Blockchain Meets Wall Street in Securitize’s $1.25B Merger Deal

- Securitize to go public in a $1.25B merger with Cantor-backed SPAC, entering a $19T market.

- The new Securitize Corp. would trade on Nasdaq under SECZ, linking crypto with Wall Street.

- Securitize to tokenize its own equity, pioneering the publicly listed blockchain firms.

Securitize Inc. has signed a merger deal with Cantor Equity Partners II Inc., a special purpose acquisition company linked to Cantor Fitzgerald. The agreement would make Securitize a public company valued at $1.25 billion before the merger. The move positions it in a $19 trillion market for tokenizing real-world assets, a major step for blockchain-based finance.

The combined company would be known as Securitize Corp. Its shares would trade on the Nasdaq stock exchange under the ticker symbol SECZ. This deal bridges the blockchain-enabled finance and traditional markets, broadening access to regulated digital currency products.

Securitize would also tokenize its own equity after the closing. The move is a first for the industry and is intended to demonstrate how shares of public companies could be issued and traded on blockchain.

Institutional Powerhouses Fuel Securitize’s $469M Deal

Major financial institutions are backing the merger. Investors such as BlackRock, ARK Invest, Blockchain Capital, Hamilton Lane, Jump Crypto, Morgan Stanley Investment Management, and Tradeweb Markets would roll all of their equity into the new company.

The deal is expected to raise about $469 million in total proceeds. This includes $225 million from a fully committed PIPE funded by Arche, Borderless Capital, Hanwha Investment & Securities, InterVest, and ParaFi Capital. Another $244 million would come from Cantor Equity Partners II’s trust account, depending on investor redemptions.

Securitize has developed the most powerful and flexible digital asset issuance and lifecycle management platform. It uses blockchain to link issuers and investors, while adhering to regulations. The chain connects with 15 leading blockchains and interacts with DeFi protocols, stablecoins, and custodians to facilitate asset issuance and secondary trading.

The company holds a full range of U.S. regulatory licenses. It is registered with the SEC as a transfer agent, broker-dealer, alternative trading system, investment advisor, and fund administrator.

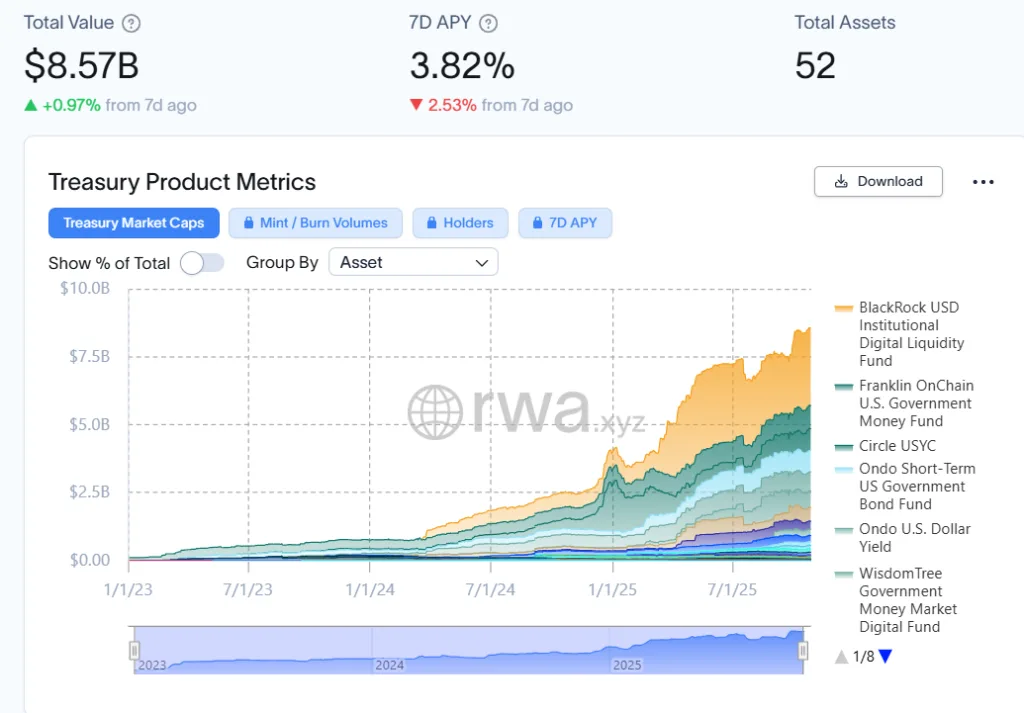

The tokenized real-world asset market has grown rapidly over the past year. Tokenized U.S. Treasurys have reached a combined value of $8.57 billion, an increase of more than 200%, according to RWA.xyz. The broader tokenization market now stands near $35 billion, growing 135 percent over the same period.

Source: rwa.xyz

By 2030, tokenized markets and assets could come to be nearly $4 trillion in size, according to Citi analysts. Institutional interest in blockchain investments is only on the rise, which bodes well for firms such as Securitize.

Securitize Strengthens Growth Plans Ahead of 2026 Public Debut

Securitize would use the proceeds from the deal to bolster its balance sheet and fund growth efforts. The firm intends to grow its platform, institutional adoption, and new financial products. No current shareholder would be selling stock or receiving cash, and the transaction is structured to keep ownership for long-term value creation.

The merger has been approved by the boards of both companies and is expected to close during the first half of 2026, subject to regulatory approval. When the deal is finalized, it would be one of the more well-known public companies in digital assets.

Related: Circle Wins Approval to Run Stablecoin Services in Abu Dhabi

The move comes after a spree of crypto-related companies going public. Circle went public on the New York Stock Exchange earlier this year and raised $1.1 billion. Cryptocurrency exchanges Gemini and Bullish also made their entrance this year. Their listings indicate a growing acceptance of blockchain infrastructure in traditional finance.

The company has secured deals with prominent asset managers that bolster its leadership. In 2024, BlackRock debuted the USD Institutional Digital Liquidity Fund, or BUIDL, on Ethereum, working with Securitize. The fund enables eligible investors to hold tokenized U.S. Treasurys and gain on-chain yield.

In partnership with Apollo, Hamilton Lane, KKR, and VanEck BlackRock, Securitize has tokenized over $4 billion of assets. These relations underscore the firm’s positioning to assist institutions in tokenizing traditional financial products on blockchain networks.