amid improving macro conditions.

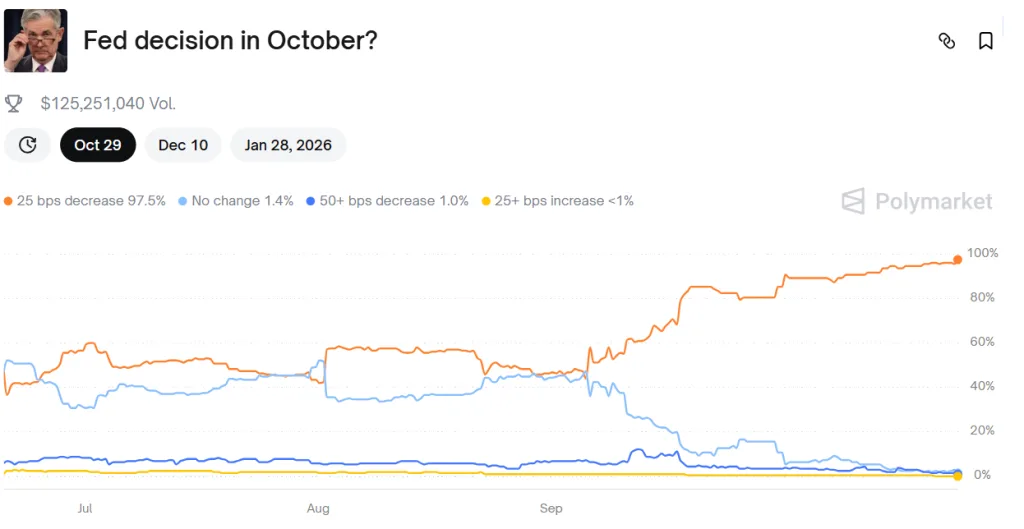

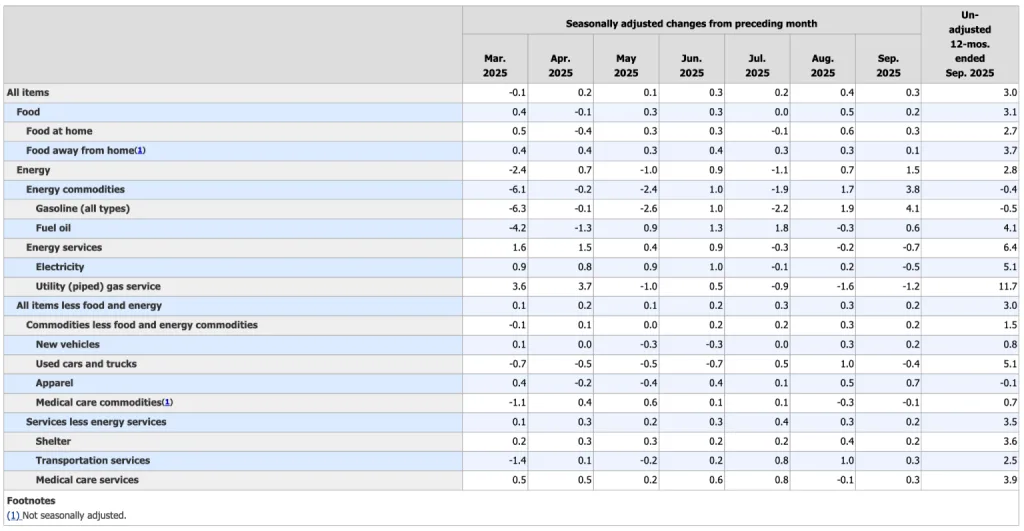

The U.S. Consumer Price Index (CPI) increased by 3.0% (y/y) in September, slightly below the 3.1% forecast. It marked the first time since January that inflation reached or surpassed the 3% level. The lower-than-expected data caught markets off guard. Traders quickly raised expectations for a Federal Reserve rate cut, with Polymarket showing a 97.5% probability of a 25-basis-point reduction in October, soon after the release.

The rising fuel and food costs were the main drivers of the inflation uptick, with additional pressure from tariffs, according to economists. On a monthly basis, CPI advanced 0.3%, under the projected 0.4%.

Core CPI, which excludes volatile food and energy prices, rose 3.0% year-over-year and just 0.2% month-over-month, missing the 0.3% forecast. These weaker readings pointed to a faster-than-anticipated cooling of price pressures.

Rate Cut Bets Fuel Bitcoin and Equity Rally

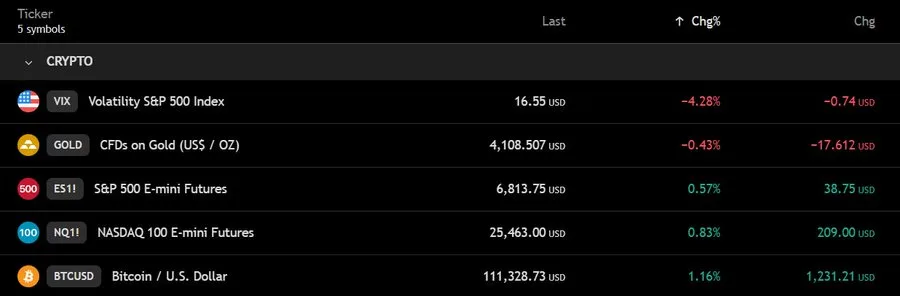

Signs of strain in the labor market supported expectations of a near-term policy shift. Investors now anticipate a 25–50 basis point rate cut at the Fed’s next meeting. The softer inflation data also lifted sentiment in equity markets. Nasdaq futures gained 0.83%, while S&P 500 futures rose 0.57%, showing investor optimism for looser monetary policy ahead.

Analyst Michael van de Poppe said the weaker inflation figures could push Bitcoin toward new record highs within a month. Furthermore, Bitcoin’s price continues to correlate closely with global liquidity trends. Research from VanEck showed that changes in the global M2 money supply explain more than half of Bitcoin’s price movements. The firm highlighted this relationship as evidence of Bitcoin’s function as a safeguard against excessive money creation.

Earlier this month, Bitcoin futures open interest hit $52 billion before a wave of liquidations triggered an 18% price decline. VanEck analysts called the drop a standard mid-cycle correction, not the start of a bear phase. They noted that leverage ratios have normalized, sitting near the 61st percentile.

Related: Bitcoin Rallies on CPI Data but Jobless Claims Add Pressure

Institutional Confidence Rises as Bitcoin Shows Mixed Technical Signals

Analysts cited a mounting correlation between revenue on blockchain networks and token price. Corporate Bitcoin holdings are growing; crypto keeps earning its place within traditional portfolios. This continuing adoption trend indicates increased institutional trust in the long-term potential of Bitcoin.

Yet technical indicators send mixed signals. Analyst Ali Martinez cautioned about a bearish cross in Bitcoin’s monthly MACD indicator. Such patterns, in previous cycles, were followed by severe drops averaging some 70%. Those patterns appeared in 2012, 2018, 2019, and 2021, each after major crypto bull runs. Such signals typically confirm existing weakness instead of predicting fresh declines.

Bitcoin is trading near $111,000 as of press time, down roughly 12% from its recent high of $126,000. If a bearish MACD cross occurs, analysts estimate that it would validate ongoing consolidation as opposed to sparking another leg lower. With potential rate cuts ahead, macro conditions appear more supportive for digital assets.

Traders are putting near-term bets on Bitcoin’s trading between $95,000 and $120,000. A strong-volume breakout above $120,000 would open the road toward $140,000–$150,000. For now, the more moderate CPI print has shifted expectations across markets. Traders see it as a turning point that could introduce a resurgence in liquidity and more momentum to Bitcoin.