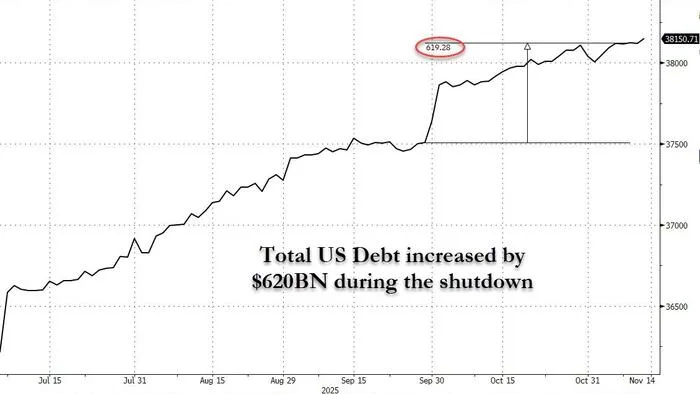

US Debt Jumps $620B as Shutdown Sparks New Liquidity Shift

- Debt rose by $620B, and this shift shaped liquidity paths that influenced market tone.

- Treasury issuance stayed active, and this movement guided the direction of risk flows.

- Markets tracked the surge, and this trend shaped new views on future macro signals.

The United States recorded a sharp $620 billion rise in national debt during the shutdown period from late September through early November 2025, with the total debt moving past $38.15 trillion by mid-November.

Treasury Issuance Continues Despite Shutdown Pressures

The shutdown began after lawmakers failed to approve key spending bills before the October 1 deadline. Disputes involved federal spending levels and healthcare provisions, which created a severe political standoff. According to a report, this stalled many nonessential federal functions and delayed several government services. This raised an urgent question for investors: How does debt keep rising when much of the government remains closed?

Even so, Treasury operations continued without interruption. The Treasury maintained debt issuance because it must fund pre-approved obligations. It also must service existing commitments such as interest payments.

Treasury desks kept issuing securities because many financing processes follow legally binding schedules. Funding needs also remained steady because earlier authorizations required ongoing borrowing. This kept debt levels rising even as discretionary federal activity slowed.

Large Borrowing Volumes Trigger Liquidity Movements

The debt increase reflected the net change in liabilities during the shutdown. Treasury issuance fed fresh securities into global markets. Investors then absorbed the new supply through purchases, which shifted liquidity across several financial channels.

Markets often react quickly to heavy issuance. The larger supply of Treasuries could, in a way, drain the capital from other instruments. Besides, traders keep adjusting their positions in accordance with daily government cash balance changes. The shifts in the Treasury General Account at the Fed not only impact reserves but also money-market conditions and short-term rates.

There are historical precedents where the same happened. The 2011 debt-ceiling episode saw the government borrowing at its apex. Investors’ hopes were for the Fed to cut rates, as the latter already indicated that it was ready with upcoming support. The ongoing situation had the same dynamics, with the issuance pace making the traders rethink liquidity expectations.

Restructuring was the response from the credit markets. Analysts from the market pointed out that borrowing in the course of a shutdown is similar to an indirect liquidity push. The government borrowed money all the time, and the spending was still lagging, which led to the creation of short-lived distortions in the assembly of the financial services conditions.

Related: Bitcoin Eyes Rebound After Fed’s Rate Cut and Liquidity Plan

Crypto and Risk Assets React to Fiscal-Monetary Interplay

The crypto sector followed the developments closely. Digital-asset markets often respond to liquidity signals because large liquidity shifts influence risk appetite. When Treasury issuance rises sharply, markets frequently anticipate easier money ahead.

This environment usually favors high-beta assets such as Bitcoin. Liquidity shifts also support asset-price expansion when short-term yields adjust downward. Traders watched the $620 billion jump as a potential early driver of renewed risk flows.

The continued borrowing during the shutdown showed that fiscal operations remained active despite political pressures. This reduced the typical liquidity drag expected during a halt. As a result, traders interpreted the surge as a sign of ongoing structural liquidity support. Analysts noted that repeated issuance waves could guide markets toward expectations of future rate adjustments.

The overall pattern revealed a consistent mechanism. Heavy Treasury issuance during shutdown periods affects liquidity, interest rate expectations, and capital flows. Market observers stated that these dynamics warrant close monitoring, as they may influence upcoming phases of risk-asset positioning and crypto-market behavior.