Aster Targets the $1.59 Zone as Momentum and Volume Rise

- Aster held firm during the market pullback as trading activity increased sharply.

- SWFT Bridgers listing improved ASTER’s cross-chain speed and reduced transfer costs.

- Aster stayed above key resistance as buyers supported every intraday pullback.

Aster (ASTER) continued to stand out as one of the few altcoins showing strength during a broad market pullback. As of press time, Aster is trading at $1.24, up by 3% over the past day and 11.94% in the past week. The performance contrasted sharply with losses across major cryptocurrencies.

A listing on SWFT Blockchain’s Bridgers listing also helped the token gain more attention. The BNB Chain integration resulted in faster ASTER transfers on the BNB Chain. Reduced fees and increased speed were attractive to traders completing cross-chain transactions.

Aster Draws Attention With Major Trading Event

Aster’s revelation of an intensive trading competition only increased the interest. The latest event put up $10 million in prizes, the biggest competition of its kind from the project. High-value competitions often elicit a quick response from trading enthusiasts. The news prompted further conversations in crypto communities.

Price action is adding further weight to the bullish outlook. After ASTER broke through its key resistance level, it managed to hold above it, with buyers stepping in on intraday pullbacks. This stability reduces the risk of sharp reversals, even during periods of broader market weakness.

Technical Signals Point Toward Strengthening Trend

The cryptocurrency was consolidating on the 4-hour timeframe before a change of momentum occurred. The candlestick bodies were small and the volatility low, an indication that sellers and buyers reached a fragile equilibrium. The token floated owing to nearness with short-term EMAs, which implied a neutral setup.

The EMAs then curled and turned upwards, indicating a better short-term sentiment. The 200 EMA of $1.190 continued to act as a strong support, indicating that the market still supported higher prices.

Technical indicators also supported the shift. The MACD line rose to 0.039, and the signal line was at 0.030 with a bullish crossover pattern. The histogram was near 0.009, indicating continued buying interest.

If the $1.19–$1.20 range support holds, then a bull bias can prevail in ASTER. Further establishment of a higher low would further build the structure and confirm the trend. A move beneath the EMA cluster, particularly below $1.19, would imply weaker momentum.

The days ahead should prove pivotal for the medium-term outlook of ASTER. To establish a new bull attempt, the market must close daily above $1.28. Breaking through this level would add momentum to break out and clear the way for strong resistance in the $1.50-$1.59 area next.

Related: Aster Surges After CZ’s Announcement About the Purchase

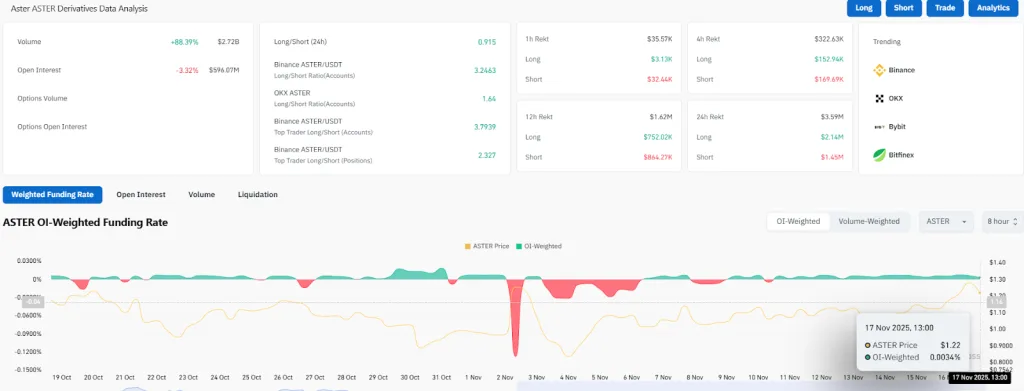

Data from CoinGlass illustrated notable shifts in trading participation. Volume increased 88.39% to $2.72 billion, showing strong engagement. Open interest fell 3.32% to $596.07 million, indicating reduced leveraged positioning. The OI-weighted funding rate stood at 0.0034. Total liquidations reached $3.59 million in 24 hours, with $2.14 million in long positions and $1.45 million in shorts.

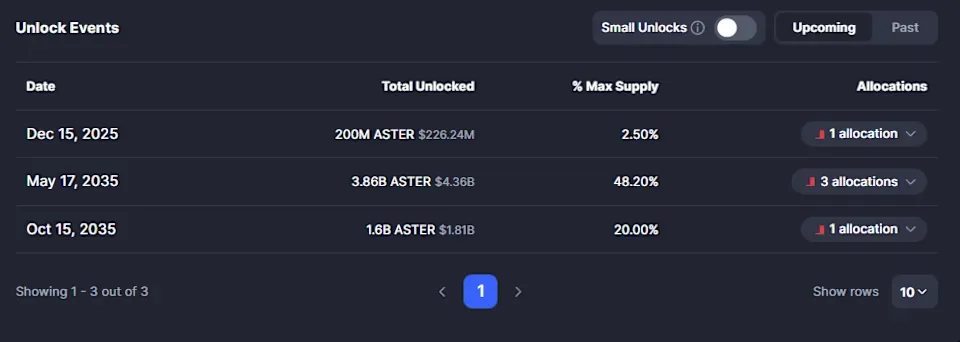

Amid these market fluctuations, Aster also addressed concerns after CoinMarketCap displayed token unlock data that differed from earlier presentations. The listing showed a 200 million ASTER unlock scheduled for December 15, 2025, along with a 5.46 billion release planned for 2035. These figures prompted questions among community members watching supply conditions.

Aster’s rise came alongside news about unlocking schedules and supply transparency. Lagging planned unlocks gave a temporary respite from the supply pressure. The clarification was seen as critical for traders who watch vesting schedules, particularly when markets are turbulent.

Increases in activity throughout the Aster DEX ecosystem also helped to bolster the token’s performance. As a consequence, users were trading more often with existing features, and this sustained liquidity.

Aster remains under close market observation during current conditions. Traders are watching to see if the token could maintain its advantage as market stress continues.