Bitcoin and Ethereum Lead $1.17 Billion Crypto Fund Outflows

- Bitcoin and Ethereum recorded the heaviest fund exits last week amid trading activity.

- Solana and XRP continued attracting capital, showing resilience within digital markets.

- Institutional portfolios adjusted exposure, reflecting uncertainty and investor sentiment.

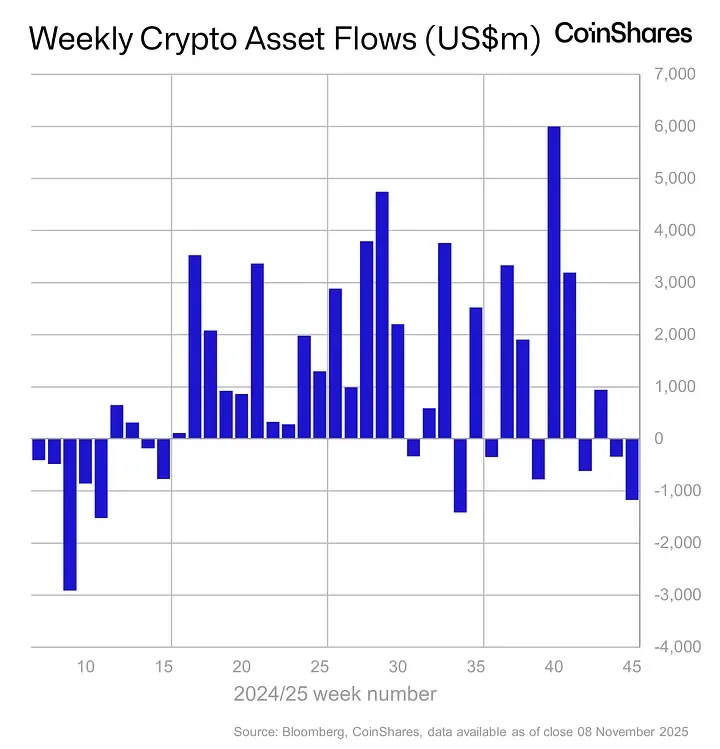

CoinShares’ latest market report shows that digital asset investment products recorded total weekly outflows of $1.17 billion, reflecting a cautious shift among institutional investors. The withdrawals were driven mainly by Bitcoin and Ethereum, which together accounted for more than $1.3 billion in losses.

Despite the downturn, total year-to-date (YTD) inflows remain firm at $47.84 billion, while industry assets under management (AUM) stand at $207.47 billion. Data compiled by Bloomberg and CoinShares as of November 8, 2025, indicates that investor flows continue to react to global market conditions and ETF-related movements.

Bitcoin and Ethereum Lead the Outflows

Bitcoin topped the list of digital assets with $932 million in outflows during the week. Nonetheless, Bitcoin keeps the record of $28.49 billion in YTD inflows and $162.33 billion AUM. While the market leader experienced the most significant outflow, it was still followed by Ethereum, which saw $438 million in withdrawals, revealing that the investors are still hesitant about engaging with large-cap cryptocurrencies.

Source: Coinshares

On the contrary, short bitcoin exchange-traded products (ETPs) saw boosted inflows amounting to $11.8 million, the strongest since May 2025. Gradually, short positions are increasing, meaning that some traders are positioning their trades as a form of protection against price swings. Sui and Cardano, respectively, had a minimum of $3.8 million and $0.1 million.

The overall capital net flow during the decline did not cover up the fact that some altcoins were attracting money. Solana’s weekly outflow for the last week was $118.4 million, and over the last nine weeks, it has been a whopping $2.1 billion, thus keeping its upward trend. XRP was the user of $28.2 million, while Litecoin and multi-asset funds received $1.9 million and $12.3 million, respectively. The total inflow of HBAR was $26.8 million, and that of Hyperliquid was $4.2 million, showing that the investor interest in digital assets remains strong

Provider and Regional Breakdown

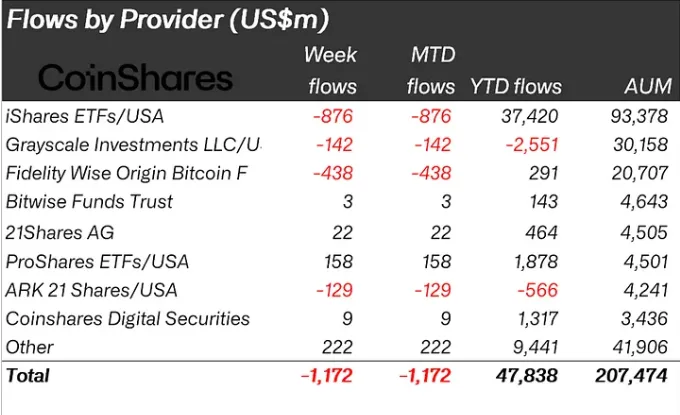

Among asset managers, iShares ETFs/USA posted the largest losses with $876 million in weekly outflows, trimming their YTD inflows to $37.42 billion. The Fidelity Wise Origin Bitcoin Fund was the biggest loser, with $438 million pulled back, and Grayscale Investments got $142 million less, thus being left with a YTD deficit of $2.55 billion.

Source: Coinshares

On the other hand, ProShares ETFs/USA had a total of $158 million in inflows, and 21Shares AG $22 million. The inflows for Bitwise Funds Trust and CoinShares Digital Securities were less significant but still positive, totaling $222 million combined.

The United States was the biggest region with $1.22 billion in outflows. Yet it still has a strong dominance in the global fund flow scenario with $44.31 billion in YTD inflows and a total AUM of $145.7 billion. The highest inflow of $49.7 million was reported by Switzerland, followed by Germany with $41.3 million.

The inflow to Brazil was $12 million; on the other hand, Australia faced a slight drop of $1.1 million. The outflows of $24.5 million from Hong Kong, $7.6 million from Canada, and $18 million from Sweden indicated different trends in the regions.

Market Trends and Institutional Behavior

The flow data for 2024 and 2025 shows a pattern of fluctuating demand. Graduating by weeks 20 and 30, the weekly inflows increased from $1 billion to $4 billion, indicating the market’s confidence was restored after midyear corrections. However, the period of 10 to 15 weeks and 42-45 experienced a loss of more than a billion dollars, which highlighted the market’s intermittently cautious approach.

Related: Gold and Silver Beat Stocks and Bitcoin Since Trump’s Election

The institutional interest remains extremely strong but has become more selective, with fund managers switching between their risk management types of exposure between spot and leveraged positions. These movements of funds indicate that the process of capital allocation is still ongoing and that it is influenced by changes in policy and the liquidity pressure that the market undergoes.

The most recent research conducted by CoinShares, backed by Bloomberg data, indicates a digital asset sector characterized by a short-term cautious approach yet supported by long-term institutional presence.