Zcash Surges Hours After Arthur Hayes’ Bullish Prediction

- ZEC surged 16% after Arthur Hayes forecasted a $10,000 price target in the past 24 hours.

- RSI at 75.81 indicates strong momentum but hints at possible short-term pullbacks.

- Rising privacy focus and upcoming halving have recently continued driving demand for ZEC.

Zcash (ZEC) surged 16% within 24 hours after BitMEX co-founder Arthur Hayes predicted the privacy token could reach $10,000. The statement, shared through a “vibe check” post on X, pushed ZEC’s price from $272 to $348 at press time.

Arthur Hayes’ Influence Leads to Market Surge

Hayes’ message led to fear of missing out (FOMO) across the crypto market. Binance Square contributor AB Kuai Dong described Hayes as a “legendary investor” whose words often lead to chain reactions.

Notably, Hayes’ influence on token prices has historical backup. At the WebX 2025 conference in Tokyo, he said Hyperliquid’s HYPE token could rise 126 times in three years, and that prediction instantly sent its value higher.

His recent post about Zcash had a similar effect, sparking more excitement and trading activity. Several traders on X admitted they joined the rally impulsively. One user, Clemente, said he “couldn’t just watch from the sidelines” as the excitement grew.

DeFi analyst Ignas noted that Zcash’s comeback showed how social media can shape market moods. As ZEC started trending online, traders were cautious at first because it’s an older coin, but once the buzz picked up, more people jumped in, creating a loop that fueled even more hype.

Privacy Tokens

Beyond Hayes’ remarks, Zcash’s rally shows renewed interest in privacy-based digital assets. The changes comes amid growing regulatory attention on digital surveillance and data control. Built on zero-knowledge proofs, Zcash allows users to choose between transparent and shielded transactions, ensuring full privacy over transaction details.

Shivam Thakral, CEO of BuyUCoin, said Zcash’s rise results from “a perfect storm of catalysts.” These include its upcoming November halving, rising concerns over government oversight, and Hayes’ viral price call. Endorsements from Naval Ravikanth and Helius CEO Mert Mumtaz earlier this month also helped accelerate the breakout phase.

These factors advanced ZEC beyond its 2021 peak, a 30-day rally with triple-digit percentage gains. The surge shows how fast changing narratives can attract both speculative and long-term investors to older crypto assets, especially when with strong technical momentum.

Overbought but Strong Momentum

From a technical perspective, ZEC’s price movement is steep. The RSI is at 75.81, above the 70 overbought level. This suggests potential short-term correction, although sustained RSI above 70 in strong trends often signals continued buying pressure. The indicator’s signal line at 66.61 confirms strong underlying momentum.

Source: TradingView

Meanwhile, the MACD supports the bullish view. The MACD line at 45.45 is above the signal line at 40.78, with a positive histogram reading of 4.67. This widening gap shows strengthening momentum as market volume remains high.

Zcash has also flipped several key resistance levels, $250 and $300, into potential support zones. If current momentum continues, the next resistance target could form near $375–$400. Market volume has surged above $1.59 billion, showing that the move is backed by active participation rather than thin liquidity.

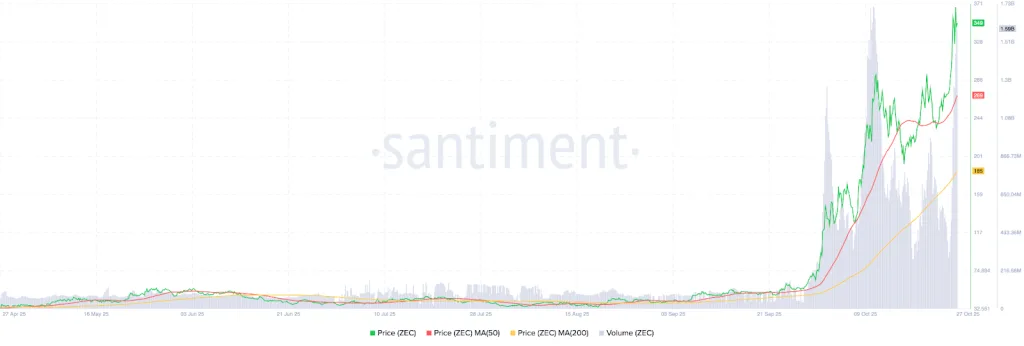

ZEC movement has also led to a golden cross formation, as the 50-day moving average at $269 is above the 200-day at $185. The wide separation between the two moving averages indicates an established uptrend.

Source: Santiment

The asset’s 360% monthly increase from around $75 to $349 supports this view. However, short-term traders may anticipate brief pullbacks toward $300–$270, where the MA50 could act as support.

Related: Arthur Hayes Warns JPMorgan’s $1.5T Plan, “QE4 for the Poor”

Interest in Legacy Projects

The recent surge shows how influential figures and viral narratives can change the outlook toward older blockchain projects. Zcash’s surge shows that renewed interest in privacy, mixed with trading excitement, can bring old tokens back to life in a growing market.

ZEC’s sharp jump, driven by social buzz and tech factors, also shows how easily the crypto market reacts to big names like Arthur Hayes. With the halving coming up and momentum still high, many are watching closely to see where ZEC’s price goes next.