U.S. Prosecutors Challenge Crypto Policy in MEV Bot Trial

- The MEV bot trial could impact the legal interpretation of blockchain-based trading.

- Prosecutors demand that the court exclude policy debates from the brothers’ defense.

- The verdict might define how law interacts with decentralized finance activity.

U.S. prosecutors have moved to block efforts to introduce crypto policy arguments in the ongoing trial of Anton and James Peraire-Bueno. The brothers are accused of exploiting Ethereum through maximal extractable value (MEV) bots in a $25 million scheme. The case, now in its 11th day at the U.S. District Court for the Southern District of New York, could set a major precedent for blockchain law.

Source: X

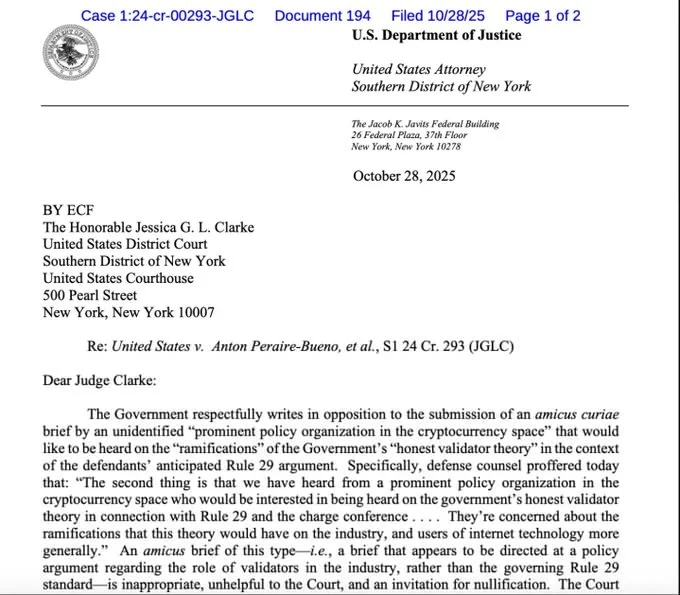

Prosecutors Reject Coin Center’s Amicus Bid

In a Tuesday filing, prosecutors opposed an amicus curiae brief from Coin Center, a Washington-based cryptocurrency advocacy group. The brief, they argued, might persuade jurors to acquit based on industry policy concerns rather than the presented evidence.

According to the filing addressed to the presiding judge, policy issues should be handled by Congress, not the courts. Prosecutors wrote, “To allow an amicus brief of this type—arguing that the defendants should be acquitted because of the implications to an industry—is to allow the defendants to argue for nullification and is lawless.”

The filing continued, “The sole concern of the Court is whether a reasonable jury could find the defendants guilty based on the evidence adduced at trial. Larger questions of policy are not appropriately heard in this arena.”

The U.S. government claims the brothers “tricked their victims” through a “high-speed bait and switch” method to steal the funds. If convicted, they each face up to 20 years in prison on charges of conspiracy to commit wire fraud, money laundering, and conspiracy to receive stolen property.

MEV Bots and the Ethereum Exploit

The charges stem from an alleged April 2023 exploit on the Ethereum blockchain. Prosecutors say the Peraire-Buenos used MEV bots—automated trading systems designed to extract value from transaction sequencing to manipulate trades worth $25 million.

An MEV attack occurs when validators or traders reorder transactions within a block to gain an unfair advantage. These practices can generate massive profits while causing losses to ordinary users. Between December 2022 and January 2025, Ethereum-based MEV revenues reached $963 million, with profits totaling $417 million, according to the European Securities and Markets Authority.

Trial proceedings began on October 15 and are expected to continue into November. The court’s eventual ruling on Coin Center’s participation could influence future policy engagement between crypto advocates and federal courts.

Defense Response and Industry Repercussions

Lawyers defending the brothers argued that Coin Center’s submission would help the court understand the broader implications of the government’s case theory. They described it as providing a “unique perspective that will aid the Court.”

The defense stated, “Because Ethereum users are engaged in economic activity, the government’s theory would mean any trading strategy involving competition could give rise to federal criminal liability.” They added that prosecutors had “refused to defend this breathtaking theory, which is inconsistent with common sense and Second Circuit precedent.”

Related: A Beginner’s Guide to Maximum Extractable Value (MEV)

Industry observers are following the trial closely, noting its potential to reshape how courts interpret blockchain-based trading activity. A guilty verdict could expand criminal liability for digital-asset traders and developers. A ruling favoring the defense might limit how far prosecutors can stretch existing statutes to cover decentralized finance.

As the trial advances, prosecutors remain firm that crypto policy debates belong in Congress. Meanwhile, defense attorneys and advocacy groups insist the court must consider the technological complexity of MEV trading. The key question now is whether the judge will permit Coin Center’s amicus brief, a decision that could define how U.S. law interacts with blockchain innovation.