Zcash Holds Support After 40% Fall: What’s Next for ZEC?

- ZEC holds above $429 support as traders anticipate signs of a renewed buying wave ahead.

- On-chain data reveals heavy long liquidations and ongoing profit-taking among top traders.

- RSI nears oversold levels as buyers prepare for a possible upward momentum shift soon.

Zcash (ZEC) is showing signs of steadiness after sliding 43% from its all-time high. The token has managed to hold above the $429–$371 range, a level that has served as a key turning point in past corrections. Traders now view this zone as the line between a healthy recovery and another possible breakdown.

That support aligns closely with the 38.2% Fibonacci retracement level and a trendline that has contained ZEC’s decline since mid-October. At the time of writing, the coin trades a little above $479, a mild 1% dip over the last day. Although the move is small, the steadiness suggests that selling pressure is slowing and that buyers may be quietly regrouping.

Source: TradingView

However, market volume tells a softer story. Trading in privacy-focused coins has thinned sharply, with the sector’s total turnover down 38% to about $6.53 billion. ZEC’s own 24-hour volume plunged roughly 60% to $2.1 billion, leaving fewer active hands and narrower price swings for now.

Even so, the broader picture remains strong. Zcash is still up around 8% for the week and nearly 84% over the past month. On a yearly scale, its price has grown by more than 1,000%. Consequently, the pullback looks steep in the short term, but the long-term chart still paints a story of sustained growth and investor confidence.

On-Chain Metrics Show Shifting Trader Behavior

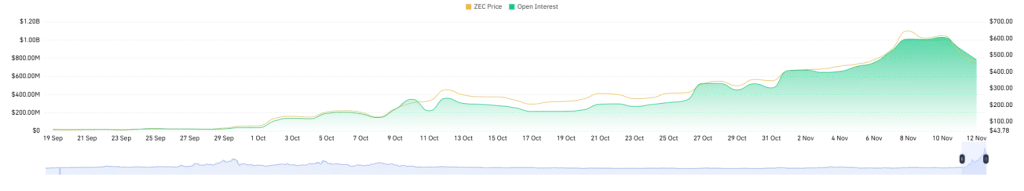

Recent on-chain activity shows traders taking a step back. The open interest in ZEC derivatives has dropped from $1.03 billion to about $779 million in just two days. This decline signals that many short-term speculators are taking profits. Yet the remaining open positions are still large enough to keep volatility alive.

Source: CoinGlass

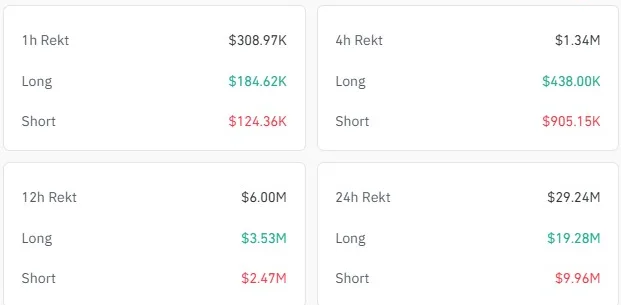

Spot trading activity adds another layer. Around $26 million worth of ZEC has moved into exchanges within 24 hours, often a sign that holders are preparing to sell. At the same time, data shows roughly $19 million in long positions have been liquidated, compared to $9 million in shorts.

Source: CoinGlass

This imbalance hints at a long squeeze, when leveraged buyers are forced to close positions, pushing prices lower and shaking weak hands out of the market. Such flush-outs rarely last long. Once the selling wave settles, new buyers often emerge, taking advantage of lower prices.

Related: UNI Soars Over 60% in a Week to $10—Can Bulls Keep the Rally Alive?

ZEC Price Action: Key Levels to Watch

From a technical viewpoint, ZEC currently trades between two critical moving averages, the 50-period MA near $538 and the 200-period MA around $351. If the current support holds, the coin could push back toward $538. A clear break above that resistance might open room for a run to $627, matching the 78.6% Fibonacci level, and possibly the $681–$750 resistance, near this year’s top.

Regardless, if the market turns lower again, the next meaningful support sits around the 200-period MA, with the potential to reach out for the $312 level, close to the 23.6% retracement zone. A fall to that area would represent a deeper 25–34% correction from current prices.

On the other hand, ZEC’s Relative Strength Index (RSI) stands near 43, edging closer to the oversold threshold. This suggests the token may be nearing exhaustion on the downside, though there’s still a little room left before buyers take full control.

For now, Zcash remains in balance. Bulls are defending crucial ground, while sellers continue testing their resolve. The coming days could decide whether this pause becomes the foundation for a new rally or the start of another leg down in one of crypto’s most unpredictable assets.